As Bitcoin (BTC) aims to break through the $120,000 resistance level, insights from the AI platform ChatGPT suggest that this leading cryptocurrency could potentially reach $135,000 by October 1, 2025.

This upward movement towards $135,000 would signify an approximate increase of nearly 17% from its current value of $115,511.

The Journey to Bitcoin’s $135,000 Target

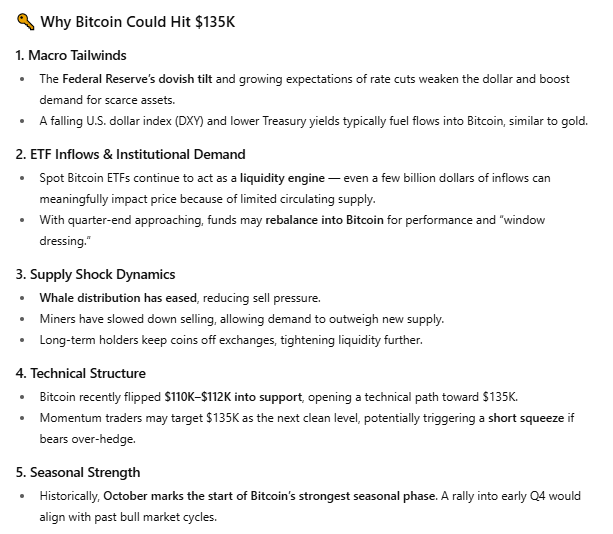

ChatGPT’s analysis indicates that several factors are contributing to a potential rise to $135,000. These include favorable macroeconomic conditions, increased institutional interest, and supportive market frameworks; however, certain risks persist.

The platform noted that the Federal Reserve’s accommodating policies and anticipated interest rate reductions are putting pressure on the U.S. dollar. This situation is enhancing demand for limited assets like Bitcoin. Historically speaking, a weaker dollar combined with lower Treasury yields has directed investments into alternative value stores such as Bitcoin—similar to gold’s appeal.

Furthermore, ChatGPT pointed out that spot Bitcoin ETFs play a crucial role in driving liquidity. The model emphasized that even small inflows can significantly influence prices due to Bitcoin’s restricted supply; additionally, upcoming quarter-end rebalancing may further stimulate institutional demand.

On the supply front, signs indicate a tightening market for Bitcoin. Observations from ChatGPT reveal a slowdown in whale distribution patterns while miners have decreased their selling activities and long-term holders continue retaining their coins off exchanges. This scenario reduces available liquidity and amplifies any incremental demand’s effect on price movements.

From a technical standpoint in the short term perspective analysis provided by ChatGPT shows that support has been established within the range of $110K-$112K which paves way toward reaching $135K target effectively.

This momentum could be further accelerated by traders if short sellers find themselves over-leveraged during this period; additionally seasonality might also contribute positively since historically October has been one of BTC’s strongest months for growth.

Pitfalls Ahead for Bitcoin as October Approaches

Nonetheless,ChatGPT warns about existing risks such as possible ETF outflows,hawkish signals from Fed officials or geopolitical events prompting investors towards safer assets instead。Significant sell-offs by whales or miners along with excessive leverage causing liquidations could hinder any bullish momentum seen thus far。

In summary,ChatGPT concluded stating how favorable macroeconomic trends,supply dynamics coupled with seasonal strength might propel bitcoin up towards its goal of hitting$135k within weeks but cautioned against negative ETF flows、central bank policy shifts or large-scale on-chain selling which may impede progress below$130k threshold triggering pullbacks downwards toward$110k support levels。

Featured image via Shutterstock