Bitcoin Is Increasingly a Purchased Asset Rather Than a Used Currency

Throughout much of Bitcoin’s existence, its price trends and user activity generally moved in tandem.

When the price surged, more individuals engaged with the network—wallets became active and transaction volumes rose. Although not perfectly aligned, this correlation was consistent enough to treat price as an approximate indicator of adoption.

However, this connection has recently unraveled.

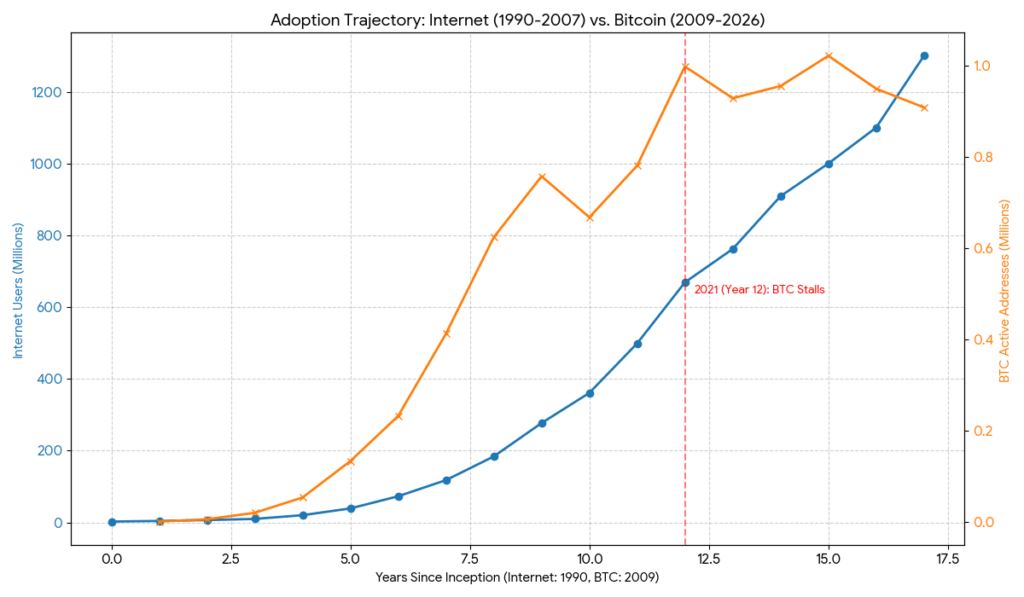

For years, Bitcoin’s growth was likened to that of the internet in its infancy—with many proclaiming “we’re still early.” The upward trajectory seemed assured. Yet since 2021, Bitcoin’s usage metrics have ceased following this pattern.

| Years Since Launch | Total Internet Users (Year) | Bitcoin Active Addresses (Year) | |||

|---|---|---|---|---|---|

| Year 1 | The BTC network began from a significantly smaller base compared to early internet users.</td&a mp;; gt;</tr&a m p;; gt;

<tr&a m p ;; gt ; | Year 5 | 1995 : &# x A03 9 .2 M | 2014 : ~150 ,000 | Rapid scaling observed for BTC during this period . |

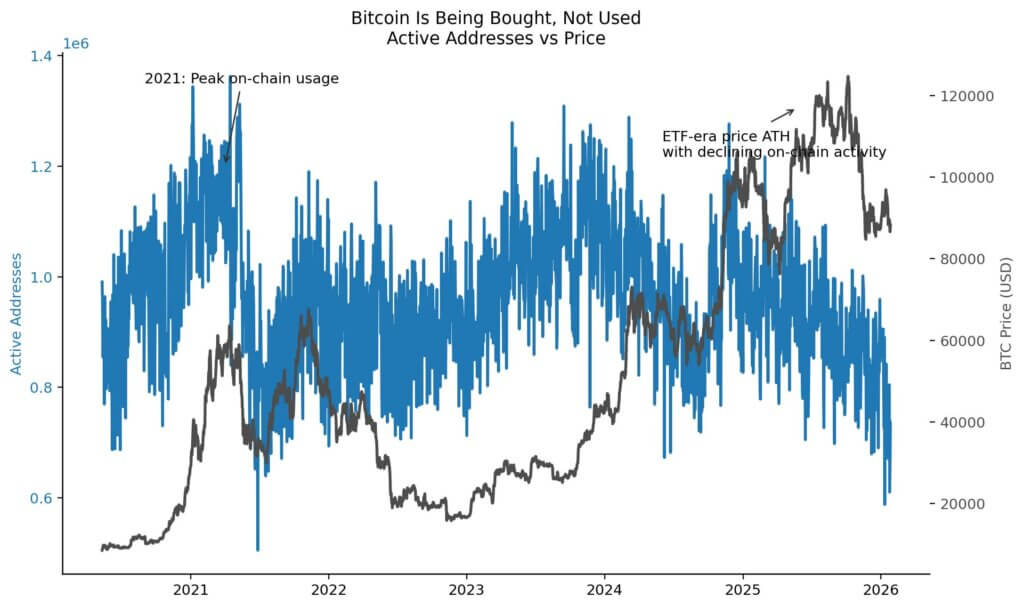

Despite Bitcoin reaching unprecedented prices that would have seemed unimaginable just a few years ago, actual network usage has declined. While on-chain transactions haven’t disappeared entirely, they lag behind what one might expect given current valuations.

This data suggests aggressive accumulation by investors but diminishing day-to-day engagement with the blockchain compared to four years prior.

This is less likely a temporary anomaly and more indicative of a fundamental change in how Bitcoin operates within financial markets.

The Disparity Between Price Surges and User Activity Growth

The initial chart clearly highlights the issue—the count of active Bitcoin addresses has dropped to levels unseen since January 2020.

To put it into perspective: back then miners earned rewards worth roughly $1.1 million per block due to higher transaction fees when miner compensation was at 12.5 BTC per block. Today miners receive about $275,000 per block on average despite lower fees because reward halving reduced payouts over time.

The peak daily active addresses were recorded during the bullish market run in mid-2021 at approximately between one point two million and one point three million daily participants—a high-water mark for blockchain engagement so far—and since then these figures have never recovered fully despite subsequent all-time high prices reached during ETF-driven rallies starting around late-2023 through early-2025 timeframe where prices hit record highs but user participation steadily declined toward bear-market levels last seen throughout much of calendar year two thousand twenty-two . This means fewer people are actively transacting or interacting directly with bitcoin than four years ago even though valuation continues climbing strongly which challenges traditional assumptions linking rising asset values directly with expanding user bases or broader adoption metrics within decentralized networks like bitcoin itself especially considering alternative investment vehicles now exist outside direct blockchain involvement .

The Influence Of ETFs On Market Dynamics And Usage Patterns

Examining why such divergence matters requires stepping back from isolated indicators towards holistic measures encompassing multiple facets representing real-world interaction beyond mere pricing signals alone — thus we developed an index aggregating key on-chain fundamentals including daily active address counts total transaction volume normalized realized versus spot pricing ratios weighted primarily toward measuring genuine utility rather than speculative valuation spikes alone aiming specifically at isolating true underlying adoption trends while filtering out noise caused by rapid price fluctuations .

Plotting this composite index against normalized spot market value reveals stark separation beginning early two thousand twenty-four shortly after US regulatory approval allowed spot bitcoin ETFs offered by major custodians such as Coinbase disrupting historical coupling between transactional use cases versus pure capital inflows facilitated off-chain through institutional products .

Price momentum persisted upward whereas actual measured adoption stalled before trending downward – contrasting sharply previous cycles where both moved largely hand-in-hand either rising together pre-bubble bursting or falling simultaneously amid downturns.

ETFs fundamentally altered who buys bitcoin plus how ownership manifests—now exposure can be gained without ever touching underlying blockchain infrastructure via custodial platforms eliminating need for wallet creation broadcasting transactions paying miner fees thereby decoupling asset ownership from direct network participation altogether.

Note:[While authorized participant OTC transfers do get recorded on chain occasionally ETF trades themselves occur exclusively off chain along with numerous other private OTC dealings conducted between Coinbase Prime accounts.]

This shift means assets exchange hands frequently yet leave no traceable footprint impacting core ledger activity.

A Growing Capital Base With Declining Network Velocity

The relationship between realized price — reflecting average acquisition cost across circulating coins —and volatile spot market pricing further clarifies ongoing structural changes.

Realized cost basis tends toward gradual increases as long-term holders accumulate steadily while short-term traders cause sharp fluctuations reflected mainly via spot prices.

Since twenty-twenty-three realized value climbed consistently signaling deeper commitment among existing holders meanwhile rapid surges driven mostly by ETF-related demand pushed spot values temporarily above sustainable levels creating widening gap illustrating increased capital concentration alongside slower transactional velocity.

These dynamics portray bitcoin evolving into collateralized treasury-like holdings emphasizing preservation over circulation diverging markedly from narratives portraying it primarily as everyday transactional currency linked tightly with rising prices .

A Fundamental Regime Change Instead Of Mere Cycle Variation

By analyzing rolling correlations spanning ninety days comparing our composite adoption metric against prevailing market prices we observe historic alignment breaking down post introduction ETFs causing erratic swings sometimes negative correlations indicating disconnects whereby increasing valuations fail reflecting growing user interactions previously characteristic throughout earlier phases marked consistently positive relationships signaling organic expansion followed by typical capitulation events seen during bear markets.

Post-ETF era exhibits unstable linkage undermining reliability using price movements alone as proxy indicators for real-world engagement confirming first time ever disassociation occurred underscoring shifts not only affecting valuation mechanisms but also fundamental patterns governing ownership access modalities along new institutional frameworks reshaping ecosystem architecture .

Implications For Measuring And Understanding Bitcoin Adoption

Noneofthismeansthatbitcoinisdecliningorlosingvalue.Instead,itreflectsanewphaseinitsdevelopmentcharacterizedbylowervelocitybutgreatercapitalintensity.Onchainuseractivitypeakedaroundtwenty-twenty-onewhilepricegrowthposttwentytwentyfourprimarilydrivenoffchaininvestmentvehicleslikeETFswhichintroducedstructuraldecouplingbetweenusageandvaluationmetrics.Realizedpriceincreasesindicatestrengthamongexistingholdersratherthanexpandinguserbase.SupportingevidencefromUTXOageanalysisrevealsoldercoinsaccountforlargersupplyproportionswhileyoungeroutputsgrowmoreslowly.Exchangeflowsfavoraccumulationoverdistribution,andtransactioncountsremainflatdespitedoublingpricessincetwentytwentytwo.

<imgsrc=' https:// cnews24 ru uploads1831837 cb438beeb4ddb36645 fbeac033adcccb png 'alt=''/&g tp;

Bitcoinisenteringanewerawhereitfunctionsmoreasastorageofvalueinstrumentthanamasspaymentnetwork.Thistransitiondoesnotinvalidateitsutilitybutnecessitatesrethinkinghowadoptionissensedandvaluationsinterpreted.Inparticular,relyingonpriceasanindicatorofnetworkusageisno longereffectiveintheETFdominatedlandscape.Bitcoinisbeingaccumulatedenthusiasticallyat scale,butactualutilizationhasdeclined.Theblockchainsignalshavebeenpointingtothischangeforquite some time making it difficulttoignorethebroadertrendoverall.