In January, the pace of corporate bitcoin accumulation surged, with a significant portion of this activity attributed to one major player, as reported by bitcointreasuries.net.

4.08 Million $BTC Held by Various Entities, According to Bitcoin Treasuries Report

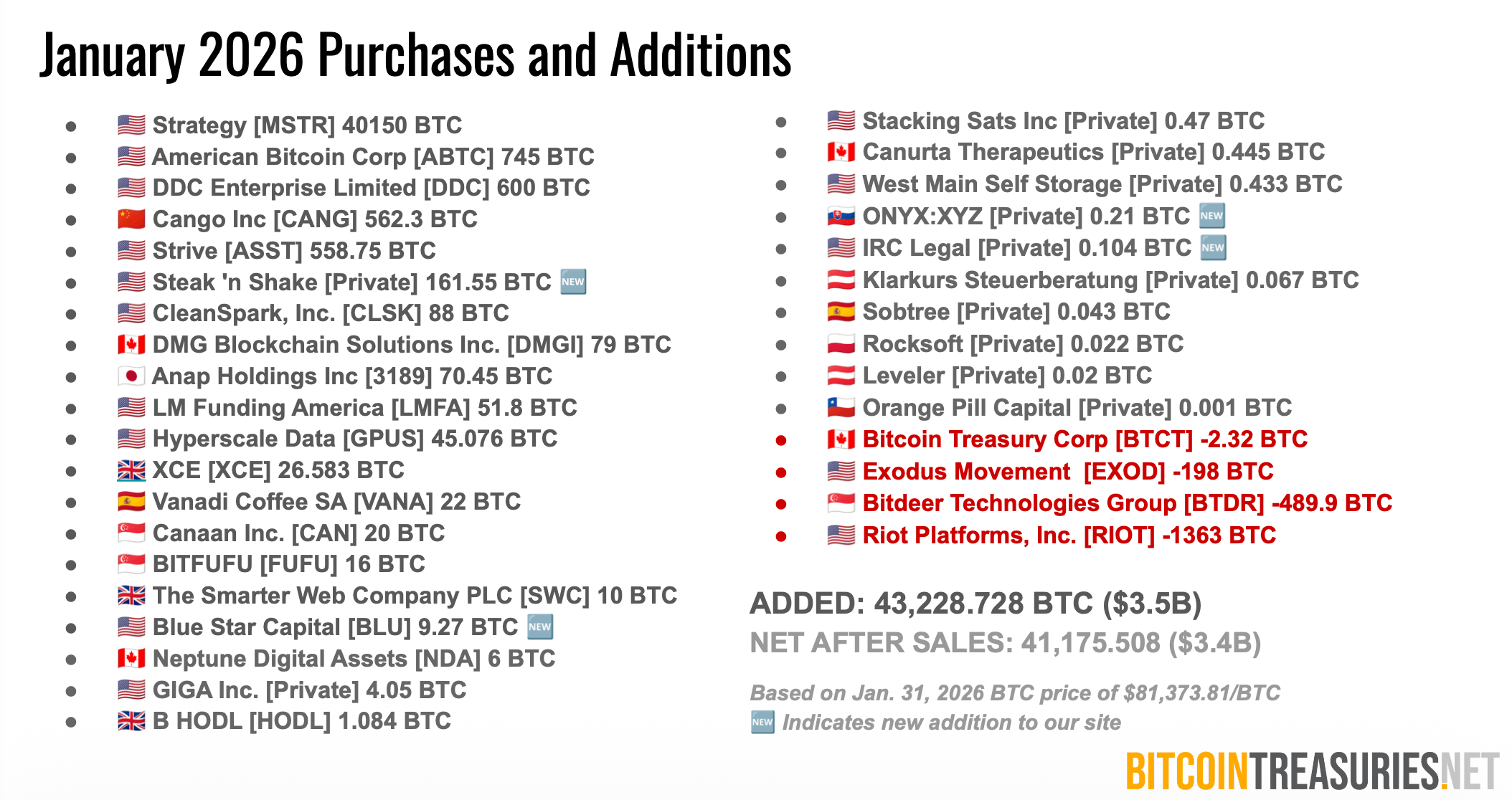

The Corporate Adoption Report for January 2026 from bitcointreasuries.net reveals that both public and private organizations collectively acquired 43,228 $BTC throughout the month. This acquisition was valued at approximately $3.5 billion based on prices from January 31. After accounting for sales and reductions in holdings, the net increase stood at 41,175 $BTC.

The report clearly indicates a dominant force: Strategy purchased an impressive 40,150 $BTC in January alone and concluded the month with a total holding of 712,647 $BTC. This accounted for nearly all (97.5%) of public company acquisitions after sales during this period — marking three consecutive months where Strategy has led in additions.

Total monthly purchases neared levels reminiscent of last summer; however, researchers at bitcointreasuries.net point out that this resurgence reflects concentrated buying rather than widespread participation across entities. Currently, public treasuries possess around 1.13 million $BTC, while all tracked organizations—including ETFs and government bodies—hold about 4.08 million $BTC.

The analysis also sheds light on Strategy’s long-term forecasts; under its most optimistic scenario outlined in their Q4 2025 report is potential growth reaching up to two-and-a-half times per share by the year 2032—targeting an ambitious figure of approximately 492 thousand BPS based on an assumed annual yield rate of bitcoin set at fourteen percent.

Apart from direct purchases made in spot markets, bitcointreasuries.net’s newly launched digital credit dashboard tracks a cumulative trading volume amounting to $26.8 billion associated with preferred-share products and related financial instruments—with nearly all activities stemming from Strategy’s offerings influenced by variations in yield dispersion and pricing dynamics affecting investor interest.

The research further identifies a dedicated group among repeat buyers; out of the total count comprising194 publicly traded companies possessing bitcoin assets—approximately one-third have consistently added at least one $ BTC daily since initiating treasury strategies—with twenty firms averaging no less than ten bitcoins each day.

The trend towards adoption continues to expand; since October alone saw twenty-one new treasuries incorporated into bitcointreasuries’ coverage universe contributing roughly three percent towards non-Strategy acquisitions over these past four months.

Nevertheless , concentration remains on the rise ; data cited within reports illustrates increasing disparities concerning corporate bitcoin holdings observed over recent months—even when excluding major holders.

Mining enterprises still wield influence , representing around eleven percent amongst balances held by public companies—but notable miner sell-offs recorded during January negatively impacted net additions .

In summary , findings detailed within this report indicate that while sector growth persists regarding headcount along with product complexity—including digital credit—the overall landscape remains predominantly dictated through singular balance sheets continuing their lead pace .

FAQ ❓

How much bitcoin did companies add in January?

According to Bitcointreasures.com data reveals that there were additional acquisitions totaling up-to forty-three thousand two hundred twenty-eight bitcoins made resulting ultimately yielding net increases tallying forty-one thousand one hundred seventy-five BTC after considering any subsequent sales involved .

What is current status regarding holdings held under strategy ?

This firm concluded its activities throughout end-of-month reporting having accumulated seven hundred twelve thousand six hundred forty-seven Bitcoins according available insights shared via Bitcointreasure’s analytics platform!

What scale does digital credit market currently represent ?

Cumulative estimates indicate volumes reaching upwards towards twenty-six point eight billion dollars worth traded thus far!

Is there evidence suggesting ownership trends leaning more heavily concentrated among corporations?

A resounding yes—as indicated through rising concentrations documented recently according provided insights compiled therein !