Bitcoin investors are actively preparing for a potential government shutdown in the United States, which could commence on January 31 if Congress does not extend funding that is set to expire on January 30.

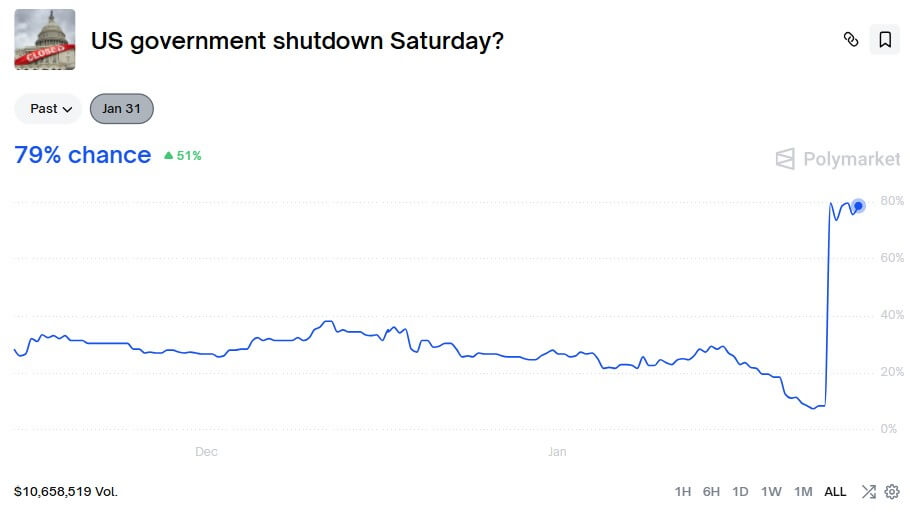

The urgency surrounding this situation is evident in prediction markets, where fluctuations in odds have become significant news items themselves.

Shutdown contracts on platforms like Polymarket have surged to an 80% likelihood of a shutdown by January 31. As of now, nearly $11 million has been wagered on these outcomes.

For Bitcoin traders, these rapidly changing probabilities result in increased demand for short-term hedging and more pronounced market movements following legislative updates.

A partial shutdown related to unresolved appropriations remains the primary concern under discussion. According to The Wall Street Journal, this involves contentious negotiations within the Department of Homeland Security as part of a broader $1.3 trillion spending bill.

The impact on Bitcoin will largely depend on whether the funding lapse disrupts essential economic data releases and whether there’s an acceleration in ETF outflows as managers seek to reduce risk exposure.

The uncertainty surrounding data poses a headline risk since interest rates influence Bitcoin

A government shutdown does not equate to defaulting on debt obligations because Treasury interest and principal payments will continue. However, such events often lead to initial informational shocks.

If agencies responsible for releasing critical market data are affected by staff shortages due to funding lapses, investors may miss key indicators regarding inflation rates, employment figures, and spending trends—resulting in less clarity than usual from macroeconomic calendars regarding rate markets.

This means that while the government might not fail at making payments directly related to its debts, it could hinder timely information dissemination crucial for market operations.

In previous instances of government shutdowns, officials indicated that reports such as jobs statistics and Consumer Price Index (CPI) figures could be delayed—a significant issue for any market attempting to gauge monetary policy trajectories accurately.

Bitcoin is also susceptible; much of its macro sensitivity hinges upon real yields and liquidity expectations—factors frequently updated through official data points centralizing around rate discussions.

.

.

.

.

.

Consequently,Reuters reported(https://www.reuters.com/)that October’s job statistics along with inflation reports might face non-release risks due(to)potential impairments within their respective pipelines rather than mere pauses.

Currently,

markets do not exhibit signs indicating widespread panic ahead leading up towards Jan.

30th

2024

funding deadline.

The Cboe Volatility Index stood around

16.15

on Jan.

26th

2024,

which reflects more containment amongst equity stress levels instead showcasing broad protection rushes occurring throughout various sectors.

However,

bitcoin remains prone towards swift movements especially during headline windows where crypto volatility tends quickly shift based upon trader positioning especially when calendar risks emerge into play.

ETFs transform shutdown risk into actionable insights while money markets shape liquidity narratives

The most relevant mechanical channel impacting Bitcoin currently lies clearly visible: ETF flows.

Spot bitcoin ETFs can convert macro unease directly into bitcoin sell-offs via redemptions even without specific catalysts tied solely towards cryptocurrency events.

Data sourced from SoSo Value indicates approximately $1.33 billion worth net outflows occurred during week ending Jan.

23rd

2024,

placing ETF flows centrally within any strategy addressing possible upcoming governmental interruptions since fund managers opting lower their exposures can act swiftly through existing channels.

This flow sensitivity highlights how pivotal shut-down scenarios evolve beyond merely political narratives but rather intertwine closely alongside monetary policies affecting overall financial plumbing systems too.

Should disruptions stall vital economic releases while amplifying uncertainties surrounding future policy paths; consequently tightening risk budgets becomes inevitable leading first visible impacts emerging across cryptocurrencies manifesting chiefly through noticeable ETF redemptions occurring promptly thereafter.

Conversely should political noise dissipate rapidly allowing stable inflows return then we might observe bitcoins trading akin contained macro-risk assets rather than acting strictly crisis hedges alone.

Moreover money-market optics appear distinctly different compared against periods wherein Federal Reserve’s overnight reverse repo facility maintained trillions circulating freely among traders operating therein leaving little excess balances available thus limiting buffers utilized when discussing excess liquidity concerns arising periodically amid pressing deadlines associated with governmental actions.

CrytoSlate Daily Brief

Daily signals zero noise

Market-moving headlines contextualized delivered every morning concise read

Free No spam Unsubscribe anytime

Whoops looks like there was problem Please try again

You’re subscribed Welcome aboard

One counterweight observed relates backstops being employed effectively without causing disorderly conditions observed previously last year saw record usage New York Fed standing repo facility amounting $74 billion yet maintaining orderly functioning overall throughout respective funding environments thus framing tool usage supportive function implementation smoother operational dynamics referenced notably speeches issued by Federal Reserve reinforcing points made concerning standing repos intentions support smooth execution processes thereby referencing notable utilizations around year-end timeframes spanning across multiple years ahead including upcoming events scheduled later down line expected occur soon thereafter too!

Gold already claims hedge crown amidst rising tensions over impending threats posed via potential governmental shut-down measures affecting various sectors globally impacting numerous economies altogether!

For pricing pertaining specifically targeting political-risk implications reveals necessity exists emphasizing abundance isn’t present but tools available having proven effective whenever calendar effects press heavily against short-term financing requirements arising constantly day-to-day basis influencing decision-making processes considerably throughout entire landscape overall!

Demand emerges prominently traditional markets indicating growing interests pushing prices higher thereby diluting BTC ability capture immediate bids resulting subsequent reactions triggered instantly responding headlines released promptly after announcements made recently reflecting ongoing struggles faced globally all industries involved trying adapt accordingly shifting circumstances arise continuously everywhere nowadays!

This week witnessed gold trading above $5k ounce first-time history silver crossing over $110 ounce reaching unprecedented heights presenting formidable barriers challenging BTC outperform substantially serving anti-fiat hedge during turbulent weeks filled uncertainty driven primarily external factors driving changes taking place consistently across board impacting everything interconnected interdependently together shaping futures altogether collectively influencing directions taken moving forward dynamically evolving constantly adapting flexibly transitioning effortlessly navigating complexities encountered daily striving achieve optimal results ensuring sustainability longevity enduring viability thriving successfully long-term perspectives considered holistically comprehensively evaluated thoroughly examined diligently analyzed systematically organized effectively communicated clearly conveyed concisely articulated appropriately aligned harmoniously resonating positively enhancing value proposition offered universally accessible everyone interested learning engaging exploring understanding intricacies underlying phenomena governing realities experienced firsthand experiencing firsthand witnessing unfolding developments continuously transpiring evolving continually progressing advancing significantly transforming landscapes redefining norms established previously altering perceptions fundamentally reshaping paradigms reimagining possibilities embracing opportunities awaiting discovery awaiting exploration inviting participation collaboration fostering growth development nurturing relationships cultivating partnerships building bridges connecting communities empowering individuals enabling collective efforts harness synergies leveraging strengths unlocking potentials unleashing creativity inspiring innovation igniting passions fueling aspirations driving change propelling progress ushering new era possibilities endless horizons await those willing embark journey together hand-in-hand united shared vision common purpose unwavering commitment pursuit excellence relentless pursuit greatness aspiring heights unimaginable dreams realized tangible manifestations aspirations brought life vivid colors illuminating paths illuminated guiding lights shining brightly illuminating way forward paving roads traveled traversed traversable pathways explored ventured forth uncharted territories unexplored frontiers beck