In January, Bitcoin experienced a sharp decline of nearly 11%, marking its fourth consecutive month of losses—the longest downward trend since 2018—amid widespread market instability. Simultaneously, gold prices also suffered significant drops, prompting savvy investors to consider capitalizing on the downturn.

Bitcoin’s value remains under $80,000 as the cryptocurrency sector grapples with ongoing market challenges. While U.S. equities posted modest improvements, oil prices sharply decreased and gold retreated from record highs.

Technical analysis and prevailing market sentiment indicate that Bitcoin’s recent uptick might be misleading—a potential bull trap—with risks of further declines toward $70,000 if it fails to sustain momentum above the $100,000 threshold.

Currently trading just above $78,400, Bitcoin ($BTC) sees the total crypto market capitalization inch up by 1.7% to exceed $2.7 trillion; however, this figure remains significantly below its peak near $4.1 trillion recorded in August 2025.

The leading cryptocurrencies on Monday afternoon (EST) include MYX Finance, Memecore, River Protocols Jupiter Network Morpho Labs and Hyperliquid Finance.

The stock markets showed moderate gains: major indices such as the S&P 500 rose by approximately 0.7%, while Nasdaq 100 increased about 1.1%. The iShares Russell 2000 ETF led midday gains with a rally of around 1.32%.

Meanwhile crude oil prices plunged amid heightened U.S military presence in the Gulf region.

The Brent crude benchmark fell by roughly 4.75% to trade near $66 per barrel whereas West Texas Intermediate dropped down close to $61 per barrel levels simultaneously gold — traditionally considered a safe haven — pulled back from an all-time high of around $5,568 down to approximately $4,600 per ounce.

Additional insights from Polymarket reveal that probabilities for U.S strikes against Iran have declined recently—from about an eighty percent chance earlier this year down to nearly sixty-nine percent now for actions expected before year-end.

The cryptocurrency sell-off paused somewhat as reflected by the Fear & Greed Index plunging into extreme fear territory at level fourteen—the lowest reading seen so far this year—which historically precedes rebounds within crypto markets when investor sentiment reaches such pessimistic extremes.

Technical Signals Point Toward Potential Bull Trap In Bitcoin Rally

$BTC's price chart | Source: crypto.news

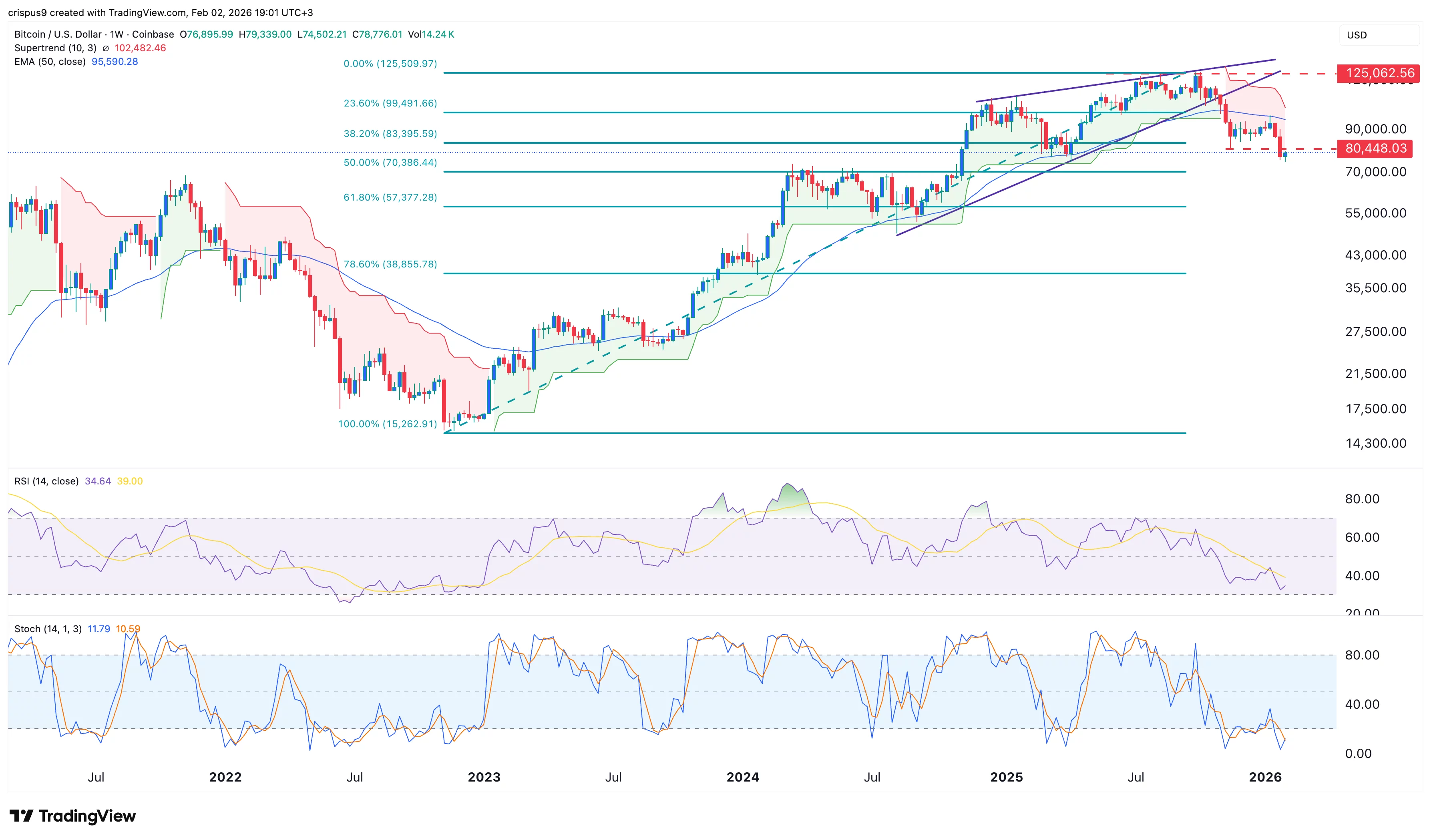

A weekly overview reveals that Bitcoin's price has sharply fallen over recent months.

The Supertrend indicator has switched from green (bullish) back into red (bearish), mirroring conditions last observed in early-2021 after which BTC lost more than seventy percent of its value.

The coin has dipped beneath key technical thresholds including both the thirty-eight point two percent Fibonacci retracement level and fifty-week exponential moving average lines,

while momentum indicators like Relative Strength Index (RSI) and Stochastic Oscillator continue trending downward. nnnnnnnnnnnnnn”,

“finish_reason”: “stop”

}