Bitcoin’s recent sharp rejection near the $90,000 mark on Wednesday served as a clear reminder to investors that traditional precious metals like gold and silver are currently outperforming digital assets such as Bitcoin in the ongoing debasement trade.

Back in October, analysts at JPMorgan suggested that both gold and Bitcoin were benefiting from this trend and would continue to do so. They forecasted Bitcoin to mirror gold’s trajectory, estimating a price target of $165,000 for BTC when adjusted for volatility relative to gold.

However, this prediction has yet to materialize.

While Bitcoin hovers around $88,000—down roughly 30% from its early October peak—gold is trading close to all-time highs near $4,350 per ounce. Meanwhile, silver surged past record levels above $66 on Wednesday, marking a 40% increase since October.

“Bitcoin enthusiasts cannot overlook the ongoing bull market in precious metals,” noted Charlie Morris, founder of ByteTree. “It continues to gain momentum.”

What Explains Bitcoin’s Underperformance?

The current weakness in Bitcoin stems largely from its correlation with riskier asset classes. According to Morris’ report released Wednesday, although stock indices remain near historic highs overall, sectors characterized by high speculation—such as data centers and artificial intelligence infrastructure investments along with recent IPOs—have experienced significant declines over recent weeks.

A technical factor also contributes: the BTC-to-gold ratio peaked late last year and has since entered a bear market phase declining more than 50%.

This ratio formed a lower high back in August signaling weakening momentum; it continued downward afterward reaching new lows on Wednesday—the lowest point seen in nearly two years.

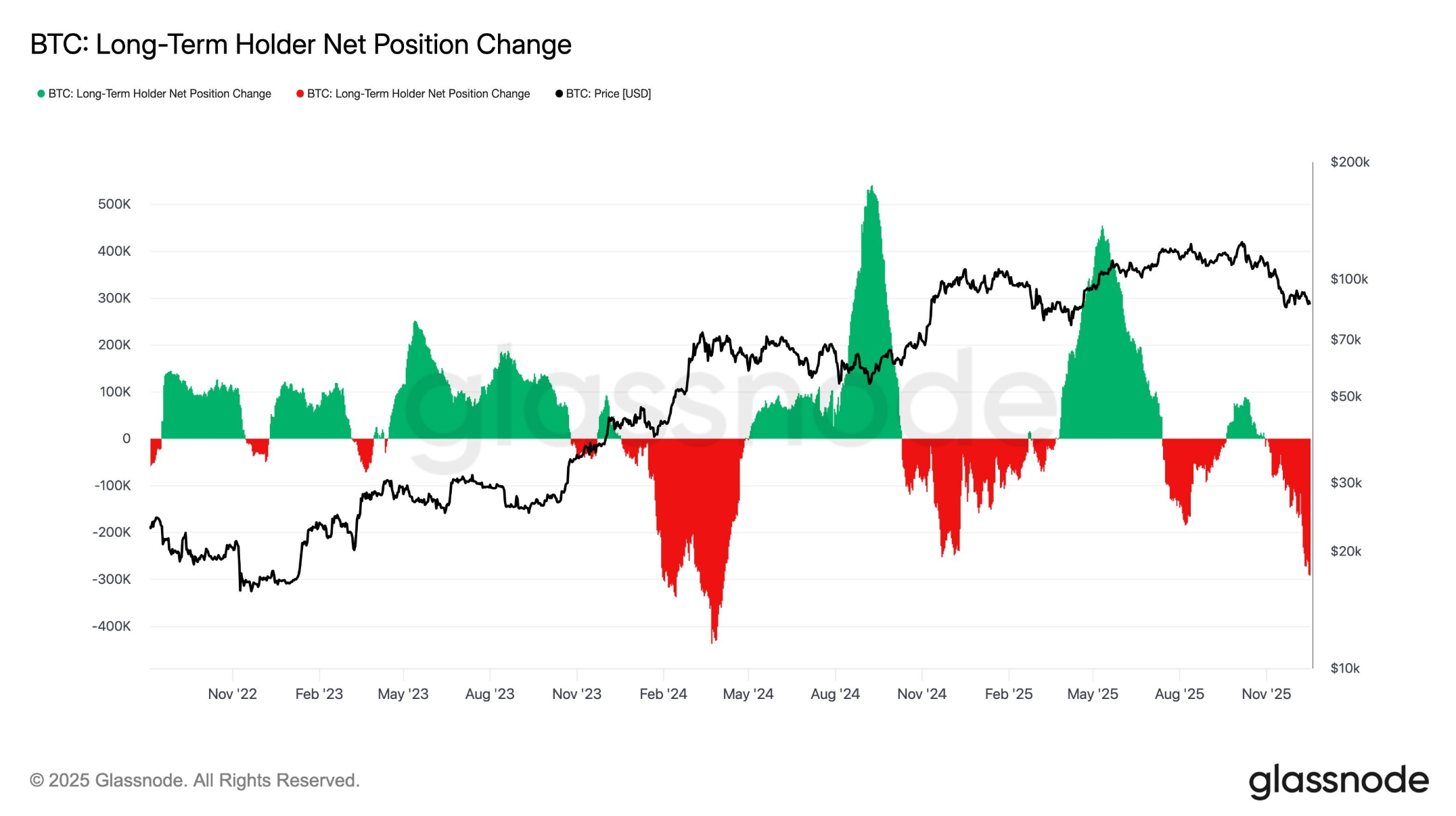

Adding pressure is structural selling by long-term holders. Research led by Vetle Lunde at K33 revealed that unspent transaction outputs (UTXOs) older than two years have steadily decreased with approximately 1.6 million BTC reactivated since early 2024. Glassnode data corroborates these findings showing increased selling activity among long-term investors.

“This provides on-chain evidence of sustained selling pressure coming from holders who have kept their coins for extended periods,” Lunde explained.

An additional concern adding uncertainty among investors involves potential risks posed by quantum computing technology against Bitcoin’s cryptographic security—even though these threats remain mostly theoretical at present.

Analysts See Silver Rally Paving Way For Future BTC Gains

The bright spot for those invested in bitcoin lies in expectations that once gold’s rally subsides further down the line; bitcoin may assume leadership within this space instead.

Historical trends indicate that peaks observed within gold markets often precede surges in bitcoin prices by about 100-150 trading days according to Bitfinex analysts who view current consolidation phases as transitional groundwork setting up stronger rallies expected around 2026.

Morris shares this optimistic outlook:

“I remain bullish regarding silver but anticipate its rally will eventually lose steam,”

“When that happens bitcoin is likely positioned well enough historically — ready take over.”