For a long time, Bitcoin has been celebrated as the “digital gold,” offering protection against inflation and excessive policy measures.

However, with geopolitical tensions escalating and trade conflicts resurfacing in the news, traditional gold is reclaiming its prominence.

Data from TradingView reveals that on October 17th, gold reached an unprecedented peak of $4,376 per ounce, boosting its market value to over $30 trillion.

This makes gold approximately 14 times more valuable than Bitcoin’s current valuation of $2.1 trillion and surpasses the combined worth of major tech giants like Apple, Microsoft, and Nvidia.

This year alone, gold has surged by an impressive 60%, far outstripping the S&P 500’s rise of 14% and Bitcoin’s increase of 17%.

The Rise in Gold Prices

The recent spike can be attributed to renewed trade tensions following US President Donald Trump’s announcement regarding tariffs on China.

This decision shook global markets and increased demand for traditional safe-haven assets. Gold emerged as a preferred choice for investors seeking refuge from currency fluctuations and policy uncertainties due to ongoing central-bank purchases bolstering its appeal over several months.

“Gold is gaining traction as nations aim to diversify away from US dollar dominance,” stated Jurrien Timmer from Fidelity. “The proportion of reserves held in gold has steadily grown alongside those held in euros. Hard assets are taking precedence over fiat currencies while diminishing dollar dominance.”

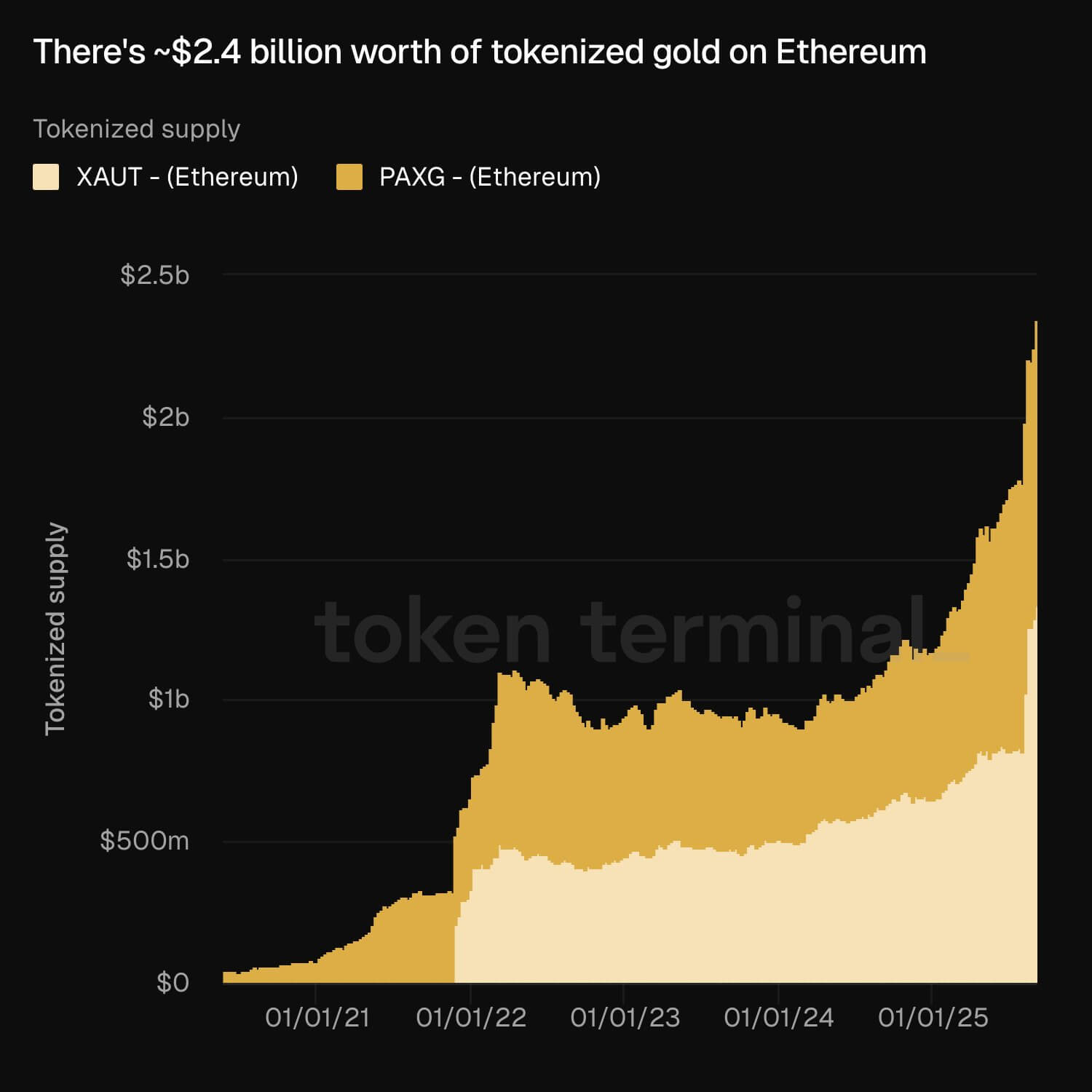

Supporting this perspective are data showing tokenized versions on Ethereum have risen by more than double this year — exceeding $2.4 billion according to Token Terminal figures.

Tether Gold (XAUT) exemplifies such growth with its market cap expanding significantly within one year—from just under half-a-billion dollars ($650 million) up past one-and-a-half billion ($1 .6 billion).

CryptoRank estimates indicate institutional investments into precious metals have surpassed those into bitcoin by upwards fifteen-trillion dollars since January twenty-twenty-four—highlighting their shift towards safer havens amid uncertain times globally.

The Decline In Bitcoin Value

<emphasize The same factors driving up prices across commodities seem responsible also dragging down cryptocurrency leader BTC according CryptoSlate reports: Within last day alone , it fell four percent touching lowest point seen June before rebounding slightly above hundred-thousand mark currently sitting around hundred-six-thousand fifty-one press time yet still marking sixteen-percent drop compared previous record high achieved earlier year reaching hundred-twenty-six thousand-one-hundred seventy-three . Bitget Wallet CMO James Elkaleh suggests short-term panic rather structural weakness explains downturn describing situation “early panic-induced selling” triggered tariff-related shocks Coinperps data reveals sentiment shifted dramatically back “Fear,” reminiscent levels experienced April when trading below eighty-grand Meanwhile argues politically charged environment ultimately benefit core proposition non-sovereign hedge risk currency debasement : According him , remains hybrid asset initially reacting macroeconomic disturbances similar high-beta stocks later transitioning safe haven role once liquidity conditions improve confidence wanes benefiting fixed supply global accessibility separation state-issued money.

<emphasize The same factors driving up prices across commodities seem responsible also dragging down cryptocurrency leader BTC according CryptoSlate reports: Within last day alone , it fell four percent touching lowest point seen June before rebounding slightly above hundred-thousand mark currently sitting around hundred-six-thousand fifty-one press time yet still marking sixteen-percent drop compared previous record high achieved earlier year reaching hundred-twenty-six thousand-one-hundred seventy-three . Bitget Wallet CMO James Elkaleh suggests short-term panic rather structural weakness explains downturn describing situation “early panic-induced selling” triggered tariff-related shocks Coinperps data reveals sentiment shifted dramatically back “Fear,” reminiscent levels experienced April when trading below eighty-grand Meanwhile argues politically charged environment ultimately benefit core proposition non-sovereign hedge risk currency debasement : According him , remains hybrid asset initially reacting macroeconomic disturbances similar high-beta stocks later transitioning safe haven role once liquidity conditions improve confidence wanes benefiting fixed supply global accessibility separation state-issued money.

Mentioned in this article: