In the last 24 hours, Bitcoin surged past $117,000, achieving impressive gains even as global stock markets experienced significant fluctuations following the Federal Reserve’s recent interest rate reduction.

While equities struggled to establish a clear trend, Bitcoin remained resilient, buoyed by renewed investments in cryptocurrency products.

Increase in Bitcoin ETF Inflows

The Federal Open Market Committee (FOMC) revealed a 25 basis points cut in interest rates, which theoretically benefits digital currencies. However, traditional markets interpreted this move as an indication of deteriorating economic conditions. As a result, stock indexes exhibited erratic behavior with sharp spikes and declines during trading sessions.

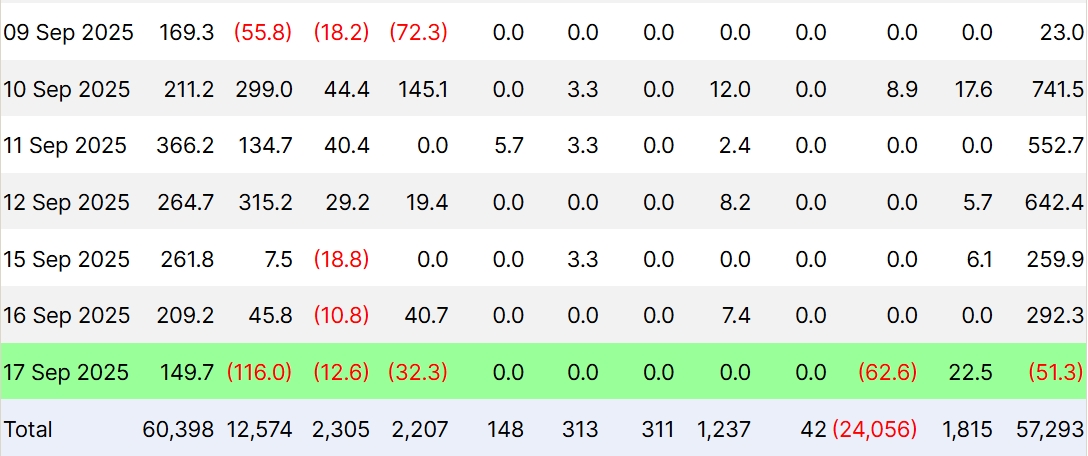

Conversely, Bitcoin sustained its upward momentum primarily due to institutional backing. Throughout the week leading up to September 17—prior to the FOMC announcement—ETF inflows remained robust. Investors seemed undeterred by macroeconomic uncertainties and continued betting on a positive trajectory for Bitcoin despite broader financial market anxieties.

If you’re interested in more insights about tokens like this one? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

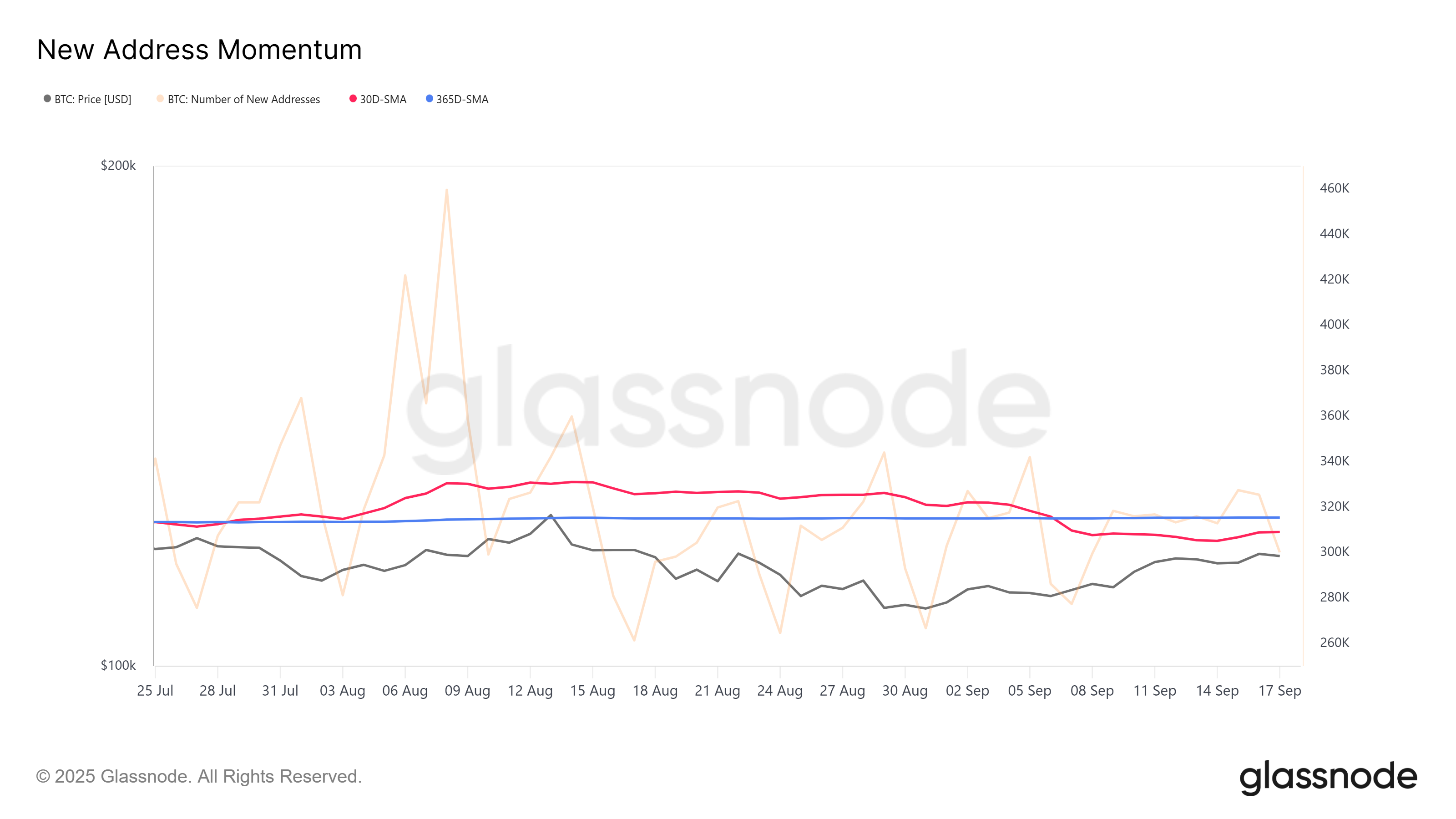

The on-chain metrics indicate that not all market participants share this optimistic outlook. Recently observed New Address Momentum has declined slightly, suggesting some reluctance among retail investors. The decrease in new market entries raises concerns about potential saturation or an upcoming reversal of trends.

Nevertheless, long-term holders and institutional players continue their consistent activity levels which support BTC’s price stability. Although retail investor caution may slow growth rates temporarily, Bitcoin’s strength is highlighted by its ability to decouple from stock markets during periods of high volatility.

The Potential for Continued BTC Rally

Currently priced at $117,182; Bitcoin continues its upward trend established earlier this month. The immediate hurdle is converting $117261 into support—a successful conversion would provide the necessary foundation for further increases.

If it manages this feat successfully; targeting $120000 could be next on the agenda for Bitcoin traders. Establishing and maintaining positions above that threshold could pave the way for additional gains—especially if ETF inflows persistently bolster investor confidence going forward.

However; challenges remain ahead! Should selling pressure intensify significantly; it might become difficult for bitcoin prices to stay above crucial levels such as $115000—a drop below that point could trigger corrections towards around$112500 invalidating bullish sentiments while cooling off short-term momentum!

This article titled “Bitcoin Price Soars Past $117000 Following Fed’s 25 bps Rate Cut” first appeared on BeInCrypto!