Renowned market analyst KillaXBT has put forth an audacious forecast regarding a potential Bitcoin super cycle. Despite previous miscalculations by various market commentators, this anonymous expert asserts that the true breakout for Bitcoin is yet to commence, emphasizing a crucial condition in the marketplace.

Decline in Metal Markets, Rise of Bitcoin

KillaXBT shared insights on December 27 via an X post, suggesting that a genuine super cycle will materialize only when investment capital shifts significantly from precious metals to Bitcoin. This transition signifies not just another crypto surge but rather a generational transformation. Unlike earlier “premature” predictions driven by mere optimism, the analyst points out emerging price patterns that suggest an impending substantial rally for Bitcoin.

Interestingly, interest in precious metals has surged recently as gold and silver reached new all-time highs of $4,500 and $77 respectively. Similar to many analysts’ views, KillaXBT foresees these metals entering into a prolonged downtrend over several years which will compel investors to seek alternative hedges against inflation. The expectation is that while older generations may cling to gold as their safe haven asset, newer investors are increasingly gravitating towards Bitcoin as their preferred store of value. As metal performance declines, demand for limited supply of Bitcoin is anticipated to soar.

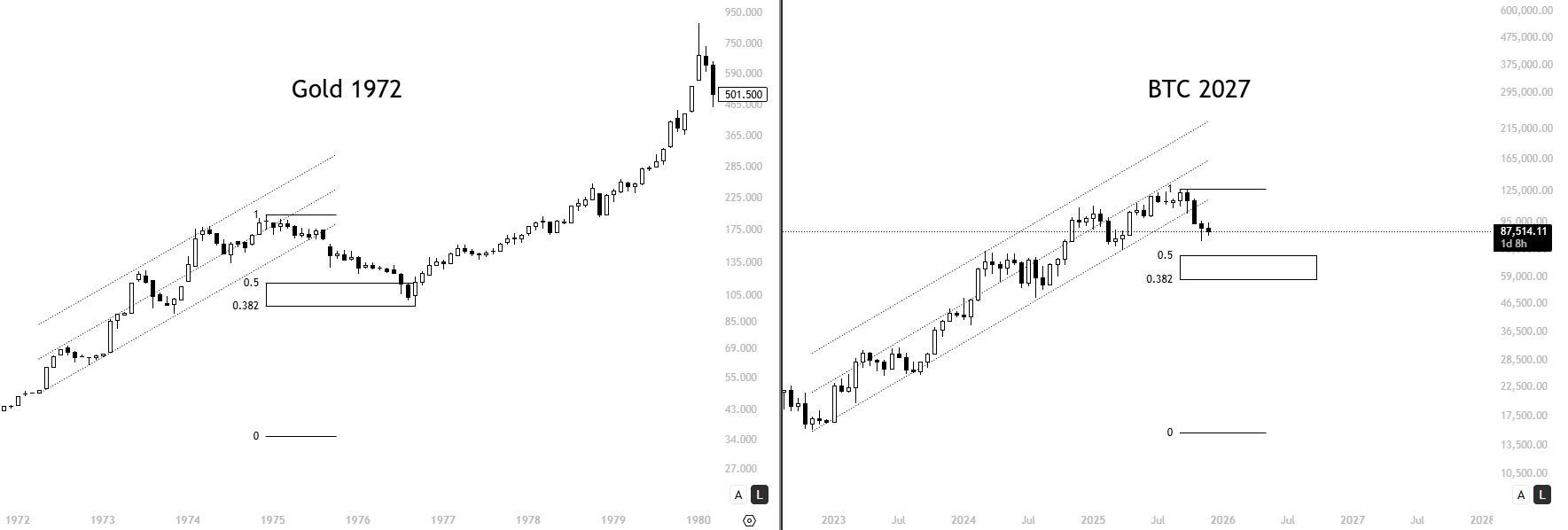

The analyst draws comparisons between gold’s situation in early 1972 and where Bitcoin stands today heading into 2027. During that time frame, gold embarked on a significant multi-year uptrend as investors sought refuge from inflationary pressures and currency devaluation. KillaXBT posits that Bitcoin is nearing its own pivotal moment and could surpass all major asset classes in the forthcoming cycle.

Notably intriguing is the fact that while gold has long been regarded as the ultimate store of value with an estimated market capitalization around $31.7 trillion; meanwhile, Bitcoin’s valuation hovers near $1.83 trillion currently. KillaXBT elaborates that even if Bitcoin were priced at $200k per coin its market cap would still only reach about $5 trillion—roughly one-sixth of gold’s value—underscoring how nascent bitcoin remains within global financial assets hierarchy.

This Could Be The Final Bear Market Below $100K – Analyst

KillaXBT concludes by noting how skepticism often accompanies significant rallies within the realm of bitcoin; this doubt tends to peak right before substantial upward movements occur historically speaking . In prior cycles , critics raised concerns about regulations , environmental impacts , or volatility risks . Presently however those fears have shifted toward burgeoning technologies like artificial intelligence & quantum computing .

The analyst warns these apprehensions might once again drive investors away prematurely from participating actively within markets today . Nonetheless he maintains an optimistic outlook believing we may be witnessing what could potentially be viewed retrospectively as last extended bear phase where bitcoins trade beneath six figures threshold ($100k). Yet he cautions stakeholders should prepare themselves for supercycle boom expected around year 2027 given bearish conditions likely persist throughout most part next calendar year (2026).

Featured image from Shutterstock; chart sourced from Tradingview