Technical analysis indicates that Bitcoin (BTC) might climb beyond $140,000 by the close of 2025, despite its current consolidation phase.

This forecast is derived from insights shared by renowned cryptocurrency analyst TradingShot, who in a TradingView post dated September 30, emphasized the significance of the asset’s 20-period moving average (1W MA20) as a pivotal benchmark for achieving this target.

The expert’s analysis reveals that historically, this indicator has been instrumental in steering Bitcoin’s bullish trajectory and currently serves as a measure of momentum.

Since April 2025, each time Bitcoin’s weekly candles have closed above the 1W MA20 line, it has maintained an upward trend. On occasions when prices dipped below this mark—most notably in June 2023—the decline persisted until it tested or neared the longer-term blue trendline known as the 1W MA50.

The recent market dynamics underscore this level’s significance. For three consecutive times since August 25, Bitcoin concluded its week above the crucial threshold of the 1W MA20, solidifying its position as support. This validation bolsters expectations for higher valuations provided this level remains intact.

Historically speaking, when Bitcoin rebounds from such formations, rallies have surpassed gains of over 90%. Even during weaker advances within this cycle so far reached an impressive growth rate of approximately 96.38%. Replicating similar movements from current conditions suggests potential targets around $145K come December.

An Analysis on Current BTC Valuation

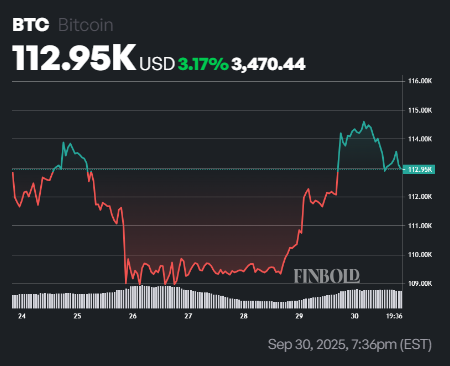

The latest figures show that BTC trades at roughly $113K after experiencing minor corrections amounting to about -0.7% over recent days while witnessing growth nearing +3% throughout last week’s period.

The present trading status sees BTC slightly beneath its short-term moving average—the SMA spanning fifty days—which stands at approximately $113849; however maintains dominance compared against longer durations such as two hundred-day averages valued nearabouts ~$104380 respectively reflecting healthier long-range trends indicative towards sustained bullish tendencies overall!

Slightly lower positioning relative shorter duration averages like fifty-day SMAs suggest ongoing consolidation rather than immediate breakout scenarios potentially arising soon enough!

Additionally observed readings via fourteen-day RSI clocking values around ~52 points denote neutrality suggesting neither excessive buying nor selling pressures exist thereby implying balanced momentum prevailing amidst these circumstances presently encountered thus far indeed!

Main image courtesy Shutterstock