Bitcoin is showing little excitement today, maintaining a steady price around $87,867. The market capitalization stands strong at approximately $1.75 trillion, with a robust 24-hour trading volume of about $47.44 billion. Throughout the day, Bitcoin’s price has fluctuated narrowly between $87,640 and $90,315 as traders cautiously navigate these critical levels without decisive moves. Market volatility is decreasing while momentum weakens; although technical patterns hint at an impending significant shift, the exact direction remains unclear.

Technical Analysis of Bitcoin

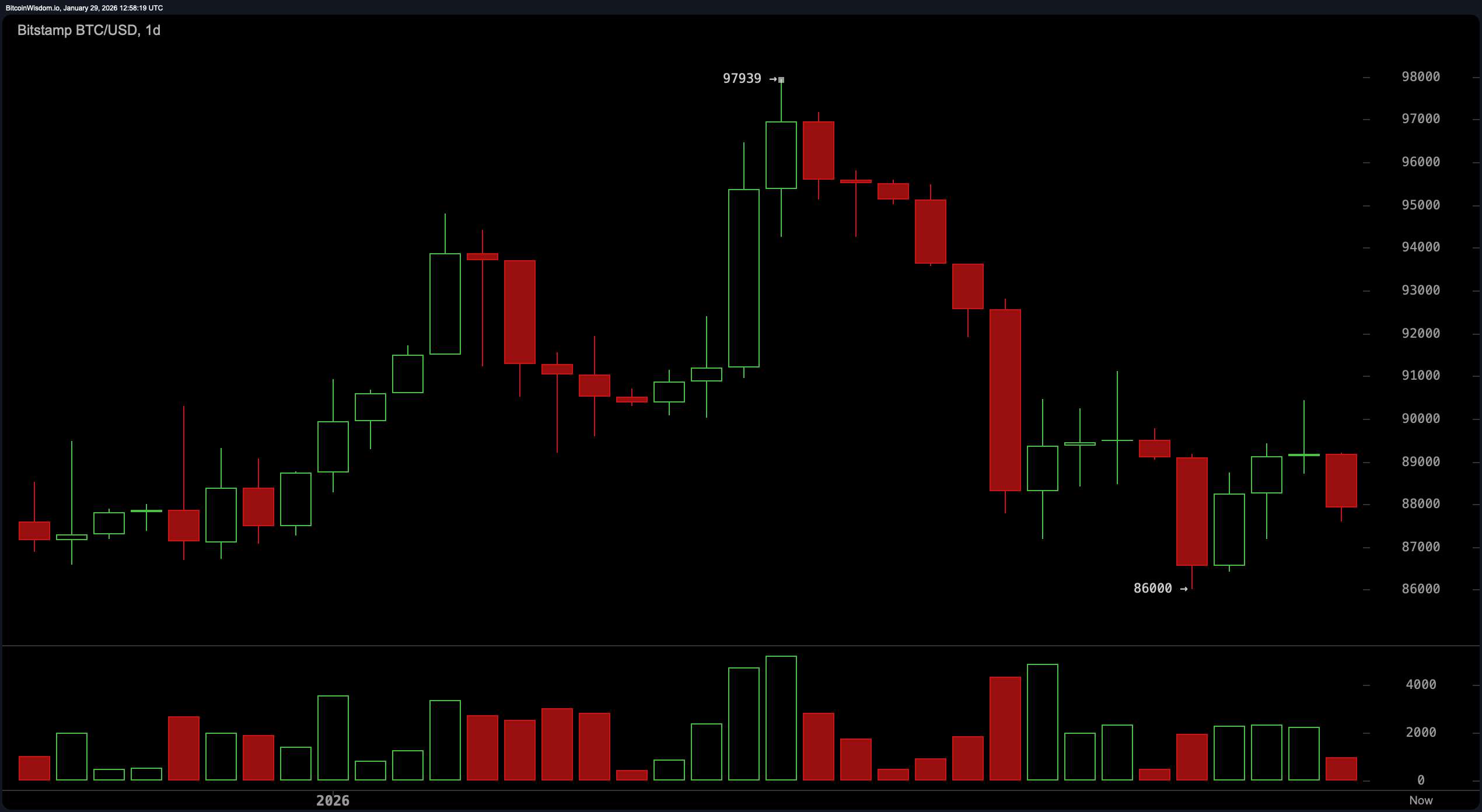

On the daily timeframe, Bitcoin appears to be undergoing a short-term correction within a larger sideways trend. After facing sharp resistance near the $98,000 mark that triggered a steep decline down to roughly $86,000, prices have since stabilized somewhat.

The recovery so far seems tentative and unable to break through the resistance zone between $92,000 and $93,000—a range that previously acted as support but now serves more like an invisible barrier preventing upward movement. While holding above the key level of $86,000 remains crucial for sustaining this base formation narrative; any firm drop below it could invalidate current bullish setups.

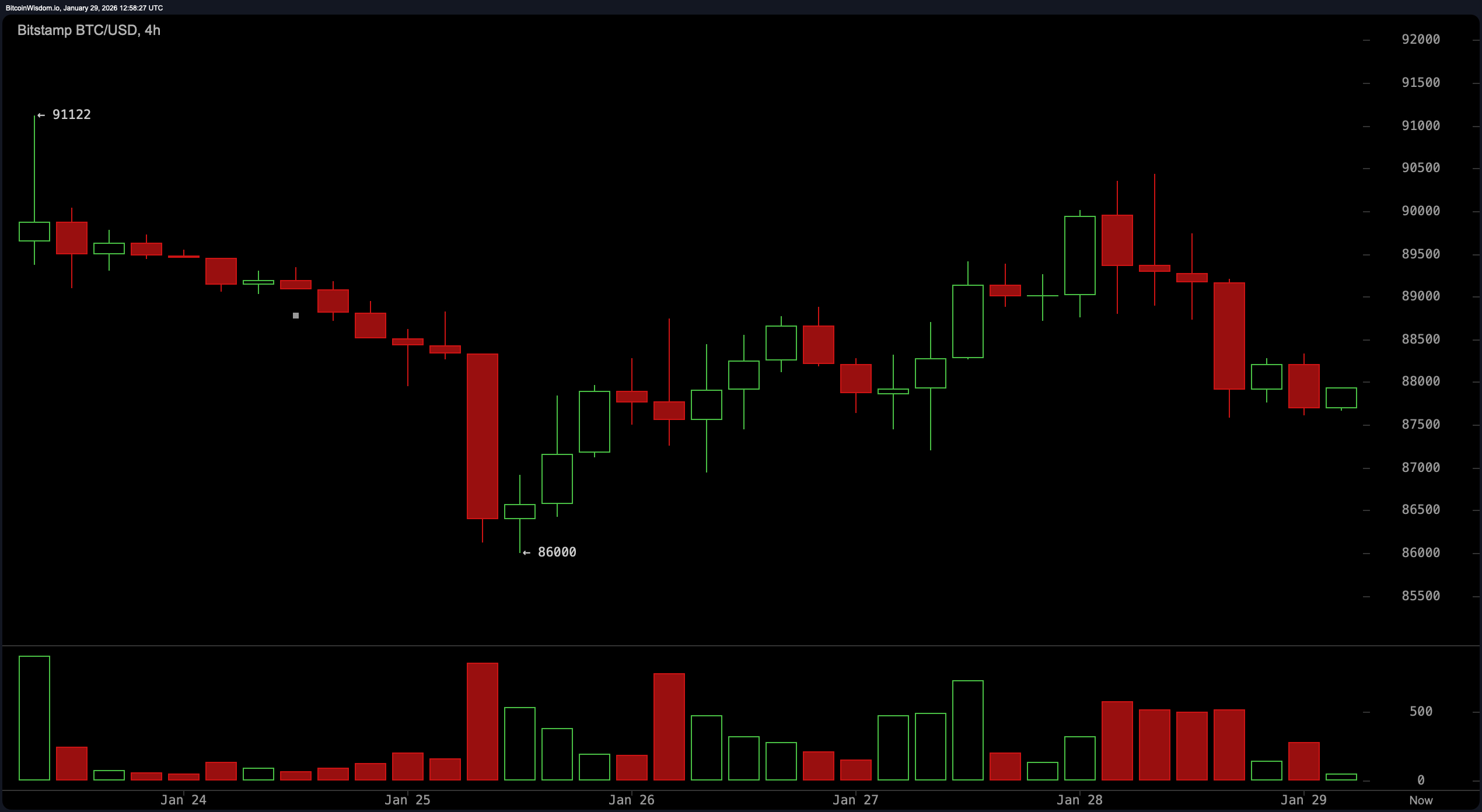

The 4-hour chart reveals continued consolidation within defined boundaries where price swings create more whipsaw effects than clear trends. A rebound from around $86K briefly lifted hopes but fizzled just under the important threshold near $91K. Volume analysis supports this uncertainty: heavy selling pressure during declines contrasts with weak buying strength on rallies—classic signs pointing toward corrective behavior rather than trend reversal momentum.

Zooming into shorter intervals on the 1-hour chart highlights tight consolidation between roughly $87,500 and just below$88,&&&;800 levels where support is tested repeatedly yet no breakout materializes.

This pattern shows minor higher lows suggesting some buyer interest exists but lacks conviction until surpassing about$89,&;500 decisively.

If prices fall beneath approximately$87,&;300 support again though,it may trigger retesting lower zones near$86,K creating palpable tension akin to moments before sudden volatility erupts.

<IMG SRC="HTTPS://CNEWS24.RU/UPLOADS/232/2323F67D25E08C06E6A7873B867BE738936FE5D2.JPG"&ALT="$BTC/USD 1-HOUR CHART">

Diving into oscillator readings on daily charts paints an indecisive picture: RSI rests around41&period7&comma stochastic lingers low at about24&period6&comma CCI registers negative79&period2&comma ADX sits modestly at23&period4&comma while Awesome Oscillator signals deep negativity near minus2379&period6.

Momentum indicators also reflect weakness with values deeply in red territory (around minus4686) alongside MACD hovering negative close to minus769—suggesting latent shifts may be brewing beneath surface movements yet remain unrealized for now.

The moving averages offer little optimism either—all from short-term exponential (10-period EMA ~89,&period227) up through long-term simple moving average (200 SMA ~104,&period544)—hover above current pricing indicating prevailing downward pressure across multiple timeframes &mdash reinforcing that reclaiming territory beyond$92,K remains essential before bulls can confidently regain control.

Bullish Perspective:

Bulls need one key condition fulfilled: maintain support above$86,K then break convincingly past resistance near$92,K allowing them room to push towards higher targets in vicinity of97–98 thousand dollars thus reshaping short-term structure favorably & reigniting positive momentum dynamics.—Until such breakthroughs occur bullish hopes stay tentative akin to flickering candlelight awaiting stronger gusts.

Bearish Outlook:

Bears hold advantage provided Bitcoin struggles under90 thousand dollars—the inability even keep firmly above87000 let alone86000 risks triggering deeper sell-offs targeting demand areas located in low80 thousands range.With every major moving average sloping downward combined with weakening momentum metrics,the bears’ case technically appears cleaner & louder amidst present market conditions.—The path lower carries greater conviction unless proven otherwise by strong upside action soon enough.

🕑️</span> FAQ

<strong>What&#39;s bitcoin&#39;s current trading value?</strong> The latest data places bitcoin around eighty-seven thousand eight hundred sixty-seven US dollars as recorded January twenty-ninth two thousand twenty-six.

<strong&gtWhich critical support level should traders monitor?</strong&gt Eighty-six thousand USD represents pivotal floor whose breach might accelerate downside risk further downwards.</p&pgt;

<b&gtWhat resistances are limiting bitcoin's rally?</b&gt The ninety-two-to-ninety-three-thousand-dollar band acts as stiff ceiling capping upward advances currently.

& lt ; b > Is bitcoin trending upwards or downwards ? At present ,bitcoin trades sideways within defined ranges ,with bearish sentiment dominating shorter timeframes .