Several experts argue that Bitcoin’s current downward trend is simply a correction within an ongoing bull market. But what insights does the actual market data provide?

Bitcoin has experienced a decline for five consecutive months, now trading approximately 46% below its record high of $126,000. Despite this persistent drop, many analysts hesitate to label it as a full-fledged bear market. Instead, they view it as a temporary pullback during a larger bullish cycle rather than signaling another prolonged crypto winter.

Contrary to this optimistic perspective, Japanese research firm XWIN Research contends that Bitcoin has already entered the initial phase of a bear market. The company suggests that many investors overlook this reality because current price levels remain elevated compared to previous downturns.

Key Highlights

Bitcoin’s value has decreased by 46% from its peak at $126,000 and currently hovers around $67,900 after five straight months of losses.

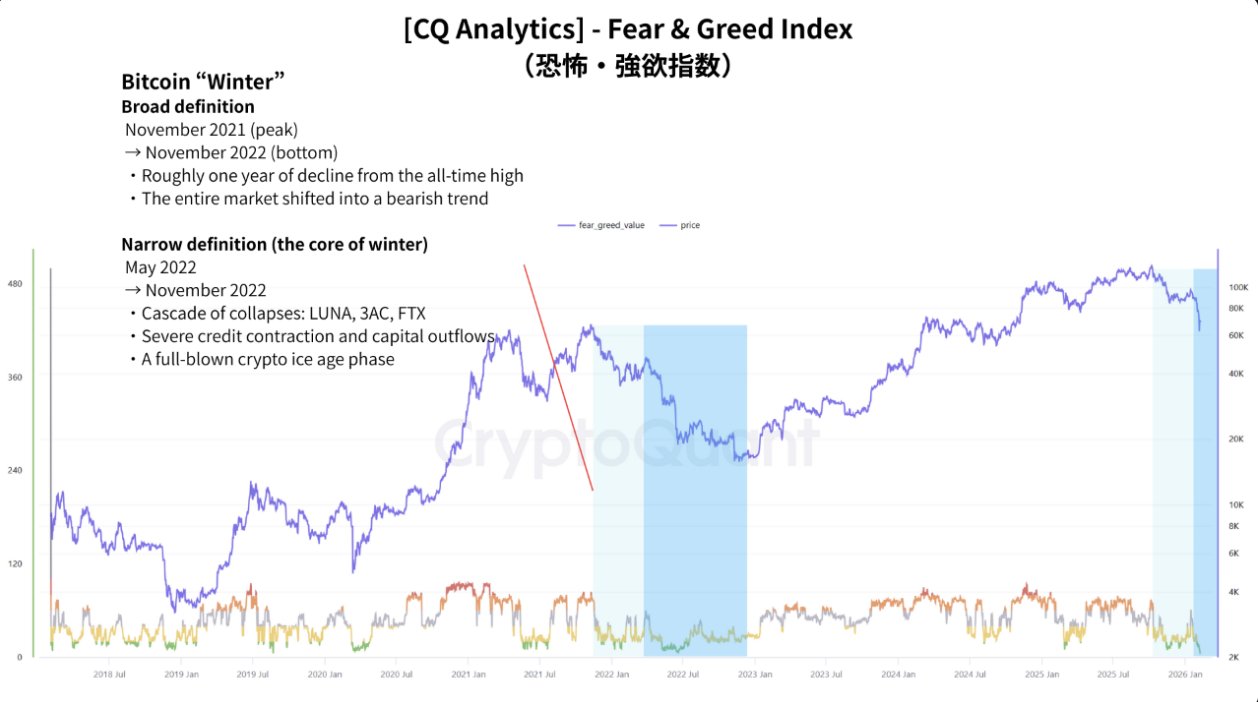

XWIN Research identifies early signs of bear market conditions with the Fear & Greed Index plummeting to 14—categorized as Extreme Fear—and structural selling pressure evident in capital flow metrics.

While $10 billion inflows in 2024 helped expand Bitcoin’s market capitalization, over $300 billion inflows in 2025 coincided paradoxically with declining overall market cap.

The net realized losses recently surged to $13.6 billion—levels comparable to those seen during the harshest periods of the 2022 bear run—with historical bottoms typically forming about five months after such peaks in losses.

Bitcoin endured four consecutive losing months with an accumulated decline of 41%, mirroring patterns last observed during both the 2018 and 2022 bear markets.

The Reluctance To Accept A Bear Market

A recent analysis by CryptoQuant cited by XWIN Research indicates that today’s price movements no longer resemble healthy corrections within an uptrend but instead align more closely with early stages of crypto winter or even its resurgence.

XWIN outlines reasons why many investors resist acknowledging this shift: lingering trauma from the painful declines in 2022 makes them hesitant; additionally, Bitcoin’s nominal prices are significantly higher now than during prior winters which creates an illusion that conditions differ fundamentally.

The advent of spot ETFs along with increased institutional involvement and enhanced infrastructure further bolster confidence among participants who believe history won’t repeat itself. Prominent figures like Michael Saylor have predicted continued bullish momentum extending into this year based on these factors.

The Case For An Ongoing Bear Market

XWIN emphasizes that mere price action doesn’t fully capture whether we’re experiencing “winter.” Instead, shifts in supply-demand dynamics combined with capital flows and sentiment indicators offer deeper insight into underlying trends. Currently, extreme fear dominates investor sentiment per the Fear & Greed Index reading at just fourteen points—a pattern historically preceding downward adjustments across cycles.

An examination of capital flows reveals contrasting scenarios: while modest inflows ($10B) expanded valuation last year (2024), massive inflows exceeding $300B failed to prevent shrinking valuations throughout most parts of next year (2025). This divergence signals persistent selling pressure beneath surface optimism. Additionally,on-chain profit data shows diminishing realized gains despite relatively high prices — indicating weakening internal strength within markets themselves.

[Note: Excess line breaks here can be removed if desired.].....

Based on these findings , XWIN concludes Bitcoin may already be entrenched within bearish territory , even though elevated prices combined with improved infrastructure might delay widespread acknowledgment . They also mention reassessing their stance should ETF-related fund flows stabilize alongside noticeable slowdowns in on-chain asset distribution .

Historical Perspectives On Bitcoin Winters

The report includes charts illustrating two interpretations regarding bitcoin winters : broadly defined , one lasted from November ’21 peak through November ’22 bottom — encompassing significant declines dragging down entire cryptocurrency markets into bearish trends .

Narrowly defined , core winter spanned May through November ’22 — marked notably by LUNA collapse , Three Arrows Capital failure , plus FTX bankruptcy events .

Divergent Views Among Analysts About Future Trends

Not all agree on whether we’ve officially entered bearish territory yet . Investor known as Mr.Crypto Whale shared his 's roadmap for bullish resurgence expected throughout 's roadmap for bullish resurgence expected throughout 's roadmap for bullish resurgence expected throughout 's roadmap for bullish resurgence expected throughout 's roadmap for bullish resurgence expected throughout &#rsquo;timeline leading up to mid-2026:</strong&g t ;

February – false breakdown (bear trap)

March – breakout rally

April – altcoin season

May – new all-time high near $215K

June – bull trap formation

July – liquidation cascade onset

August – official start of new bear phase

Save this forecast and revisit progress six months later.

& # x2014 ; Mr.Crypto Whale 🐋 (@Mrcryptoxwhale) February8th,  ;2026

This outlook views February’s current slump merely as deceptive weakness before March’s breakout surge occurs.

A recent report from Bitcoinsensus highlighted how net realized losses have escalated back toward extremes reminiscentof those seenduringtheworst phasesofthebearmarketin2022, reaching$13.

P/>

& # x1F6 A8 ; BIG NEWS : Bitcoinnetrealizedlossesreachbearmarketextremes 💥

P/>

Bitcoinnetrealizedlossesnowmatchworstlevelsfromthe

2022bearnarket.

Just3daysago,theylastedat$13.– Bitcoinsensus (@Bitcoinsensus) February11th,

2026

However,itwasnotedthatinpreviouscyclesbottomswereformedseveralmonthsafterpeaklossesappeared,suggestingmarketsneedtimeforrecoveryphasesbeforefinallowlightsmaterialize.

Citing earlier warningsthree monthspast,CryptoQuantauthorWooMinkyuassertedthatbitcoinenteredabearmarketwhilepricesstillhoveredabove$86K.Today,BTCtradesaround$67,900.

ADowntrendMirroringPreviousBearMarkets

Thecurrentdeclinepatternresemblespastbearmarketsclosely.Withfourconsecutivemonthsofnegativeperformanceandcontinuingtowardsafifthmonth,BTChasfallenby41%.Thelastoccurrenceoffourstraightlosingmonthswasinthe2018downturn,ratherthanduringthemorerecentfallsin202211.