A recent institutional analysis reveals that as 2026 begins, cryptocurrency markets are characterized by reduced leverage, enhanced structural integrity, and a more defensive stance. Bitcoin continues to dominate the landscape, while institutional investors show a preference for large-cap assets.

Institutions Adopt Defensive Strategies Amid Reassessment of Crypto Risks

The digital asset sector started 2026 on firmer ground following widespread deleveraging in the previous year that recalibrated risk across the industry. The Charting Crypto Q1 2026 report from Glassnode and Coinbase Institutional highlights a decline in leverage levels, more cautious derivatives positioning, and an overall repricing of risk among market participants.

Bitcoin remains the cornerstone of the market with its dominance steady around 59%, despite mid- and small-cap tokens facing challenges in maintaining earlier gains. Survey data from institutions cited in the report indicate a strong inclination toward large-cap investments amid ongoing geopolitical uncertainties and prudent risk management.

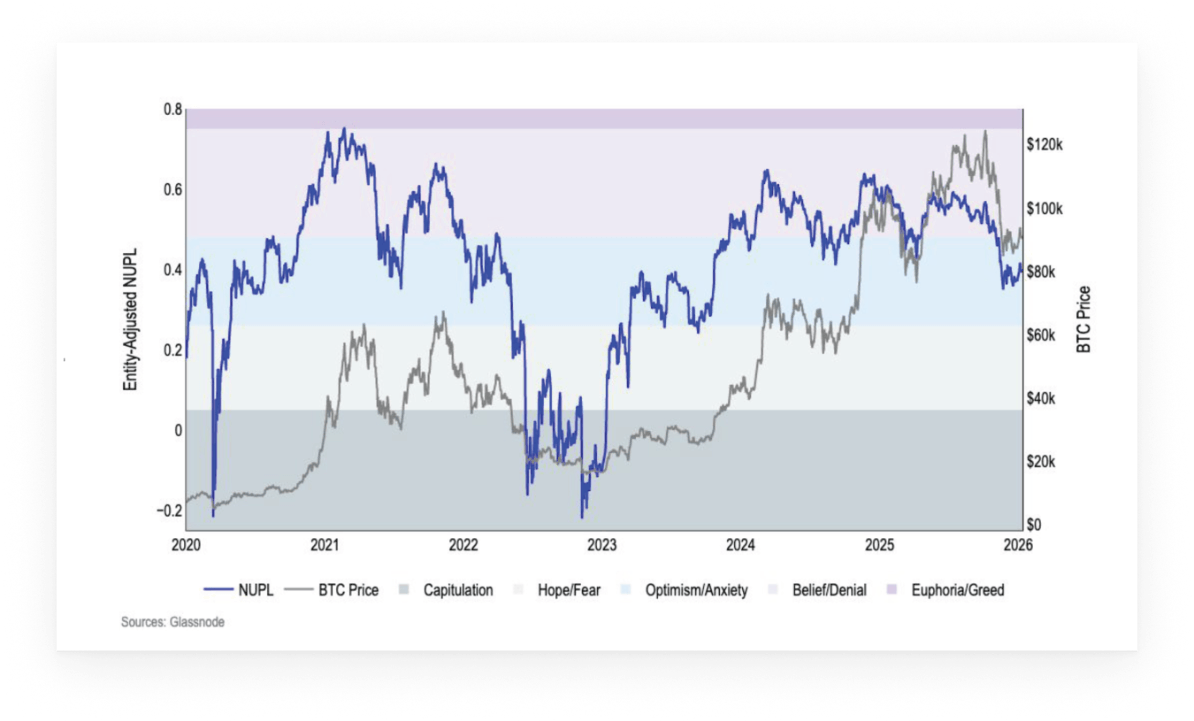

Market sentiment towards bitcoin is currently subdued. The Net Unrealized Profit/Loss (NUPL) metric has settled at lower values after significant liquidations occurred last October. This scenario suggests potential for sentiment improvement if volatility decreases or macroeconomic factors stay favorable.

A key transformation has taken place within derivatives markets: systemic leverage was significantly curtailed during October’s deleveraging event. Currently, perpetual futures’ leverage ratio stands at approximately 3% relative to total crypto market capitalization excluding stablecoins. Instead of exiting positions entirely, traders have shifted their focus toward options trading.

Open interest in bitcoin options now surpasses that of perpetual futures with an increasing emphasis on downside protection strategies and defined-risk approaches. This evolution indicates a sturdier market framework even though short-term conviction remains limited.

The report also points out emerging distribution trends for bitcoin supply: active supply over the past three months rose to 37% during Q4 2025 while dormant holdings decreased slightly—implying some portfolio adjustments by long-term holders.

Ethereum seems to be entering a mature phase within its current cycle initiated around mid-2022. However, traditional cycle indicators appear less reliable due to changes in ethereum’s economic dynamics—such as fee reductions on Layer 2 solutions and evolving usage patterns—which suggest future outcomes will depend more heavily on liquidity conditions and investor positioning rather than historical timing alone.

In summary, although caution prevails among investors, this report concludes that crypto markets are structurally stronger compared to previous cycles—with discipline replacing excess speculation as they transition into this new phase.