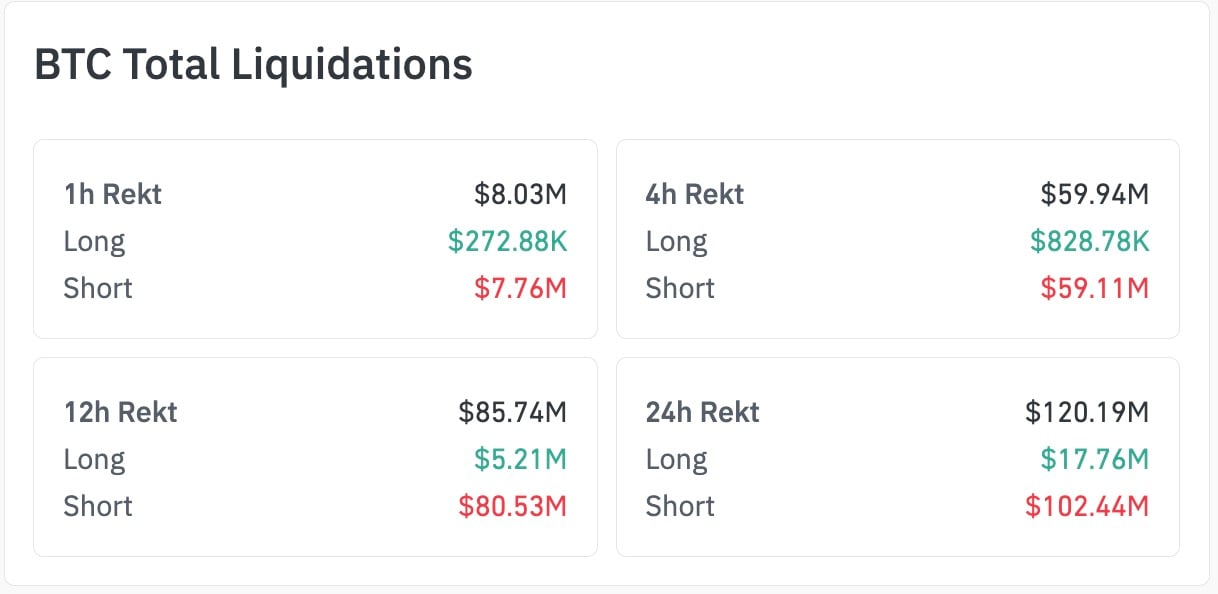

Recent liquidation statistics from CoinGlass indicate a significant short position wipeout, suggesting a potential pivotal moment for Bitcoin. Within a mere four-hour span, $59.11 million in short positions were liquidated, contrasting sharply with only $828,780 in long positions—resulting in an astonishing imbalance of 7,132%.

Over the course of 24 hours, shorts represented $102.44 million out of a total of $120.19 million in liquidations. This data implies that there has been considerable misalignment during this local downturn. While such discrepancies often precede attempts at recovery, any chance for lasting upward movement hinges on whether genuine demand can supplant the compelled buying pressure created by short sellers.

For the time being, it appears that bears have taken a hit.

Bitcoin Surges but Not in Value

Bitcoin has just experienced one of those liquidation events that can shift market sentiment for an entire week—not due to improved price feelings but because the market settled its debts through short sellers’ losses.

Data from CoinGlass shows that shorts are facing far more severe liquidations than longs across all major timeframes right now. In the latest four-hour interval alone, total Bitcoin ($BTC) liquidations reached $59.94 million; shorts accounted for $59.11 million while long liquidations stood at only $828,780.

This results in an extraordinary ratio of approximately 7,132%. Essentially, this was not merely a natural deleveraging event but rather an intense squeeze affecting Bitcoin ($BTC).

So does this bullish liquidation imbalance—the impressive “7,132%” figure welcomed by crypto enthusiasts—signal the end of a bear market? Not exactly; it signifies merely the conclusion of misaligned positioning.

The true indicator will be what transpires once this squeezing pressure dissipates: Will spot demand remain strong? Will bids re-establish themselves above previously reclaimed levels? And will funding and open interest rise again without quickly transitioning into another overly crowded long position?

This imbalance is indeed significant; however,a genuine “regime change” for Bitcoin requires more than just forced buybacks—it necessitates consistent follow-through action.