Amidst the Crypto Twitter community’s efforts to decipher Bitcoin’s recent movements, Michael Saylor made a bold statement. Donning his signature orange attire and sunglasses, he simply said: “Be cool.” This succinct message perfectly reflected the confident style of the MicroStrategy (MSTR) CEO.

This assertive tweet appeared just as Bitcoin experienced a significant liquidation event, with longs overwhelmingly favored by a 299% imbalance. The timing was impeccable.

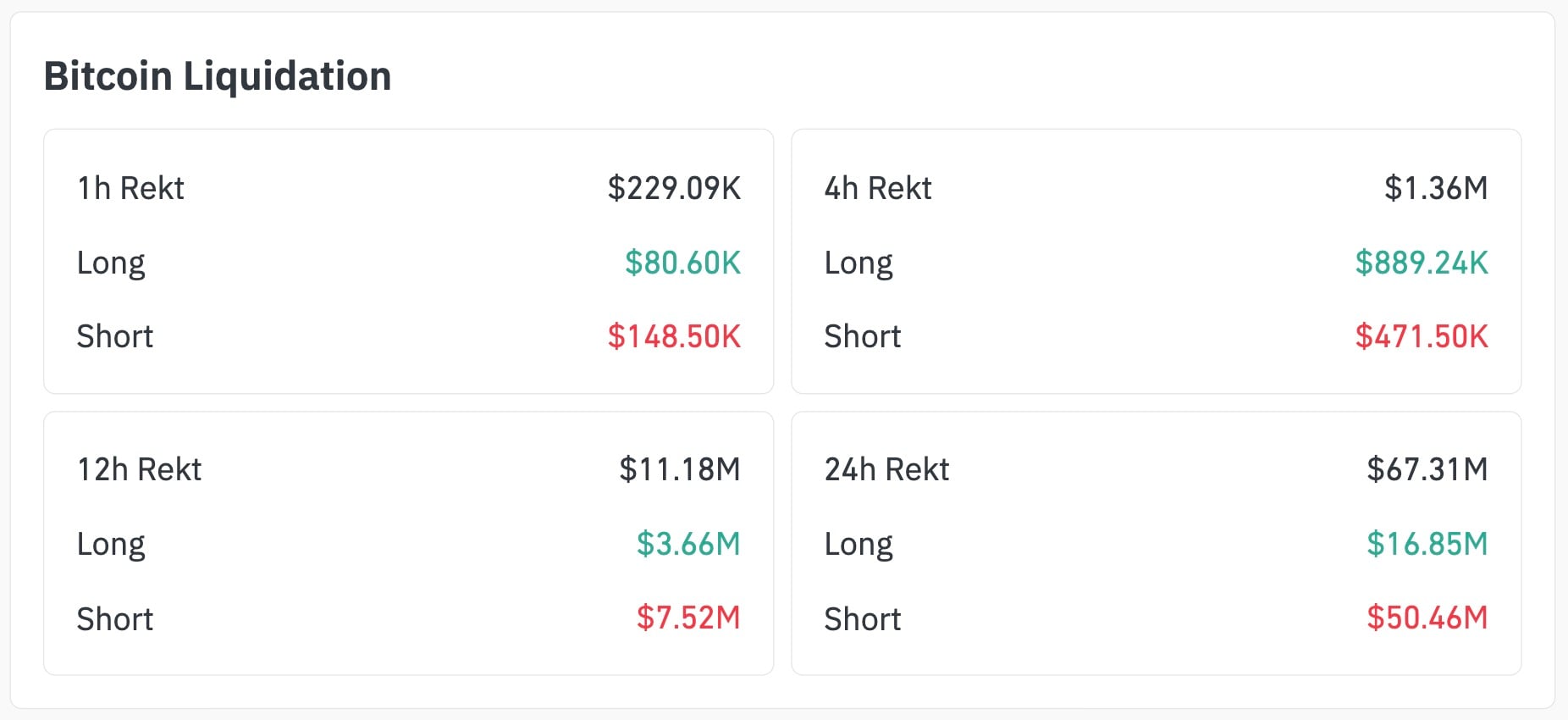

Data from CoinGlass reveals that within the past 24 hours alone, $67.31 million worth of positions were liquidated — with shorts accounting for $50.46 million and longs only $16.85 million.

₿e Cool pic.twitter.com/ZcSR8Lxt4g

— Michael Saylor (@saylor) January 27, 2026

Although Saylor’s post might seem like lighthearted banter or even a meme, it coincided precisely with bears being driven out of the derivatives market. Despite Bitcoin currently trading around $88,140 and appearing stable on the surface, beneath lies one of this month’s most intense short squeezes.

The liquidation imbalance over twelve hours also heavily favors longs at a ratio of approximately two-to-one against shorts. On shorter timeframes like four hours, this ratio approaches nearly 190%. In just the last hour alone, short positions worth about $148,500 were liquidated compared to roughly $80,600 in long positions.

A broader analysis of Bitcoin’s price chart reveals a sharp whipsaw pattern: an initial rebound near $87K followed by upward momentum that triggered numerous stop-loss orders among shorts around the $88K mark — largely due to thin liquidity and excessive leverage taken by bearish traders.

Did Michael Saylor Gain an Edge With His Tweet?

The answer is likely no — though he has been deeply involved in Bitcoin long enough to sense when market dynamics shift subtly beneath surface stability. While prices have remained relatively unchanged recently, bears have suffered losses totaling around $50 million; essentially now it seems that these forced liquidations are driving price action more than organic buying or selling pressure.

Bears had been attempting to capitalize on every local peak since BTC failed to break above its critical resistance at $90K but today’s aggressive squeeze has reinvigorated bullish sentiment significantly.

If this trend continues over another half-day period or so without interruption then we could see another major move upwards — not fueled primarily by fresh buyers entering but rather sellers closing out losing bets once again.

Amidst the Crypto Twitter community's efforts to decipher Bitcoin's recent movements,…

"Be cool."

… (and so forth for all special characters such as &, , etc.)