On February 19, Bitcoin was trading around $66,400, maintaining its position after a period of significant fluctuations. However, escalating concerns regarding a possible US military action against Iran are injecting new unpredictability into global markets, including the cryptocurrency sector.

Multiple American news outlets have reported that US military leaders have informed President Donald Trump that options for strikes against Iran are prepared and could potentially be executed as soon as this weekend.

BREAKING: Axios reports evidence suggests that a US conflict with Iran is “imminent,” with Israel bracing for potential “war within days.” Expected scenarios include:

1. A prolonged “full-scale” war unlike the operation in Venezuela

2. Joint actions by the US and Israel…

— The Kobeissi Letter (@KobeissiLetter) February 18, 2026

The Tension Between the US and Iran Escalates While Bitcoin Remains Volatile

The Pentagon has already sent additional aircraft to the region and has deployed a second carrier strike group towards the Middle East. Concurrently, Iran has conducted military drills and issued warnings of retaliation if attacked.

This situation arises amidst stalled nuclear negotiations and increasing tensions over Iran’s uranium enrichment activities along with its missile programs.

The White House maintains that diplomatic efforts are still preferred; however, officials acknowledge that military options are actively being considered. This escalation heightens risks across global financial markets.

Satellite images reveal Iran constructing concrete shields over military installations in what appears to be preparations for potential strikes from the United States. Source: Reuters

The recent price movements of Bitcoin reflect this growing uncertainty in geopolitical affairs. The cryptocurrency has significantly declined from its previous cycle peak above $100,000 and is now hovering around $60k-$70k range.

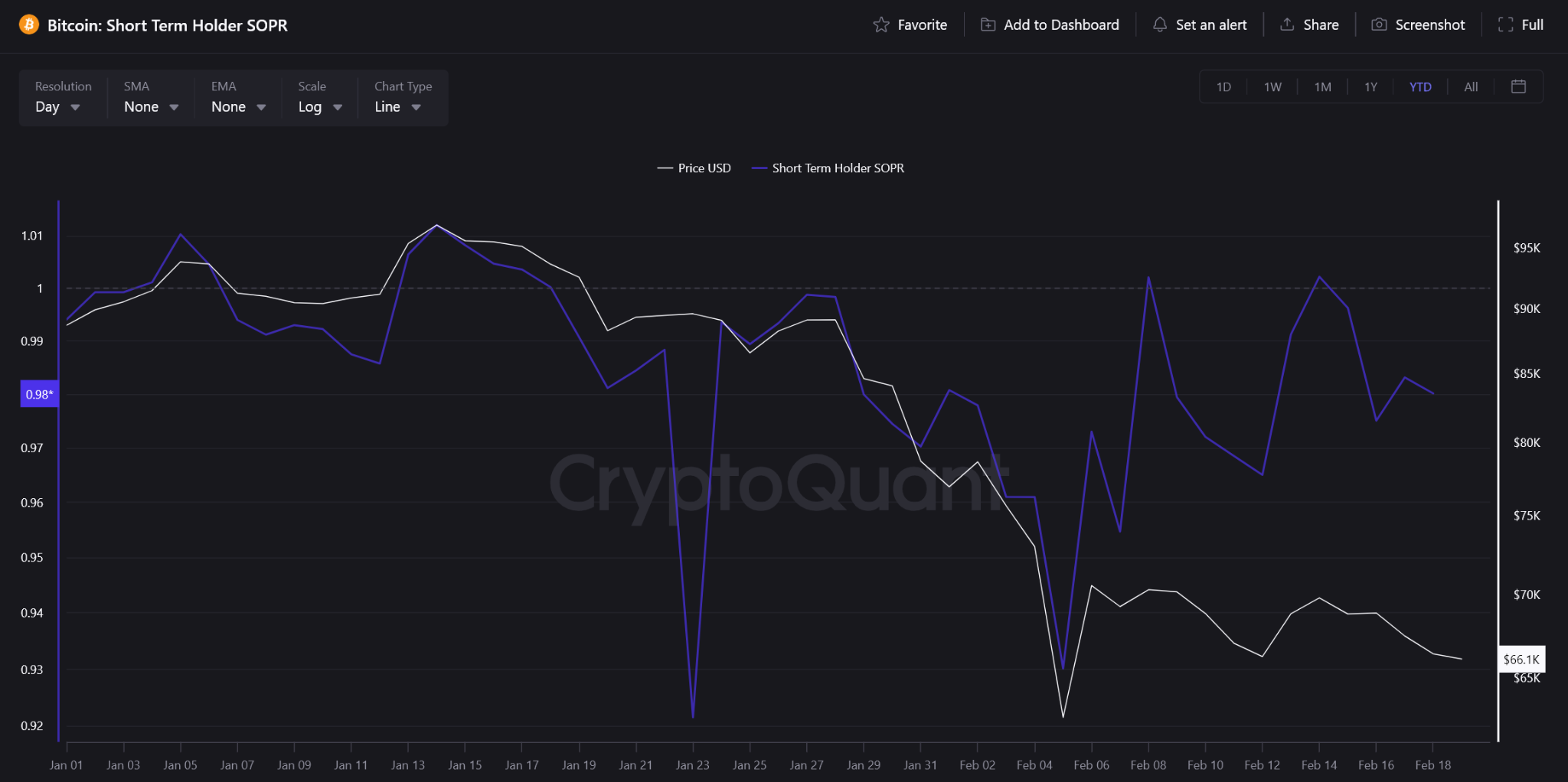

Short-term investors appear to be selling at losses according to data from Short-Term Holder SOPR (Spent Output Profit Ratio), which currently indicates values below one—suggesting many recent buyers are liquidating their positions under pressure.

Additonally, Bitcoin’s short-term Sharpe ratio has plummeted into extremely negative territory indicating poor returns relative to volatility levels—a trend typically observed during times of market distress or fear.

The SOPR chart shows short-term investors in Bitcoin selling at losses according to CryptoQuant.

If an attack occurs this weekend by U.S forces on Iranian targets, it’s likely Bitcoin will respond through two distinct phases:

Panic-Induced Volatility Signals on Blockchain Indicate Possible Market Reactions

Initially there may be an immediate sell-off; historically during sudden geopolitical events investors tend to shift towards cash or safer assets first before considering riskier investments like cryptocurrencies again. Current SOPR data reveals weakness among short-term holders who seem particularly susceptible to panic-induced selling behavior at present time frame.

The subsequent phase might unfold differently though:

The Sharpe ratio indicates that Bitcoin is currently oversold in terms of short-term performance metrics—with many weaker hands having exited their positions already reducing further forced liquidation possibilities down line . Thus any sharp decline could prove temporary if buyers step back into play at lower price points instead .

Bitcoin’s Short-Term Sharpe Ratio Has Hit Levels Typically Associated With Major Buying Opportunities

“The arrows shown indicate prior extreme negative readings were consistently followed by swift recoveries leading up new highs.” – By @MorenoDV_ pic.twitter.com/nxFBUgHxi9

— CryptoQuant.com (@cryptoquant_com) February 19 ,2026

Furthermore , rising geopolitical uncertainties can ultimately enhance Bitcoins attractiveness among certain investor circles ; often leading them seek refuge outside conventional financial systems when global tensions increase over time . This transition doesn’t happen overnight but tends develop gradually based upon circumstances unfolding across various regions worldwide .

Currently ,Bitcoin finds itself teetering on critical juncture ; anxiety remains prevalent while geopolitical threats loom large overhead yet blockchain indicators suggest much damage stemming from latest corrections may have already been absorbed within market dynamics .

Future movements will largely hinge upon whether these escalating tensions devolve into actual armed conflict or dissipate through diplomatic resolutions moving forward.

This article titled “How Will Bitcoin React if U.S Military Strikes Against Iranian Targets Occur This Weekend?” originally appeared first on BeInCrypto.