Bitcoin operates continuously, trading every minute throughout the day, while CME Bitcoin futures halt over the weekend. This discrepancy creates what is known as a CME gap, a phenomenon that frequently appears during some of the most volatile periods.

A CME gap refers to the empty space visible on a CME futures chart between Friday’s closing price and Sunday evening’s opening price (US time). Since CME futures follow a weekly schedule with no trading during weekends, but spot Bitcoin trades nonstop, when Sunday’s first trade significantly differs from Friday’s close, it results in a jump on the chart—leaving an unfilled area called the gap.

As CryptoSlate explained in their analysis, this gap isn’t some mystical signal; rather, it simply reflects that one market was closed while another continued trading. It’s not about predicting future prices but about recognizing calendar-based discrepancies shown visually on charts.

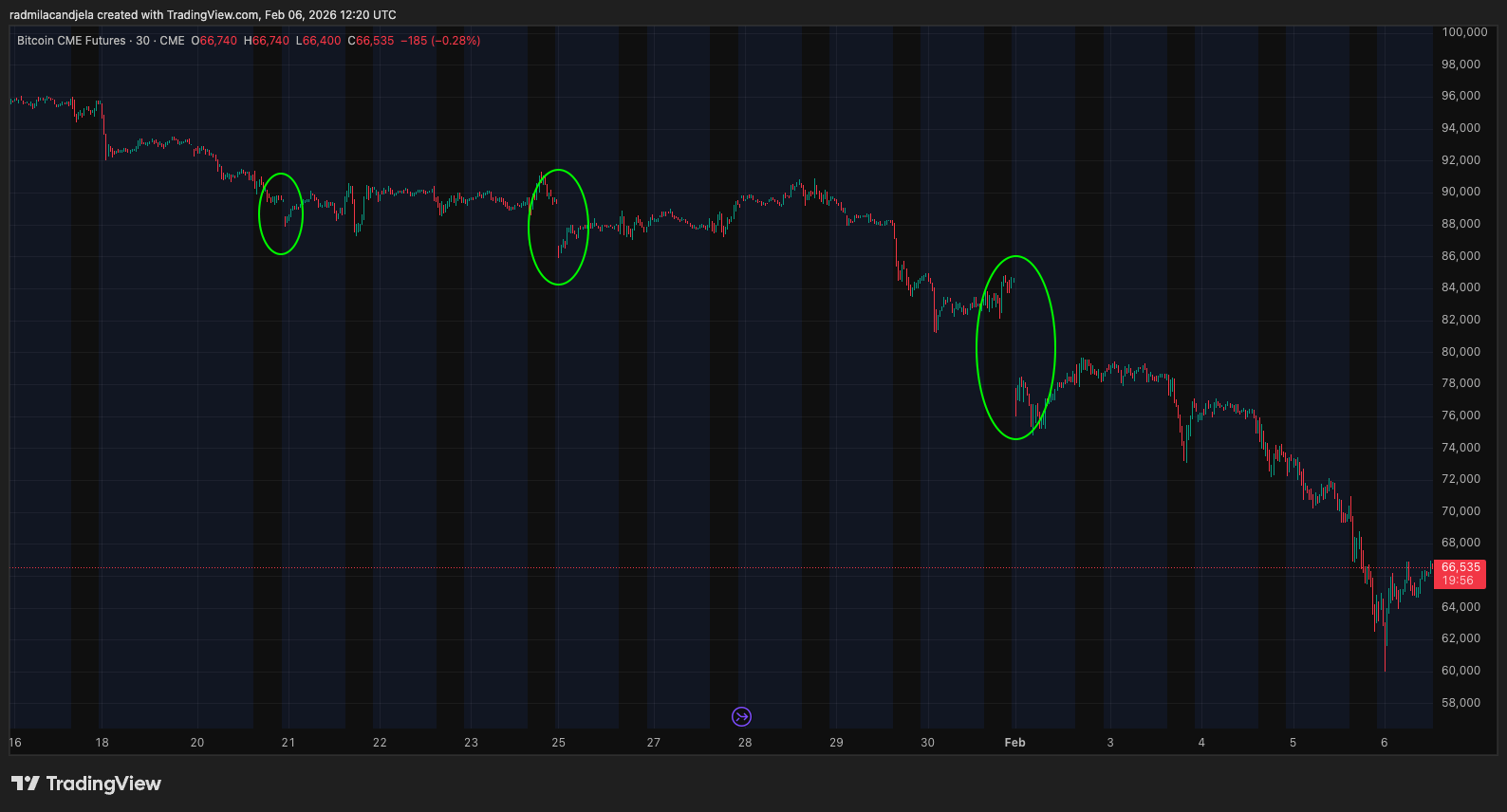

This past week offered a clear example of this effect in action.

The continuous CME Bitcoin futures chart showed Friday (January 30) closing near $84,105. When trading resumed Sunday evening, prices opened around $77,730—creating an approximate $6,375 weekend gap before further declines accelerated.

Bitcoin then dropped sharply from roughly $72,999 at February 5’s start to lows near $62,181 on Coinbase and briefly touched around $60,000 early February 6 before recovering into mid-$60K territory. The 30-minute data from CME mirrored this pattern with lows near $60,005 followed by rebounds toward approximately $66,900.

Despite such volatility and movement downward during these days’ sessions,the previous Friday’s level remained well above current prices—the gap stayed open through February 6 because price never revisited that range closely enough to fill it.

This scenario helps clarify what many non-traders wonder when they hear “gap”: why do two different BTC prices appear so disconnected temporarily? And why does this difference sometimes vanish later?

The Formation of Gaps Due to Weekend Market Closures

CME offers cash-settled Bitcoin futures traded nearly continuously from Sunday evening until Friday afternoon with daily breaks—but halts completely over weekends. Meanwhile spot Bitcoin markets operate without interruption; if significant moves occur Saturday or Sunday daytime hours when CME is closed,no corresponding trades appear on its charts for those times.

When Monday or Sunday night sessions begin again,CME doesn’t pick up exactly where it left off last Friday—it resumes at whatever level spot markets currently reflect plus any premium or discount embedded in futures pricing at reopening.This creates visible jumps between last close and new open,and leaves gaps representing missing data intervals between them.

The critical point lies beyond just acknowledging these gaps exist: whether they eventually get filled depends entirely upon market dynamics rather than any fixed rule related solely to calendar timing or mysticism around gaps themselves.

You can think of each gap like skipping pages within a book:Friday ends abruptly leaving suspense,the weekend writes several chapters elsewhere,and then Monday opens up with fresh content.Missing pages remain absent visually,but storylines have advanced independently across other venues outside CME charts’ scope .

This explains why gaps become more noticeable during turbulent weeks.When bitcoin experiences low volatility,reopening levels hover close enough together so no dramatic blank spaces emerge.But violent swings produce large voids which our brains instinctively interpret as unresolved situations demanding attention—and thus fuel popular narratives about “gaps must fill.”

Busting Myths About Gaps:

Myth:“CME gaps always need filling.”

Reality: While many gaps do fill because markets tend toward convergence once liquidity returns, there’s no guarantee they will fill within any specific timeframe. During strong trending phases,gaps may remain open for extended periods without resolution.

The Reasons Behind Gap Filling & Limitations Illustrated This Week

A “gap fill” occurs when price retraces back through previously untraded zones often reaching prior closes. CryptoSlate’s detailed explanation attributes frequent fills largely to arbitrage incentives active once full market participation resumes after weekends.

This convergence arises mainly due to straightforward economic motives rather than speculative beliefs regarding directional moves.If spot and futures stray too far apart,traders capable of operating both sides exploit differences by buying undervalued assets while selling overpriced ones aiming for profits as spreads narrow.

Hence,this process is driven by arbitrageurs seeking relative value alignment instead of directional conviction.Two linked marketplaces rarely tolerate prolonged large discrepancies after liquidity returns,because risk management frameworks impose limits preventing extreme divergence.

Another factor reinforcing fills involves collective attention.Given widespread monitoring and sharing surrounding these levels,demand clusters there enhancing liquidity availability making revisits easier especially amid choppy conditions favoring mean reversion.

CryptoSlate’s ’s earlier study confirmed high frequency &&" ;quick" ;fill occurrences post-session resumption explaining persistence behind popular beliefs despite lacking strict guarantees.& nbsp;

February 5-6 exemplify boundary scenarios maintaining realism within this narrative.BTC plunged violently touching low-$60Ks triggering massive liquidations exceeding one billion dollars inside twenty-four hours.Pricing dynamics here deprioritized prior weekly closes since immediate demand/supply dominated decisions regardless whether old reference points existed nearby.CME's historical closure point (~$84K) ceased acting like magnet pulling prices back,instead becoming distant markers irrelevant short term movements.Furthermore,this highlights how using open gaps serves better explanatory purposes rather than predictive ones.In calm environments,gap fills occur rapidly due existing oscillations facilitating easy revisit under comfortable liquidity conditions.During stressed regimes however,gap presence signals extent market has shifted away rendering old closes unreachable soon—a natural consequence reflecting recent developments not failure per se.The Febuary coverage also highlighted corporate treasury impacts deepening drawdown significance beyond mere technicalities.With corporate holders underwater,on-paper losses amplify pressure influencing equity narratives tied directly into BTC exposure.That broadens perspective emphasizing real-world consequences alongside purely chart-based observations.Finally,it reminds traders treat CEME gaps primarily as notable reference points observed widely yet not guaranteed obligations requiring fulfillment.Gaps matter most amid mean-reverting phases supported by adequate liquidity whereas trend-driven liquidation episodes keep them persistently open since bigger forces dominate price behavior overall.