After a prolonged period of silence—last observed in November 2024—the mysterious mega whale from the 2010 Bitcoin era has reemerged, awakening a dormant stash of 2,000 bitcoins mined during Bitcoin’s infancy. This cache, now valued at approximately $181 million, was transferred in one seamless transaction and fully processed at block height 931668.

Veteran Bitcoin Miner Breaks Quiet Spell with Transfer of 2,000 BTC Held Since 2010

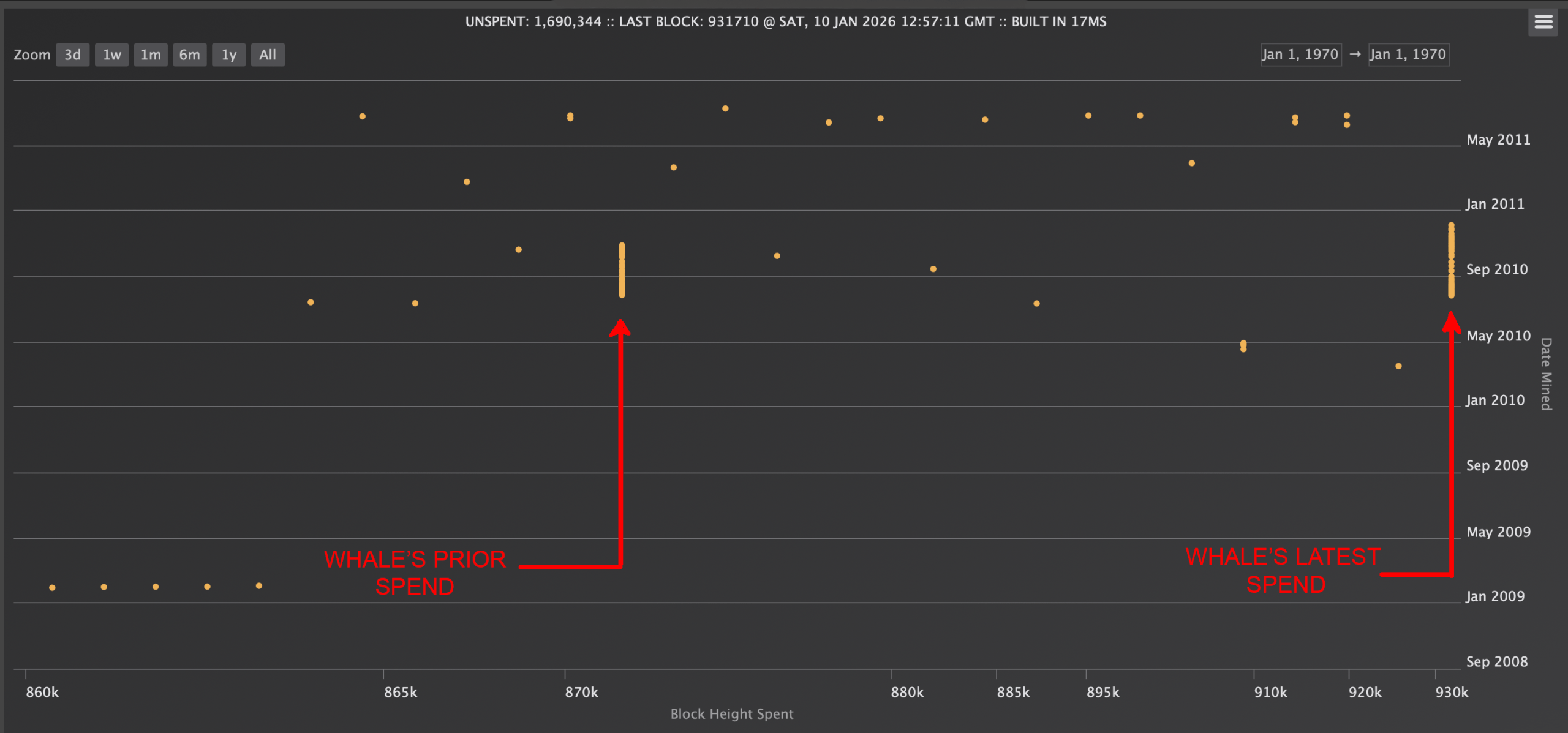

Bitcoin.com News has been tracking this particular whale since 2020 under the assumption that it represents a single individual or entity rather than multiple unrelated wallets. A deeper dive into blockchain data reveals that this miner had been quietly moving batches of coinbase rewards dating back to 2010 well before their activity was first detected six years ago.

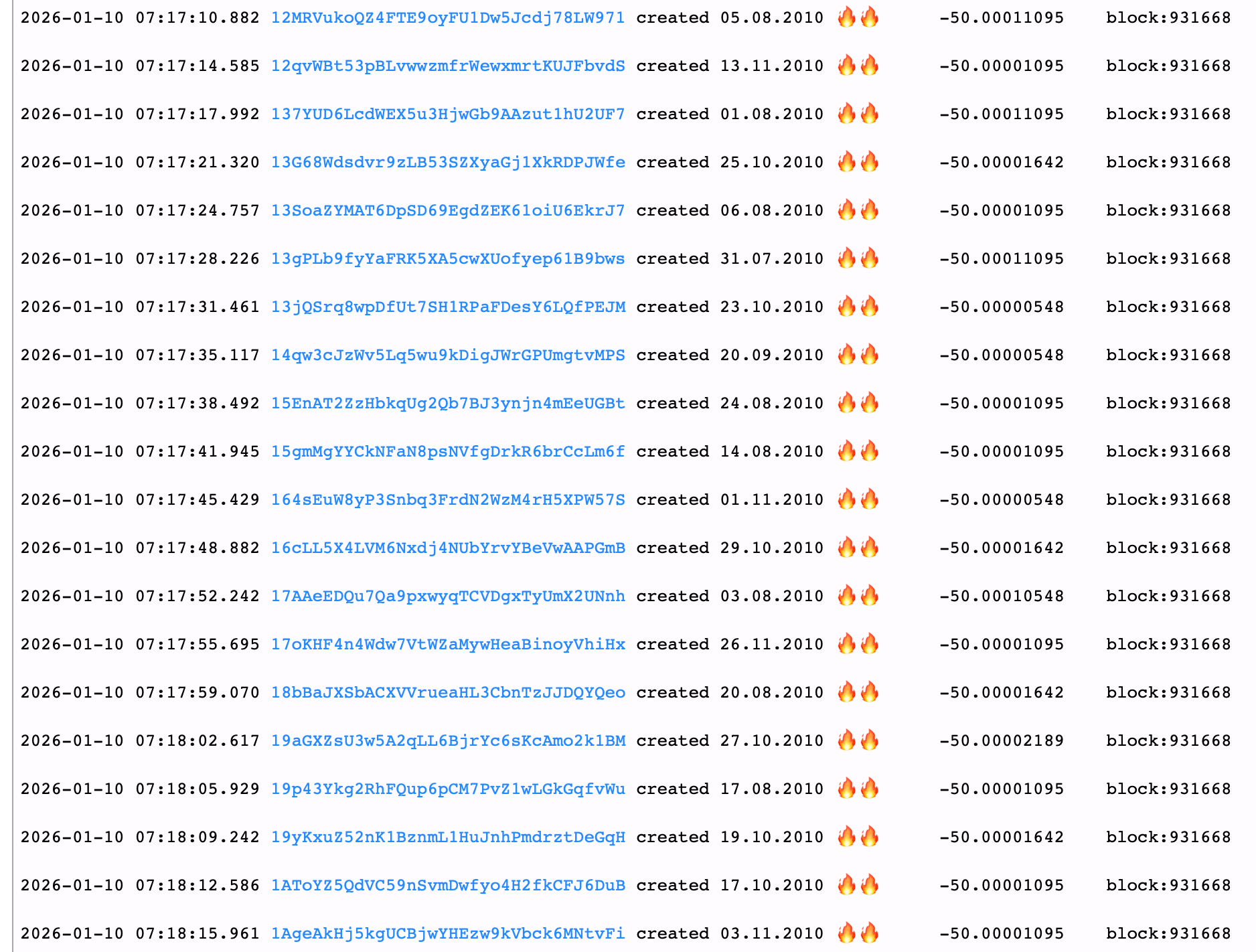

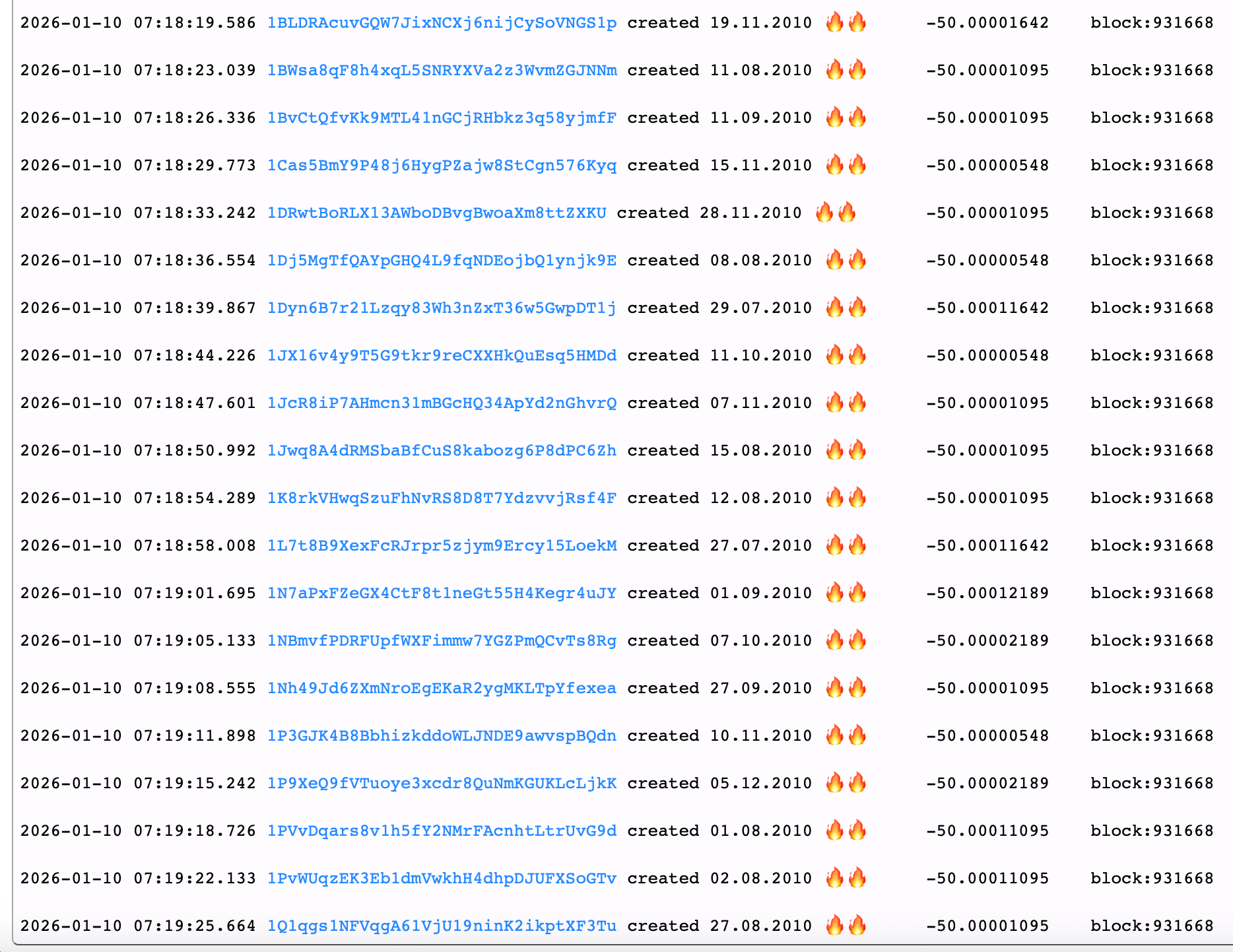

The last confirmed movement from this whale occurred on November 14, 2024. Following that date, it remained inactive throughout all of 2025. The pattern seen then closely resembled the recent January 10, 2026 transfer when the miner spent forty coinbase reward outputs mined in early Bitcoin days and completed settlement within block number 870329. The latest transfer involving another set of forty-block subsidies cleared at block height 931668 and was flagged by btcparser.com; other blockchain analysts quickly followed suit.

Sani—the founder of timechainindex.com—tweeted: “A miner just moved 2,000 BTC from block rewards untouched since 2010 to Coinbase Exchange.” He further noted these funds were held across forty P2PK (Pay-to-Public-Key) addresses.

The bitcoins originating from these P2PK wallets were consolidated into a single P2SH (Pay-to-Script-Hash) address before eventually being sent to Coinbase’s platform. This isn’t an isolated incident; previous spending patterns linked to this whale have consistently shown connections with Coinbase-related wallets as reported by Bitcoin.com News.

Twenty out of the forty P2PK addresses each moved fifty bitcoins on January 10th, 2026.

An additional intriguing detail is that corresponding bitcoin cash (BCH) associated with these same mining rewards was shuffled about five years ago. This whale—previously observed offloading tens of thousands coins—appears largely indifferent to fluctuations in bitcoin’s market price over time.

The remaining twenty out of those forty P2PK addresses also transferred fifty BTC each on January 10th, 2026.

For instance: despite having had opportunities to sell when bitcoin soared past six figures—for example around October sixth when prices hovered near $126K per coin—the coins instead moved recently while BTC traded just above $90K per unit. Such disregard for timing price peaks seems characteristic for this whale’s behavior on-chain and suggests profit maximization through market timing is not its primary goal.

Also read: Stablecoin Volumes Hit Record $33 Trillion Amid Policy Tailwinds

No matter if prices are soaring or cooling down dramatically over time—the actions imply a deliberate long-term unwinding strategy rather than reactive trading aimed at capturing ideal exit points. Moreover—with such an enormous reserve—even significant price swings make little difference financially given how minuscule bitcoin’s initial value once was ($0.01–$0.40). Holding onto them until today means realizing extraordinary gains regardless.

For now,the giant returns quietly into obscurity leaving analysts anticipating its next move among some earliest miners active during bitcoin’s genesis era.If history serves as precedent,this silence could persist months—or even years—before another carefully bundled batch mined circa-2010 resurfaces again along blockchain records.

FAQ 🐋

Who initiated the transfer of these 2,000 BTC?

A long-inactive bitcoin mega-whale connected directly with mining rewards generated back in 2010 moved these funds after more than twelve months without activity.

Where did those bitcoins end up?

The entire sum totaling two thousand BTC was aggregated then ultimately routed toward wallet addresses affiliated with Coinbase exchange platforms according to public chain analytics.

When exactly were those coins originally created?

This stash originated from mining payouts earned during early blocks produced throughout 2010, a foundational period within cryptocurrency history.

Why does observing such whales’ movements matter so much?

Larger transactions stemming directly from pioneering miners attract attention due both their sheer scale &pioneering provenance plus potential ripple effects impacting overall market sentiment. .