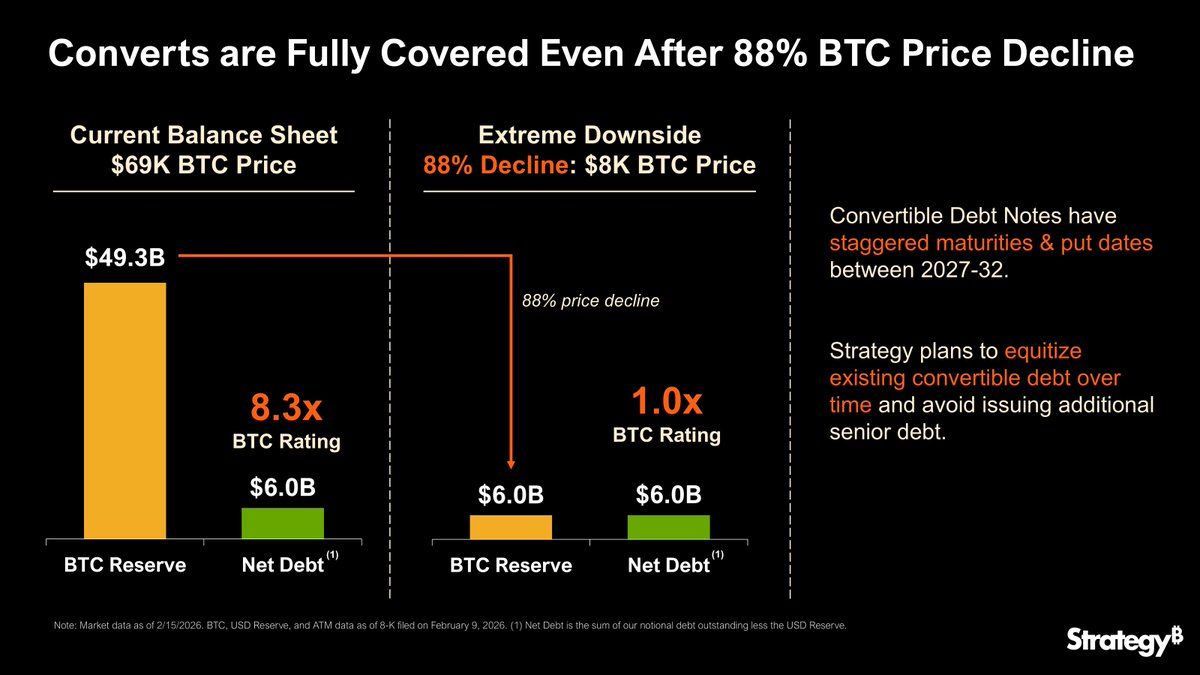

MicroStrategy recently declared that it can fully repay its $6 billion debt even if Bitcoin’s price plunges by 88% down to $8,000. Yet, the pressing question remains: what are the consequences if Bitcoin’s value dips below this threshold?

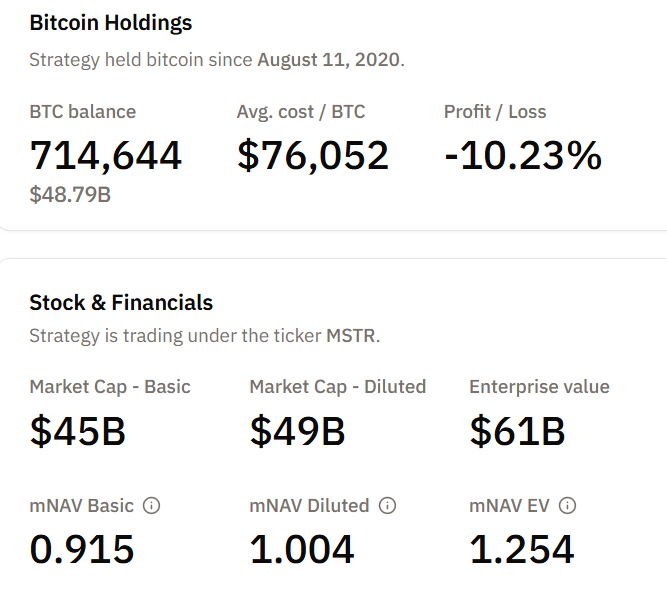

The company emphasized its substantial Bitcoin holdings valued at approximately $49.3 billion based on a price of $69,000 per BTC, alongside staggered convertible note maturities extending through 2032—measures intended to prevent any immediate forced asset sales.

MicroStrategy Reaffirms Its Position If Bitcoin Falls to $8,000

Shortly after their earnings call, MicroStrategy reiterated their stance regarding the hypothetical scenario where Bitcoin drops to $8,000 and explained how they would manage such an event for a second time.

“We believe MicroStrategy can endure a decline in BTC prices down to $8,000 while still maintaining enough assets to cover all outstanding debts,” the company stated.

At first glance, this statement reflects robustness amid severe market fluctuations. However, closer analysis suggests that the $8,000 figure serves more as a theoretical stress test rather than an absolute safeguard against financial distress.

The infographic provided by MicroStrategy illustrates how their debt coverage varies with different Bitcoin price points (source: Strategy via X).

If BTC falls exactly to $8,000 per coin, MicroStrategy’s total assets would equal its liabilities—meaning equity is effectively zero—but they could still meet debt obligations without liquidating any Bitcoins.

“$8,000 represents the approximate level where our total BTC holdings match our net debt. Should prices remain at this level long-term,” investor Giannis Andreou explained, “if so,the reserves would no longer suffice for liquidation-based repayments.”

The company’s convertible notes remain manageable due to staggered maturity dates granting management additional flexibility. CEO Phong Le recently pointed out that even in case of a 90% drop in bitcoin over several years—which he deems unlikely—the firm has ample time for restructuring options such as issuing new equity or refinancing existing debts.

“In an extreme downturn scenario with bitcoin falling 90% down to around eight thousand dollars—which is difficult but conceivable—that's when our reserves equal net debts and we won't be able pay off convertibles solely from those reserves.

At that point we may consider restructuring or raising capital through equity or new debt issuance over five years.”, said Le.

Beneath these surface assurances lies complex financial strain which could escalate rapidly should bitcoin fall further.