On platforms like Myriad, Kalshi, and Polymarket, prediction traders are arriving at a common conclusion: the likelihood of Bitcoin reaching six figures appears significantly higher than it facing a substantial downturn in the near future.

The $100K-or-Bust Mentality Gains Traction

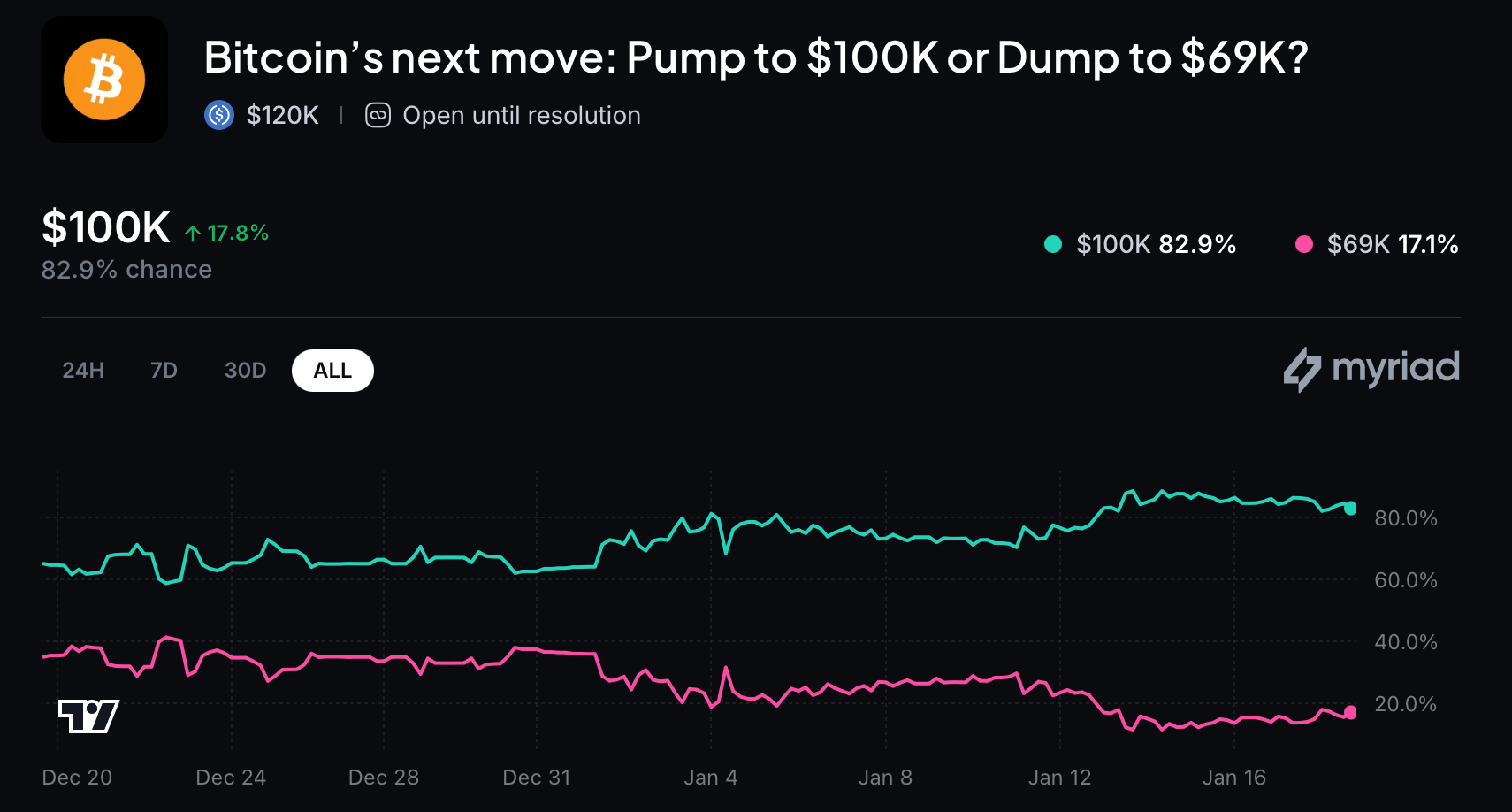

Within Myriad’s market titled “Bitcoin’s next move: Will it surge to $100K or drop to $69K?”, an overwhelming majority of traders lean towards optimism. Approximately 82.9% of participants believe that Bitcoin will hit the $100,000 mark before ever testing the lower threshold of $69,000; only 17.1% support a drastic decline scenario.

This market operates based on Binance’s BTC/USDT spot price with one-minute candle closes, serving as a quick gauge for sentiment rather than an extended forecast.

Source: Myriad on Jan. 19, 2026.

Kalshi’s Downside Discussion Is More Balanced Than Dire

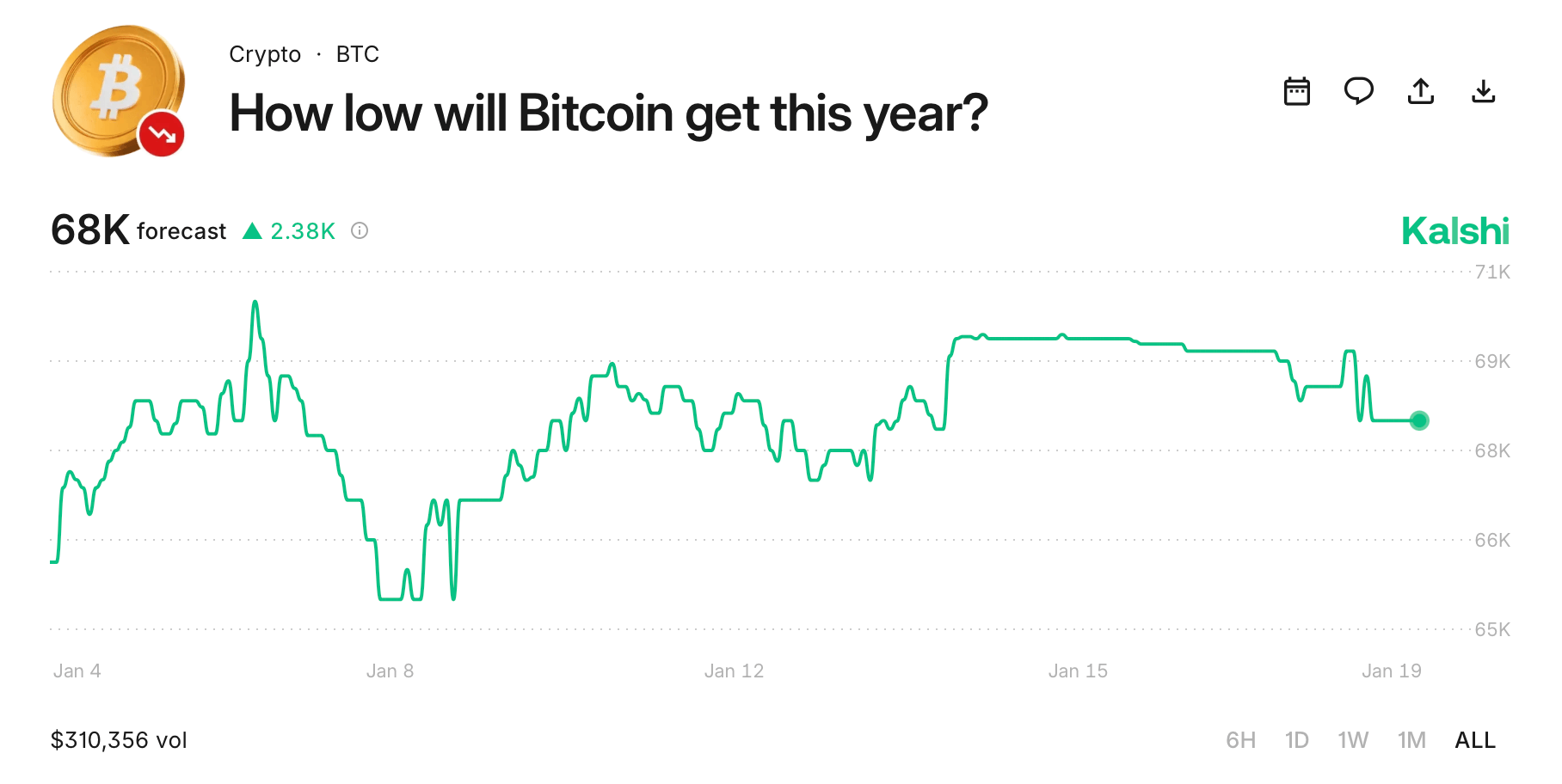

On Kalshi’s platform, discussions shift from “if” to “how low.” The contract titled “How low will Bitcoin get this year?” indicates nearly equal odds—around 52%—that Bitcoin will dip below $70,000 at some point during 2026. Predictions for deeper declines fall to about 47%, while expectations for a milder pullback below $72,000 rise to around 55%. This suggests that while downside risks are acknowledged, panic selling is not seen as likely.

Source: Kalshi on Jan. 19, 2026.

Pushing Boundaries: How High Can It Go?

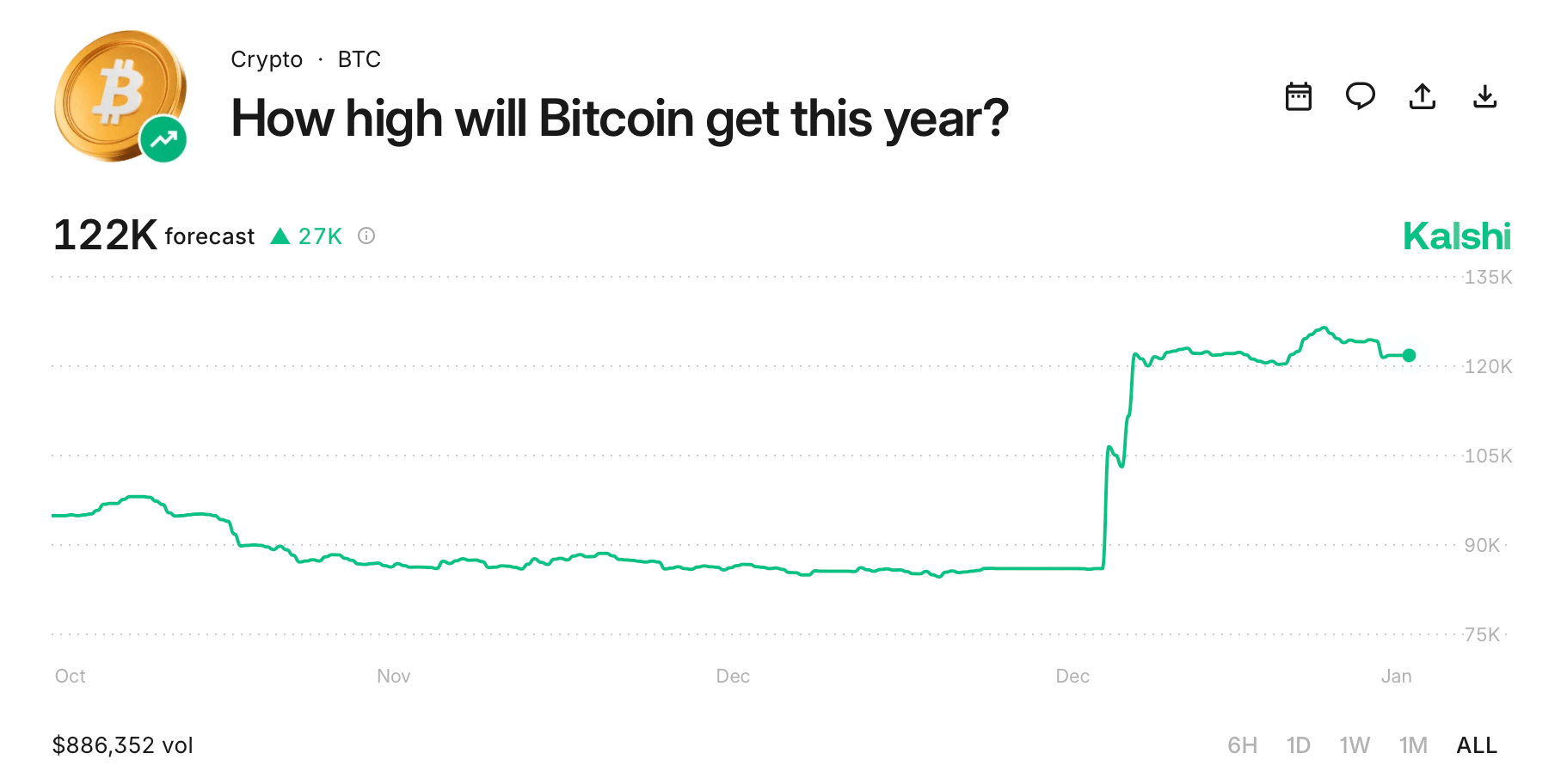

The corresponding market on Kalshi titled “How High Will Bitcoin Get This Year?” outlines potential upper limits. Traders currently estimate about a 52% chance that Bitcoin surpasses $120,000 within the year; using CF Bitcoin Real-Time Index data for settlement supports this figure. Confidence increases at lower benchmarks—approximately 68% for hitting $110k—but diminishes as targets rise higher; there’s only about a 41% implied probability of exceeding $130k. While optimism exists among traders regarding price increases ahead of them is tempered by caution.

Source: Kalshi on Jan.19 ,2026.

Polymarket’s Long-Term Outlook Keeps Expectations Realistic

Turning to Polymarket with its query “What price will Bitcoin reach in 2026?”, we see similar sentiments reflected here too where extreme targets remain unlikely aspirations—with just a mere probability of around 5% assigned to $250k and 10% each allocated to both $200k and $190k prices respectively . Sentiment strengthens closer toward realistic values : A target set at $150 ,000 carries roughly25 % chance ;while those sitting around140 ,00 sitat31 %and those pricedat130 ,00 clockin40 %. The highest confidence levels congregate near the benchmarkof120 ,00 leadingthe packwithabout51 %.

The Race Begins: Which Milestone Comes First?

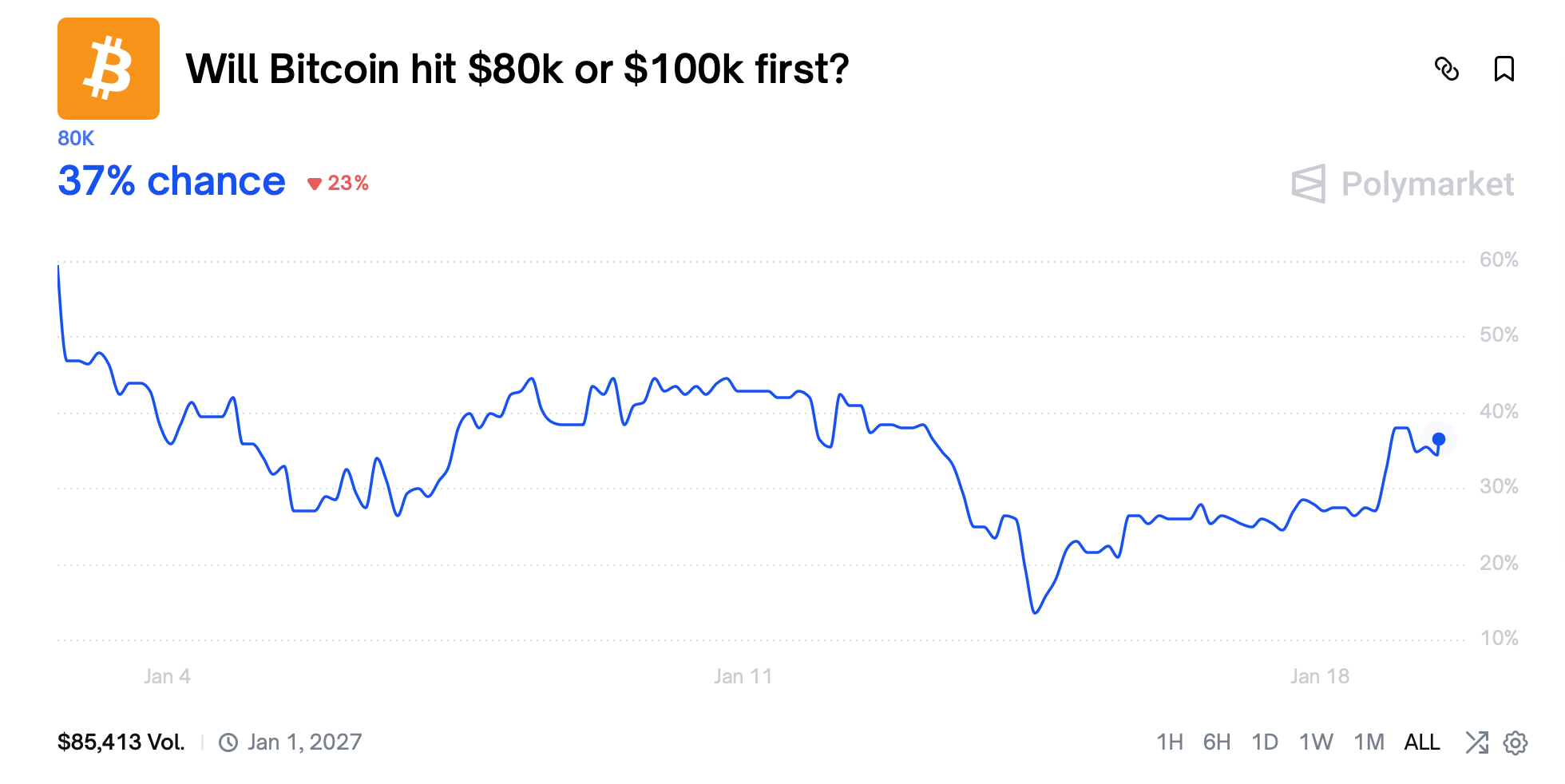

A separate contract from Polymarket investigates which milestone bitcoin reaches first between either hitting **$80** thousand or **$100** thousand . Here traders clearly favor reachingthe latter first assigning63 %probabilitytowards achievingthishigherthresholdbefore dipping downinto80 k territory . The alternative outcome restscloser t o37 %, reinforcingthe broader narrativethat pullbacksare perceivedmoreas temporary interruptionsratherthan final endings altogether

Source :PolymarketonJan .19th ,2026 .

Cautious Optimism Surrounds January Predictions

A more conservative outlook emerges in Polymarket regarding predictionsfor January pricingof bitcoin where stretch goalsarenot well-receivedbytraders Oddsforreaching150 kremainbelowone percentwiththosebetween130-115 barely registeringonthe radar probabilities thickenaroundtherealisticgoalofhundredthousandwhich leadsJanuary outcomesatroughly25 percentfollowedby105 knear9 percenton thesoftersidean85kdollar ceilingholds18percentchance suggestingconsolidationis expectedoveranydramaticmovements

AdditionallyreadEthereumDailyTransactionCountHitsRecordHighWhileFeesStayFlat

Six Markets Yield One Clear Message

Collectively analyzing these six markets reveals an impressively coherent narrative surroundingbitcoin :Downside risksare acknowledgedbutnot feared ;upward potentialis capped yetnot dismissed entirely ;andmost notably hundred thousandhas quietly emergedasthe gravitationalcenterlessafantasy goal butrathera working assumption shared acrossvarious platforms,timeframes,andcontract structures alike .

FAQ 🔮

What price level dominates bitcoin prediction markets right now?The consensus among most markets centers around approximately **$100K** being viewedas themostlikely milestone achieved soonest!

Are traders expecting any significant crashes in bitcoin value?No major collapses seem imminent despite acknowledging certain downside risks present within current projections!

Do analysts foresee possibilities exceeding two hundred grand? Extreme upside targets remain unlikely outcomes across multiple platforms!

Is short-term enthusiasm matching long-term expectations? Current January forecasts appear notably more cautious compared with full-year predictions overall!