Bitcoin is on the verge of setting a new record as it approaches $124,000, driven by a robust performance in September and an impressive start to October.

The surge has been fueled by significant institutional investments in ETFs and substantial corporate acquisitions, creating strong upward momentum.

Experts predict that if this demand continues throughout the fourth quarter, Bitcoin could reach between $160,000 and $200,000.

As 2025 enters its final stretch, Bitcoin (BTC) has surged past the $120,000 mark. This rally has reignited discussions about potential new all-time highs among traders who had anticipated such momentum.

This bullish trend follows an unexpectedly strong September and is being heralded as the beginning of what might be a historic “Uptober.”

Currently hovering just below its previous peak of $124,128 set in August, analysts suggest conditions are ripe for Bitcoin to potentially hit $200K before year-end if current trends persist.

A Seasonal Rally Gains Traction

The month of September concluded with Bitcoin above $114K—a roughly 5% increase—defying typical patterns of weakness during this period. This laid a solid foundation for October’s breakout performance.

Historically speaking when September ends positively like it did this year; subsequent quarters often see significant gains—with years such as 2015 through 2024 averaging over fifty percent increases during Q4 alone!

This pattern combined with average gains observed each October (21.8%) & November (10.8%) reinforces why “Uptober” resonates so strongly within crypto trading circles today more than ever before!

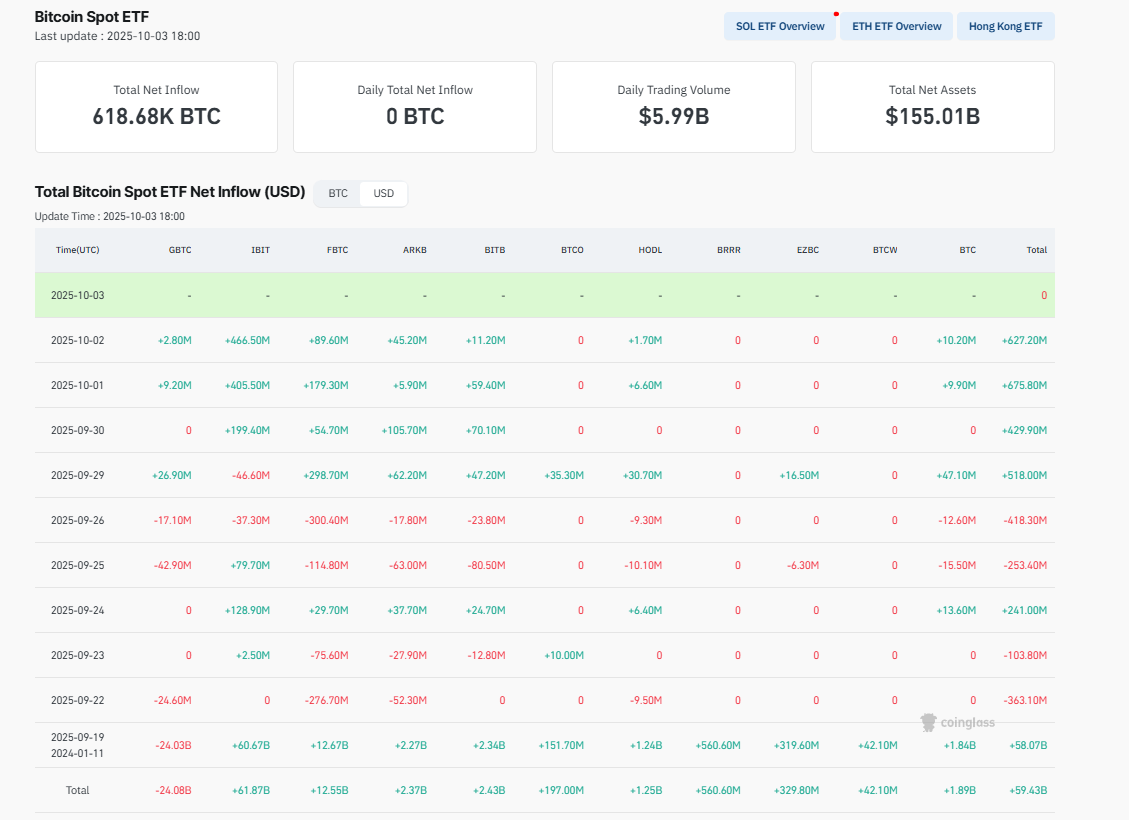

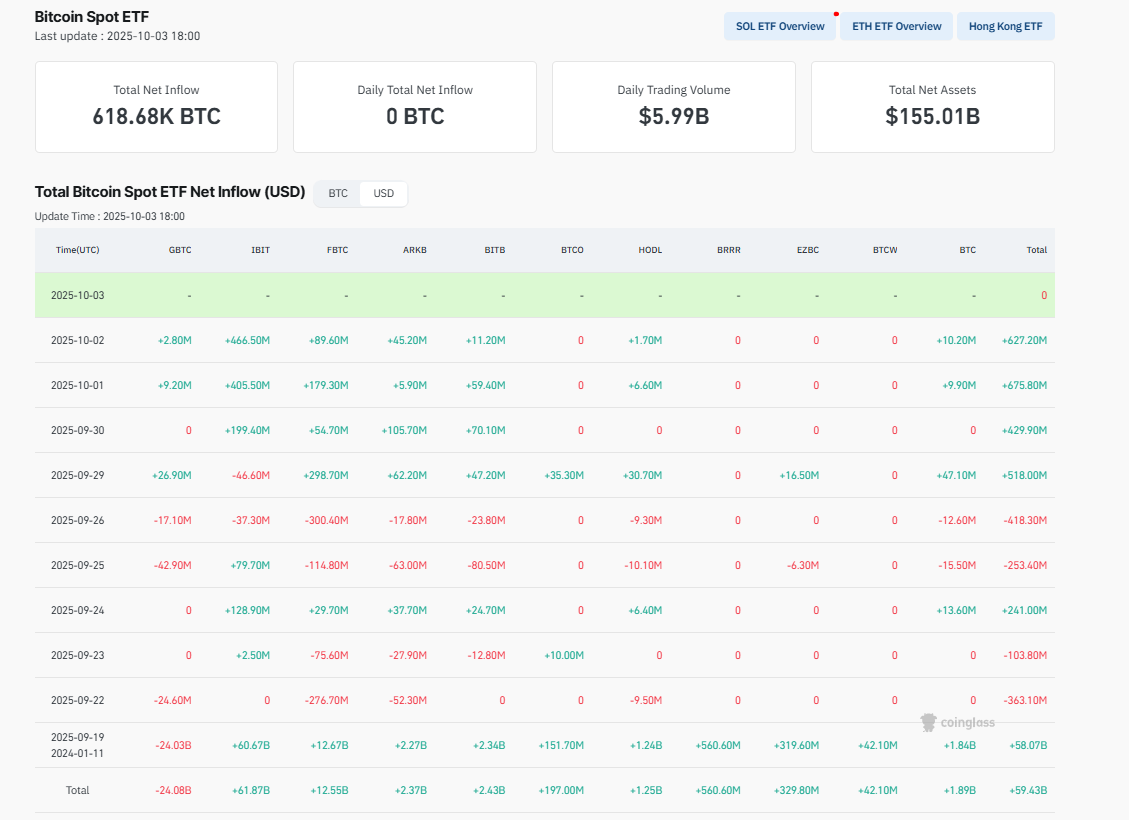

The Role Of Institutional Demand In BTC’s Rise

Source: Coinglass

Source: CoinMarketCap

$200k Within Reach?

Source: Coinglass

Source :CoinGlass.com