Bitcoin has undergone a significant plunge over the last two days, alarming individual investors and sparking serious doubts about its long-term sustainability. Although prices saw a modest recovery on Friday, market participants remain cautious, anticipating further declines and wondering how severe they might become.

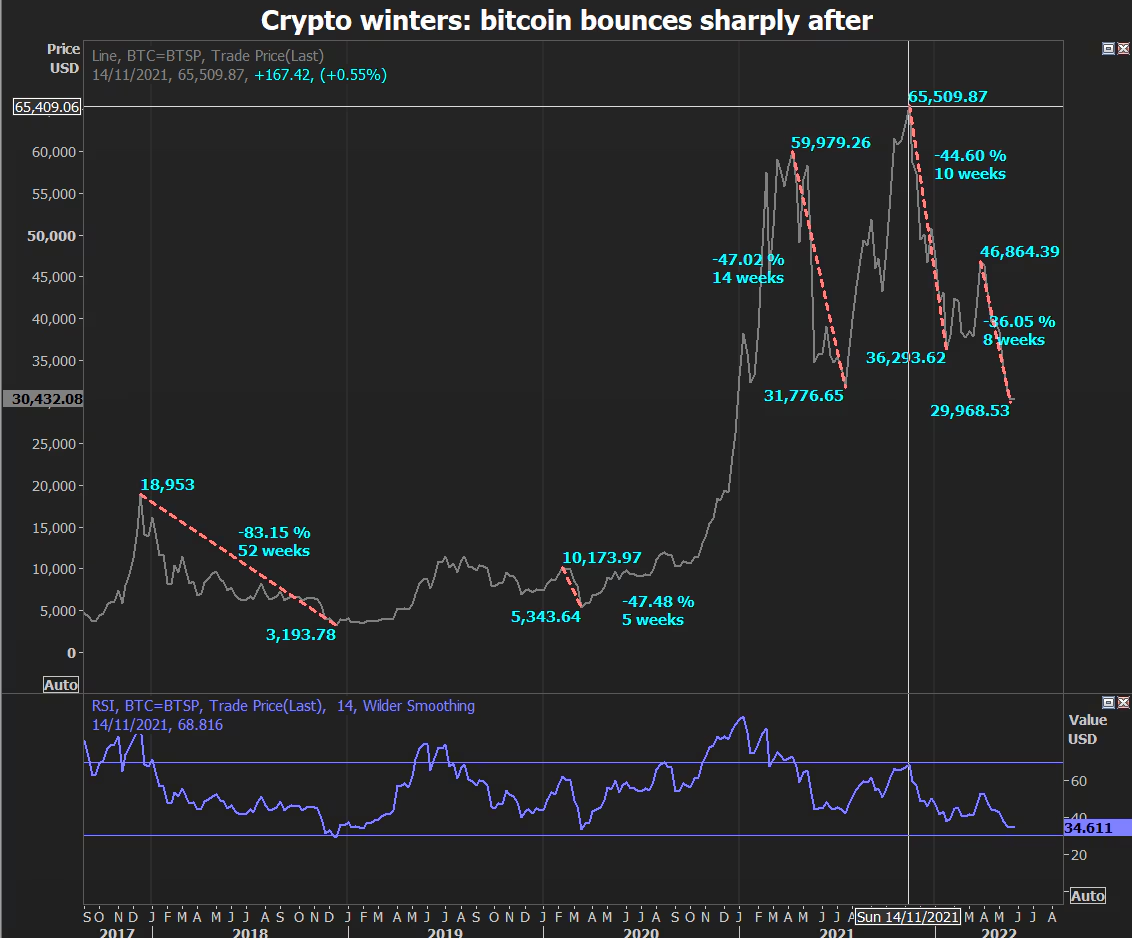

Fortunately for the cryptocurrency sector, this is not the first time it has faced such bleak prospects. In moments like these, looking back at history provides valuable insights into what might come next, which strategies to avoid, and how dire the current circumstances truly are. Many of these lessons stem from the crypto crash of 2022.

The Build-Up to the 2022 Crypto Crash

A lot has evolved since then; however, the crypto winter of 2022 set a stage that many believed could mark an end for digital currencies.

The story began in 2020 when cryptocurrencies experienced explosive growth within just one year. Capital influx surged dramatically into this space, pushing asset prices upward until they peaked around November 2021. During this period, Bitcoin’s value skyrocketed from approximately $8,300 to $64,000 in less than a year.

At that time high-yield investment products were key attractions offered by major crypto companies. The promise of earning substantial guaranteed returns on assets like Bitcoin or stablecoins was highly enticing for many investors.

However,the optimistic narrative started unraveling due to wider macroeconomic pressures.

The US Federal Reserve increased interest rates in response to persistent inflationary trends which tightened liquidity access for consumers. Additionally,the stock markets endured sharp corrections partially triggered by geopolitical tensions stemming from conflicts in Europe.

This environment prompted cryptocurrency holders to pull their money out from riskier investments rapidly.

This rush resembled bank runs seen historically but soon exposed deeper problems causing widespread mistrust among investors towards entire sectors within crypto markets.

The Chain Reaction That Followed

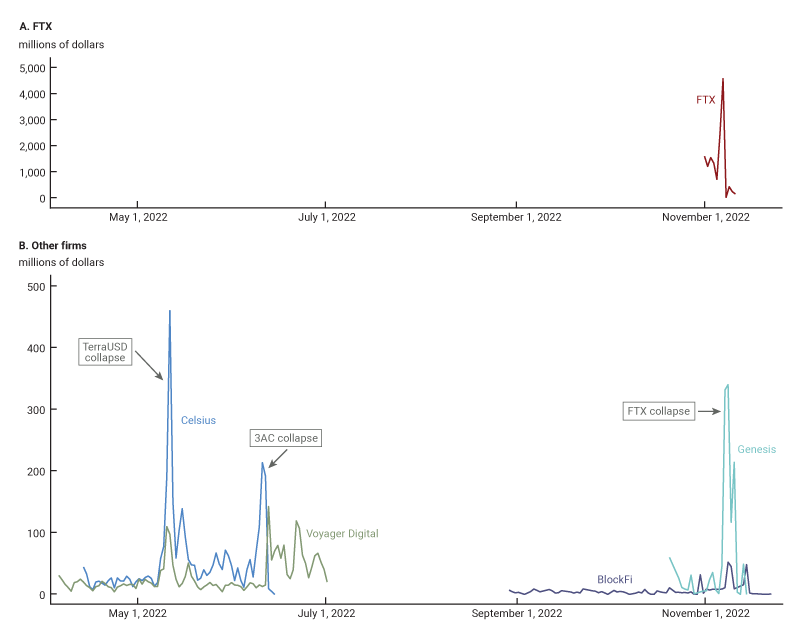

The initial shockwave hit with TerraUSD (UST) stablecoin’s collapse in May 2022 when its price plummeted drastically within just one day—shaking confidence about its ability to maintain parity with the US dollar peg.

An analysis conducted by Chicago’s Federal Reserve Bank revealed that centralized exchanges such as Celsius and Voyager Digital experienced customer fund withdrawals amounting respectively up to twenty percent and fourteen percent during eleven days following UST’s downfall announcement.

Soon after came Three Arrows Capital (3AC)’s bankruptcy filing—a hedge fund managing roughly ten billion dollars at peak value—whose risky trading combined with falling cryptocurrency valuations wiped out all assets completely forcing insolvency declarations.

Withdrawals of customer funds during ninety days before bankruptcy filings.Source: Federal Reserve Bank of Chicago.

Centralized exchanges suffered further heavy losses as additional waves of withdrawals followed shortly thereafter.

The infamous FTX meltdown occurred later in November 2022 when thirty-seven percent withdrawal rates were recorded across client accounts—all drained within two days alone.Accordingly Genesis & BlockFi pulled back around twenty-one & twelve percent respectively according to data provided by Chicago Fed during same month.

Throughout all these upheavals at least fifteen firms linked directly or indirectly with cryptocurrencies either shut down operations or entered insolvency proceedings throughout that turbulent year revealing critical liquidity flaws embedded deeply inside several business models especially their vulnerability against sudden mass withdrawals amid volatile conditions.

These incidents highlighted an essential lesson: financial commitments must be backed adequately by real liquidity reserves,and contingency plans are vital whenever stress arises.

Today’s market environment brings those warnings sharply back into focus.

Significance Behind Current Bitcoin Movements

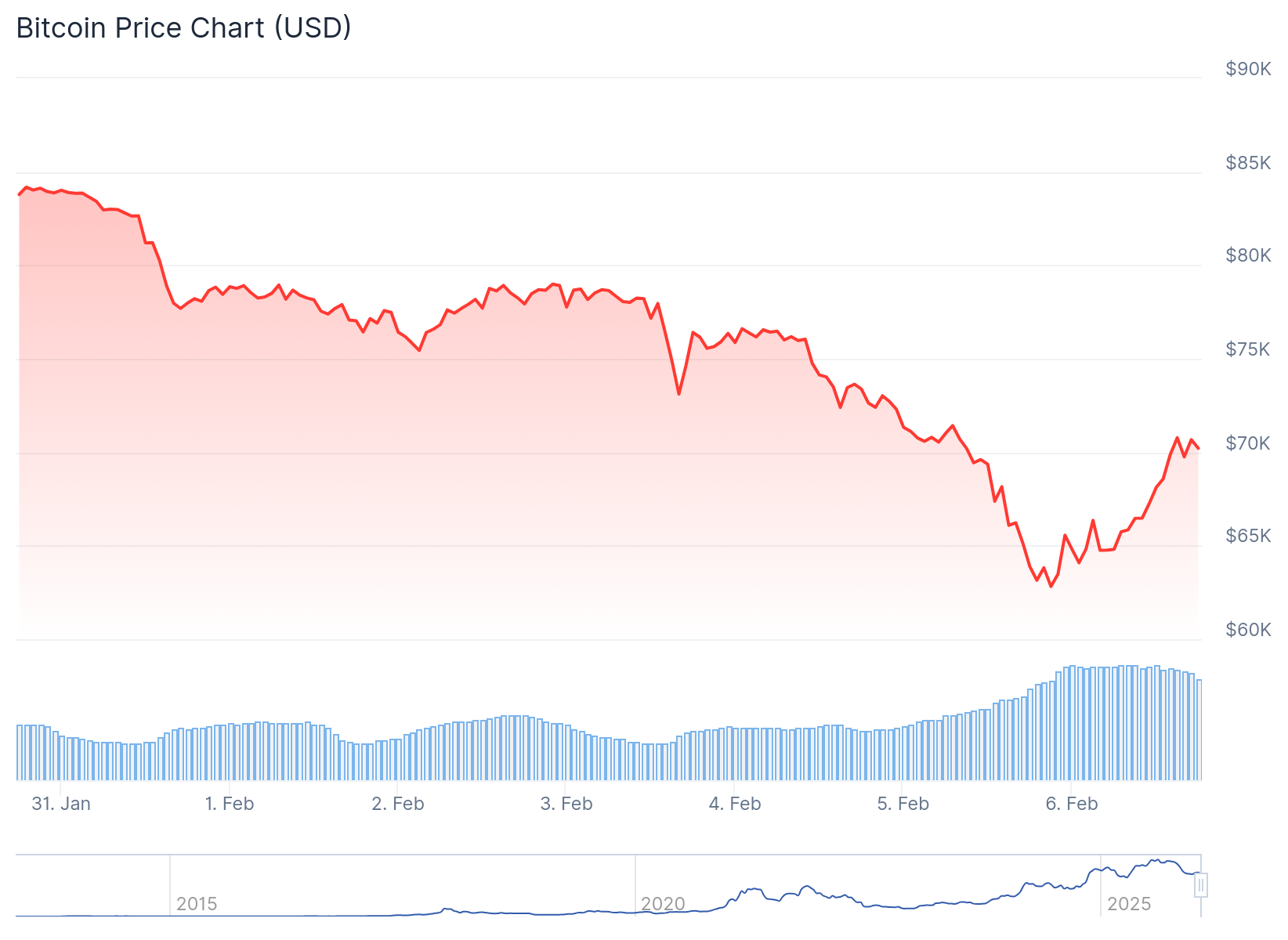

In recent times both leading coins Bitcoin & Ethereum dropped nearly thirty percent wiping away approximately twenty-five billion dollars worth unrealized gains spread across various digital asset portfolios.

This decline coincided alongside broad sell-offs hitting traditional stocks plus safe haven commodities like gold/silver indicating systemic liquidity shocks rather than isolated asset-specific weaknesses.

Consequently traders facing margin calls prioritized liquidating easily accessible holdings first.In crypto terms,this suggested more so a recalibration phase rather than outright loss-of-faith scenario.On Friday some encouraging consumer data eased short-term macroeconomic concerns enabling Bitcoin price rebound near seventy thousand dollars.

Bitcoin’s weekly price chart.Source: CoinGecko.

Nevertheless,BTC’s pattern signals underlying structural issues beyond mere liquidity fluctuations.

Over past twelve months,it failed repeatedly regaining momentum even amidst relief rallies.Analysis suggests prolonged selling pressure primarily driven by long-term holders offloading positions consistently.

Such behavior sends negative signals reverberating through market psyche.Newer retail participants tend closely follow veteran holders’ moves understanding once conviction sellers exit upside potential diminishes considerably.

Price action often represents only surface-level stress.Market sentiment usually reflects fear swiftly whereas institutional responses unfold gradually adjusting internal operations well ahead full crises manifest externally.

During extended uncertainty phases such strategic adaptations serve as early warning indicators.

Institutions Quietly Retrenching

Beyond visible price swings,institutional players have begun signaling caution through operational changes.

Gemini recently announced scaling down activities including withdrawing presence from certain European jurisdictions.This decision doesn’t imply imminent insolvency nor direct correlation with latest dips but illustrates strategic shifts responding proactively toward stricter regulatory landscapes highlighting preemptive risk management before balance sheet strains appear publicly.

Similarly Polygon executed significant workforce reductions last month cutting roughly thirty percent staff marking third round layoffs over three years span.

Bitcoin is down more than 20% over the prior 12 months. However, in 2018 it was down 80% yr/yr, and in 20222 it was down70%.&pictwitter.com/u361W9mnxR

&mmdash Robert P.Murphy (@BobMurphyEcon) February4,&mmdash20126

Historically similar quiet retrenchments surfaced late-21 early-22 well before industry-wide collapses became apparent.Firms froze hiring cut expansion initiatives reduced incentives citing efficiency improvements/regulatory compliance instead distress signs.

Attention also refocuses increasingly on corporate digital treasuries where sustained drawdowns expose vulnerabilities clearly.MicroStrategy exemplifies this trend prominently.

MicroStrategy Reveals Early Structural Vulnerabilities

After recent BTC dip below sixty thousand MicroStrategy’s extensive bitcoin holdings slipped further beneath average purchase cost rekindling worries regarding balance sheet stability

Its share prices plunged sharply reflecting intensified sell-off while company valuation fell below net worth represented solely by owned bitcoins

Should volatility persist,such financial structures may exacerbate both investor confidence swings alongside fragility simultaneously

Notably MicroStrategy abandoned previous unwavering stance never-to-sell policy.Last November CEO Phong Le admitted possibility sales under extreme crisis scenarios

Current subtle yet early indicators may escape immediate notice precisely because they lack dramatic headlines.Yet their understated nature offers crucial glimpses into gradual erosion processes reshaping industry fundamentals internally over extended periods.