Market statistics reveal that Bitcoin’s value relative to gold is currently much lower than it was during its 2015 market bottom.

To provide some background, Bitcoin hit a low of $152 in January 2015 amid a bear market. At that time, the BTC-to-gold ratio (BTC/XAU) was at 0.13, and the weekly Relative Strength Index (RSI) dropped to 27.62—one of Bitcoin’s most undervalued points before experiencing a significant rebound.

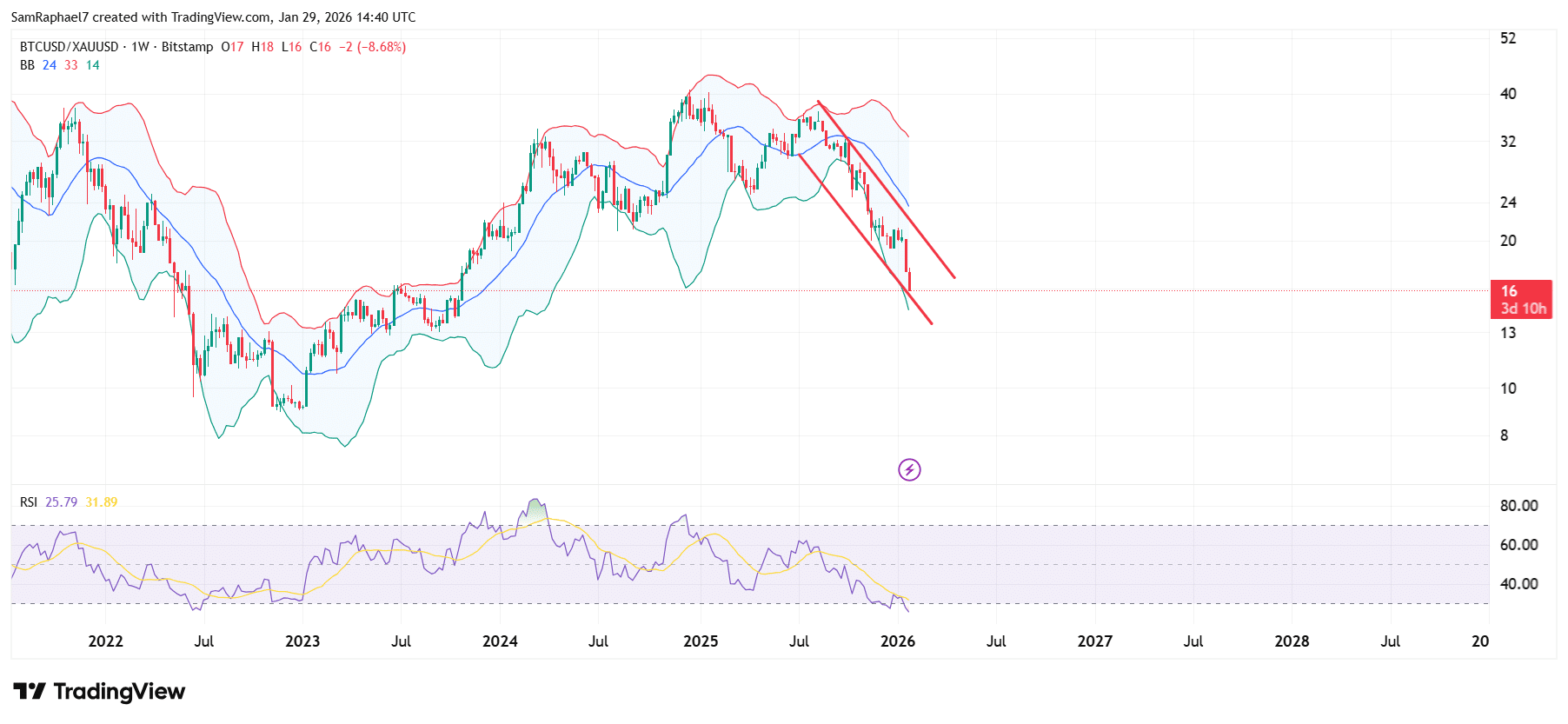

In contrast, today Bitcoin trades above $87,000 with the BTC/XAU ratio around 16. However, the weekly RSI against gold has fallen even further to 25.80, indicating that Bitcoin is currently more undervalued compared to gold than it was back in 2015. Additionally, the BTC/XAU Z-Score is also lower now than during January 2015, reinforcing this observation.

Highlights

The value of Bitcoin relative to gold has steadily declined from a high of 29 ounces per BTC in Q4 of 2025 down to approximately 16 today.

This downward trend follows Bitcoin’s peak near $126,000 in October 2025 while gold prices have surged toward record highs.

The weekly RSI for BTC versus XAU has plunged to its lowest level in fifteen years at just under 26 points.

This historic low confirms that Bitcoin’s current valuation against gold is even weaker than during its notable bottoming phase in early-2015 when RSI stood at roughly 27.6.

Moreover, market data shows that the Z-Score for BTC/XAU remains below levels seen during previous lows — signaling extreme undervaluation right now.

Bitcoin’s Decline Against Gold Continues

Michaël van de Poppe—a seasoned crypto analyst—recently emphasized this ongoing slide as he tracked how bitcoin continues losing ground versus gold since August of last year when it fell from about thirty-seven ounces per coin at its peak.

A brief recovery pushed values back up near twenty-nine ounces by late last year but selling pressure resumed afterward; presently trading close to sixteen ounces after months-long declines alongside bitcoin dropping from over $126K down toward $87K while precious metals reach all-time highs near $5500 an ounce.

An Extremely Undervalued Position for Bitcoin

The analyst pointed out how deeply undervalued bitcoin appears based on key metrics like the Z-Score—which compares actual price levels against fair valuations relative to gold—and noted this score approaching negative two marks an unprecedented low since tracking began.

This current reading falls beneath what occurred during bitcoin’s prior trough around early-2015 when prices hovered near one hundred sixty dollars and btc/xau ratios were similarly depressed (~0.13), highlighting just how cheap bitcoin looks now despite much higher nominal dollar prices and ratios closer to sixteen rather than fractions below one percent then).

Bitcoin Z-Score Versus Gold | Bitwise

This evidence suggests although bitcoins trade significantly higher nominally today ($87k vs ~$160), their value measured against precious metals like gold signals deeper discounting—and historically such conditions precede strong upward reversals within markets alike cryptocurrency or commodities alike).

RSI Data Supports This Undervaluation Thesis

The weekly Relative Strength Index comparing btc/xau pairs reinforces these conclusions: back at those critical lows five years ago readings dipped into mid-twenties territory (~27), marking extreme oversold conditions which foreshadowed rallies ahead;

Today however we see even lower figures around ~25.8—the weakest point recorded over fifteen years—highlighting intensified bearish sentiment but simultaneously signaling potential buying opportunities if history repeats itself.

A Potential Turning Point?

Van de Poppe expressed his belief that if given another chance he would buy into bitcoin again around similar valuation lows as those seen five years ago due primarily because these metrics indicate unusually attractive entry points relative both historical trends & £

He reminded listeners about past performance where following such bottoms bitcoin experienced exponential growth—for instance rising approximately one hundred twenty-two times between early ’15 lows ($160) up until December ’17 peaks nearing twenty thousand dollars.

Whether history will repeat itself remains uncertain but data strongly implies current conditions might offer investors comparable opportunities amidst ongoing volatility across global financial markets.