A little-known company based in Hong Kong has revealed a substantial $436 million investment in BlackRock’s Bitcoin ETF, sparking rumors about Chinese funds entering the cryptocurrency market through offshore channels.

Laurore Ltd, an entity previously unfamiliar to the public, disclosed its holding in BlackRock Inc.’s iShares Bitcoin Trust (IBIT) via a filing submitted to the U.S. Securities and Exchange Commission (SEC).

This announcement provides one of the few concrete indications that professional investors from Asia’s financial center are quietly connecting with digital assets by leveraging regulated American investment products.

The timing of this disclosure is notable as it coincides with a complicated phase for cryptocurrencies: risk appetite is diminishing in the U.S., while demand remains robust in regions where regulatory frameworks are becoming clearer.

Although Laurore’s ultimate owners remain undisclosed, analysts believe this setup resembles a sophisticated vehicle designed to circumvent capital restrictions or avoid reputational concerns.

Significance and Scale of Laurore’s IBIT Holding

Laurore’s stake is significant enough to attract attention due to both its size and structure.

According to its Form 13F for Q4 ending December 31, 2025, Laurore holds 8,786,279 shares of IBIT worth approximately $436.2 million. The filing lists an address located in Central Hong Kong and bears the signature of director Zhang Hui.

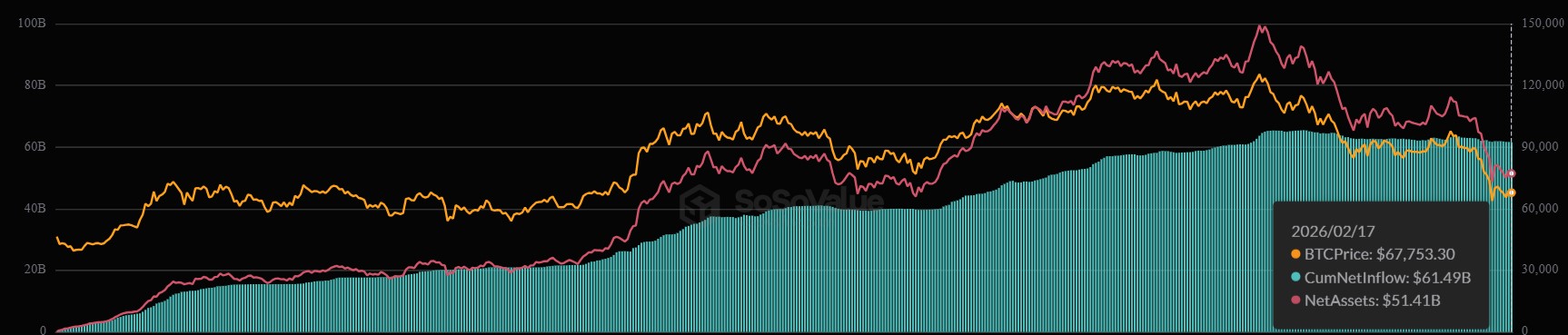

To understand this position better: IBIT ranks among the largest publicly traded vehicles offering exposure to $BTC. As reported on February 17th, it had net assets near $51.5 billion with roughly 1.34 billion shares outstanding.

The nearly 8.79 million shares represent about 0.65% ownership of total ETF shares—a considerable portion for a newcomer filer—even though it remains under one percent overall.

What makes this disclosure particularly intriguing isn’t just its monetary value but also how opaque it appears on paper.

Mystery Surrounding Laurore and Its Intentions

Jeff Park, CIO at ProCap Investments, pointed out that Laurore lacks any online presence—no website or media mentions exist beyond their SEC submission.

The name “Zhang Hui” was described by Park as akin to “John Smith” in China—a generic pseudonym offering minimal transparency regarding true identity.

The use of “Ltd” suggests incorporation within classic offshore jurisdictions like Cayman Islands or British Virgin Islands—common structures used for accessing U.S markets discreetly.

Laurore’s portfolio consists exclusively of IBIT shares without diversification into other stocks or hedging instruments.

This implies that it’s tailored specifically for targeted Bitcoin exposure rather than representing broad U.S.-based equity investments including crypto allocations.

Park theorizes that since direct Bitcoin ownership is prohibited under Chinese law,

this could be an early indication institutional Chinese capital might be channeling investments into Bitcoin indirectly through regulated ETFs instead

of using exchanges or informal gray-market routes.

He called such arrangements “the most transparent non-transparent” method imaginable.

The Appeal Of Spot BTC ETFs For Institutional Investors

This distinction matters because spot $BTC ETFs have emerged as arguably the simplest institutional wrapper providing direct cryptocurrency exposure without operational hassles like custody management or exchange access.

Large liquid ETFs absorb much administrative complexity making them attractive options for allocators unwilling or unable

to handle internal crypto infrastructure themselves.

An Emerging Pattern Among Hong Kong-Based Entities

Laurore isn’t alone—several other firms headquartered in Hong Kong have similarly disclosed sizeable positions within US-listed BTC ETFs indicating growing interest from regional managers using these vehicles:

- Avenir Tech Ltd reported owning over fourteen million IBIT shares valued around $691 million according to their Q1 March ’25 filing;

- Yong Rong Asset Management Ltd also holds limited stakes;

These developments stand out given Hong Kong offers local bitcoin funds too;

however Bloomberg analyst Eric Balchunas notes US-listed ETFs combine low fees with high liquidity making them irresistible choices worldwide,

which likely means more quiet players will enter as ETF markets mature further.

The Role Of Hong Kong Amid China’s Crypto Restrictions

Hong Kong plays a pivotal role because although mainland China maintains strict anti-crypto policies,

Hong Kong operates under distinct regulations allowing compliant institutions easier entry points into digital asset markets while staying geographically close enough

to tap mainland capital flows.

China continues enforcing prohibitions against speculative crypto trading activities,

yet over recent years HK has promoted itself aggressively as an institution-friendly hub featuring licensing regimes

and initiatives aimed at expanding market infrastructure.

In fact, a number of relaxed virtual asset rules were introduced last year encouraging liquidity growth including permission

for locally licensed platforms sharing global order books across borders.

Additionally, pioneering tokenization projects emphasize real-world utility applications positioning blockchain technology primarily as financial modernization tools rather than mere speculative instruments.

Meanwhile Beijing doubled down recently extending bans targeting stablecoin issuance along with tokenized real-world assets emphasizing:

“[We reaffirm] virtual currencies lack legal tender status… engaging virtual currency-related business domestically constitutes illegal finance activity… foreign entities must not provide unauthorized services.”

This divergence illustrates how contrasting regulatory approaches between Mainland China and Hong Kong coexist:

HK pursues regulated market development whilst Mainland preserves stringent limits on direct crypto dealings &; asset tokenization.

Within such framework,

a HK-based firm holding US-listed $BTC

ETF can effectively shift politically sensitive exposures away from Mainland jurisdiction even if economic risks remain similar.

This does not necessarily confirm all capital originates directly from Mainland institutions but demonstrates mechanisms enabling those investors’ indirect participation reducing operational hurdles plus potential reputational damage.