On February 19, Bitcoin underwent another volatile trading day, struggling to hold its value as it settled into a lower price range.

Bitcoin Navigates Increased Volatility Amid Declining Trading Levels

Bitcoin (BTC) experienced significant price fluctuations on February 19, bouncing twice from lows below $66,000 to reclaim the $67,000 mark. This pattern of volatility echoed the previous two days; however, analysts observed that Bitcoin’s trading band has shifted downward. The resistance level has decreased from $69,000 to around $67,000 while support dropped from near $67,000 to just under $66,000.

By Thursday afternoon, Bitcoin had rebounded from an intraday low of approximately $65,733 and was trading close to $66,500—a decline of about 0.9% over the past 24 hours. Since failing to maintain above the critical threshold of $70K earlier in the week on Monday, Bitcoin’s value has fallen roughly 5%, with a more pronounced drop exceeding 25% over the last month.

Despite this sideways movement in price action, Bitcoin’s network security continues hitting new highs. Recent reports show that its seven-day average hash rate reached nearly one zettahash per second (ZH/s), marking an all-time peak for computational power securing the blockchain.

A record-breaking hash rate is generally seen as a positive fundamental indicator—it reflects enhanced protection against attacks—but it tends not to have immediate effects on market prices and is considered more relevant over medium-term horizons.

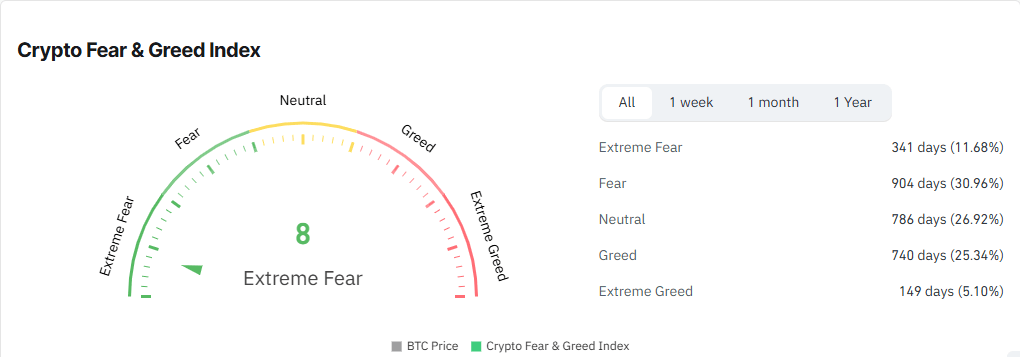

The current market mood remains dominated by “extreme fear,” further evidenced by two consecutive days of net withdrawals from spot Bitcoin exchange-traded funds (ETFs). Data reveals a net outflow totaling approximately US$133.3 million—equivalent to about 1,980 BTC—marking an acceleration compared with roughly 1,520 BTC withdrawn just one day prior.

Impact of Geopolitical Strains and Inflation Concerns

The cryptocurrency’s recent performance also appears influenced by broader economic uncertainties tied closely with geopolitical tensions in the Middle East region. Given its historical correlation with Nasdaq indices and growth-oriented tech stocks,

Bitcoin faced pressure amid fears surrounding potential U.S. military actions targeting Iran.

This conflict could provoke Tehran into blocking passage through

the Strait of Hormuz—a vital artery for global oil shipments—which would not only disrupt supply chains but likely cause oil prices

to surge sharply.

Such developments risk reigniting inflationary pressures worldwide while complicating prospects for future interest rate reductions.

Amidst these challenges, bitcoin (BTC)'s circulating supply nears an important milestone: almost reaching twenty million coins mined so far.

The latest figures put circulation at approximately nineteen million nine hundred ninety-one thousand nine hundred thirty-seven BTC , leaving fewer than ten thousand coins remaining before hitting this landmark .

This milestone highlights bitcoin's growing scarcity as issuance approaches its capped limit set at twenty-one million coins total .

<STRONG frequently asked questions ❓ ;

<B> ; What caused bitcoin’s dip below sixty-six thousand dollars recently ? </B> ; Technical resistance lowering toward sixty-seven thousand combined with increased ETF outflows triggered heightened volatility . </P> ;

<b> ; How healthy is bitcoin’s network despite recent price swings ? </b> The hash rate achieved record levels near one zettahash per second , indicating robust security even amidst falling prices .</P> ;

<b> ; Which global risks currently weigh most heavily on BTC ? </b> Rising geopolitical tensions across Middle Eastern hotspots alongside inflation concerns are pressuring risk assets including cryptocurrencies .</P> ;

& lt;b gt This figure underscores bitcoin’s increasing rarity since less than one million remain before reaching maximum supply limits imposed at twenty-one million coins total ..& lt / b gt >& lt / P >& nbsp ;