– DDC achieves profitability, delivering record gross margins and net income

– Launched Bitcoin treasury strategy and reached 1,008 BTC or 1,798% BTC Yield1 as of August 31, 2025

New York, September 5, 2025 – DDC Enterprise Limited (NASDAQ: DDC) (“DDC” or the “Company”), an Asian consumer-first company at the forefront of corporate Bitcoin acquisition and treasury management, released its unaudited financial results for the six months ended June 30, 2025.

Management Commentary

“The first half of 2025 was transformational for DDC,” said Norma Chu, Founder, Chairwoman and CEO of DDC. “DDC started as a content-driven Asian food platform and has since grown into a portfolio of beloved, ready-to-eat consumer brands. In the first six months of 2025, DDC turned profitable and delivered record high gross margin and net income of 33.4% and $5.2 million, respectively. Our core operating business is the strongest it has ever been and we expect continued growth into the second half of the year.”

Ms. Chu continued, “In addition, we entered the Bitcoin treasury strategy space with conviction. In late May, we made our first purchase of BTC and outlined a structured plan for responsible accumulation. Since then, we have scaled quickly, executing a historical $528 million financing with premier institutional investors and completed nine separate BTC purchases, bringing our treasury holdings to 1,008 BTC as of the end of August, representing a BTC Yield of 1,798% since the first purchase1.”

Ms. Chu concluded, “DDC’s Bitcoin treasury competitive advantage lies in our extensive reach into China’s vast, underpenetrated investor base and a profitable core business that strengthens our access to capital markets. This foundation enables sustainable Bitcoin accumulation and ongoing investment in growth. Our goal is clear: lead this emerging category, reach 10,000 BTC by the end of 2025 and establish ourselves as one of the world’s top three treasury company within three years.”

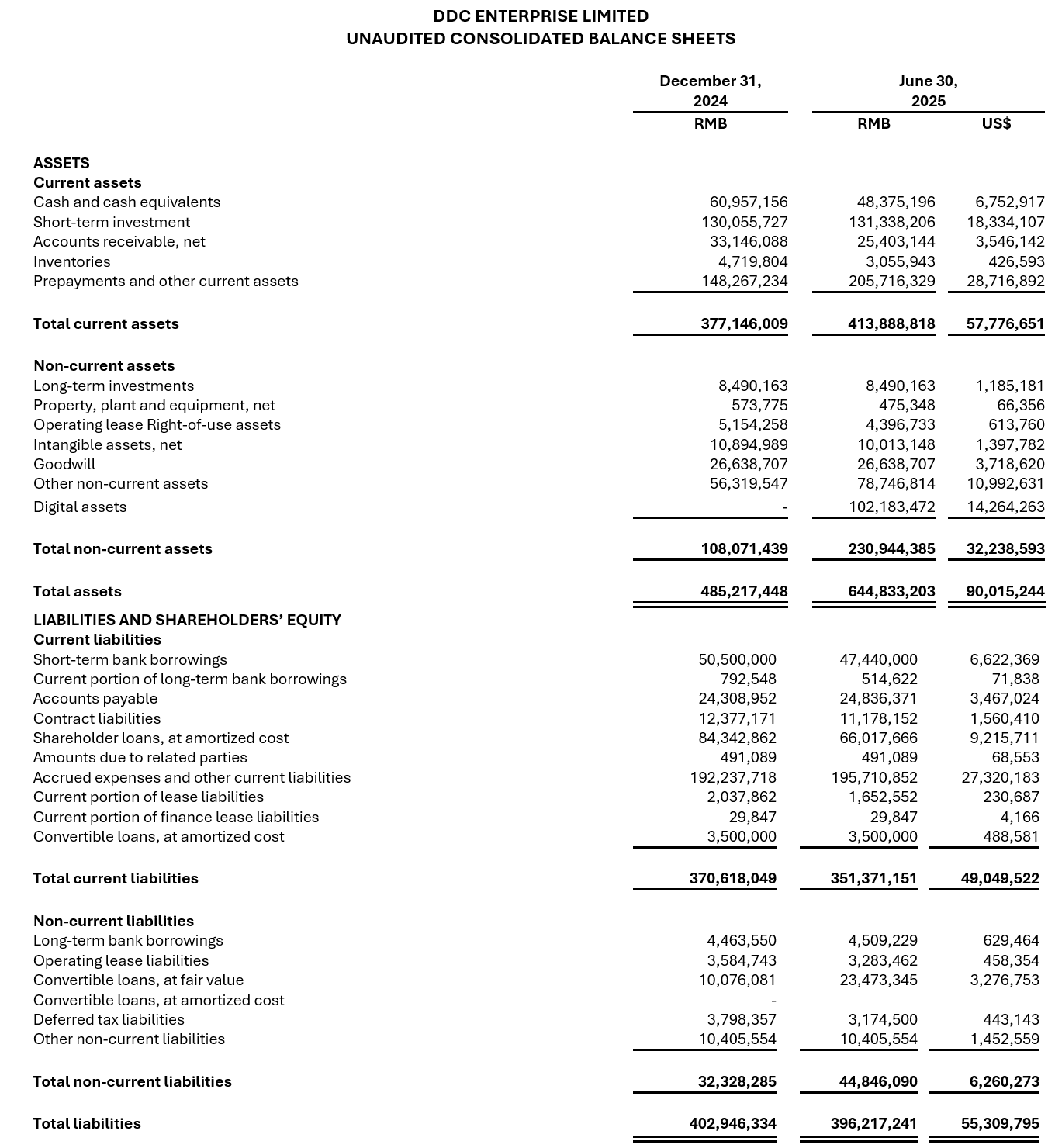

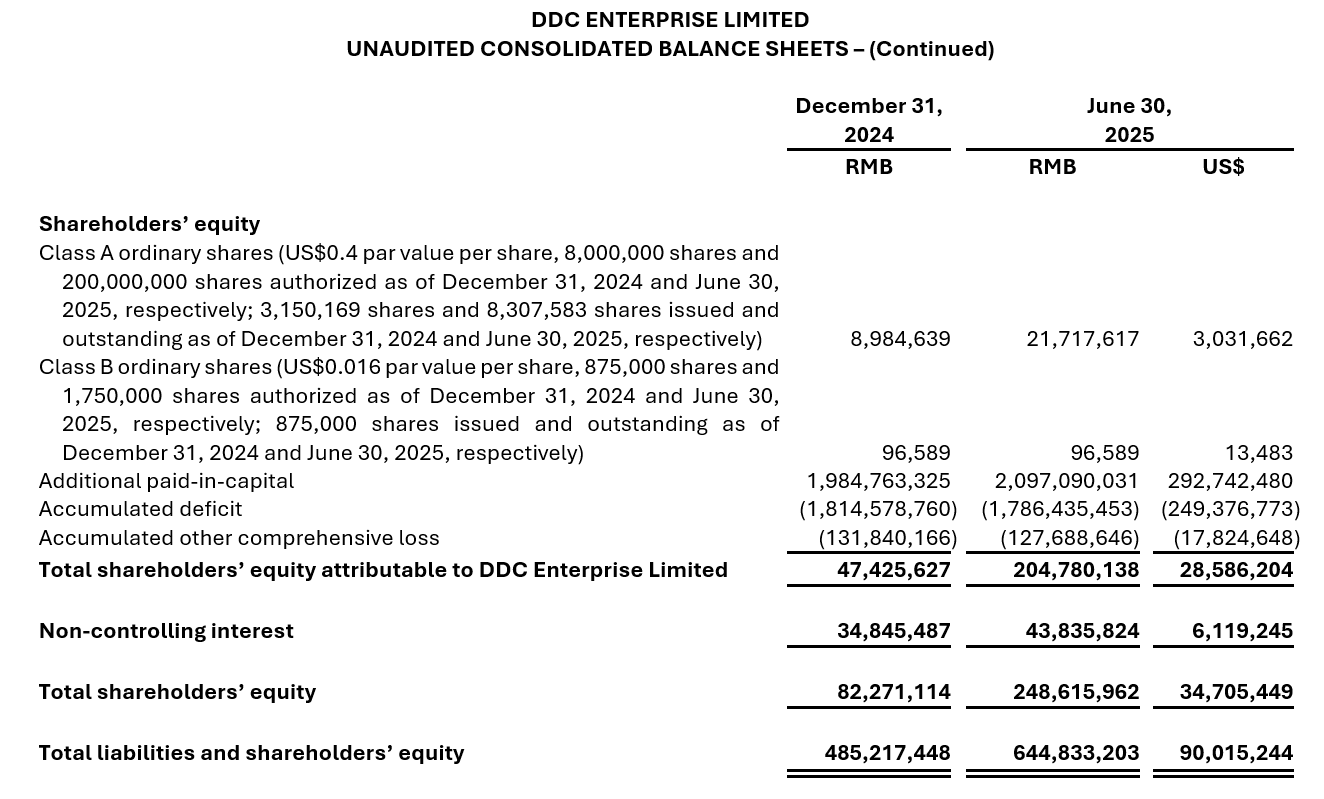

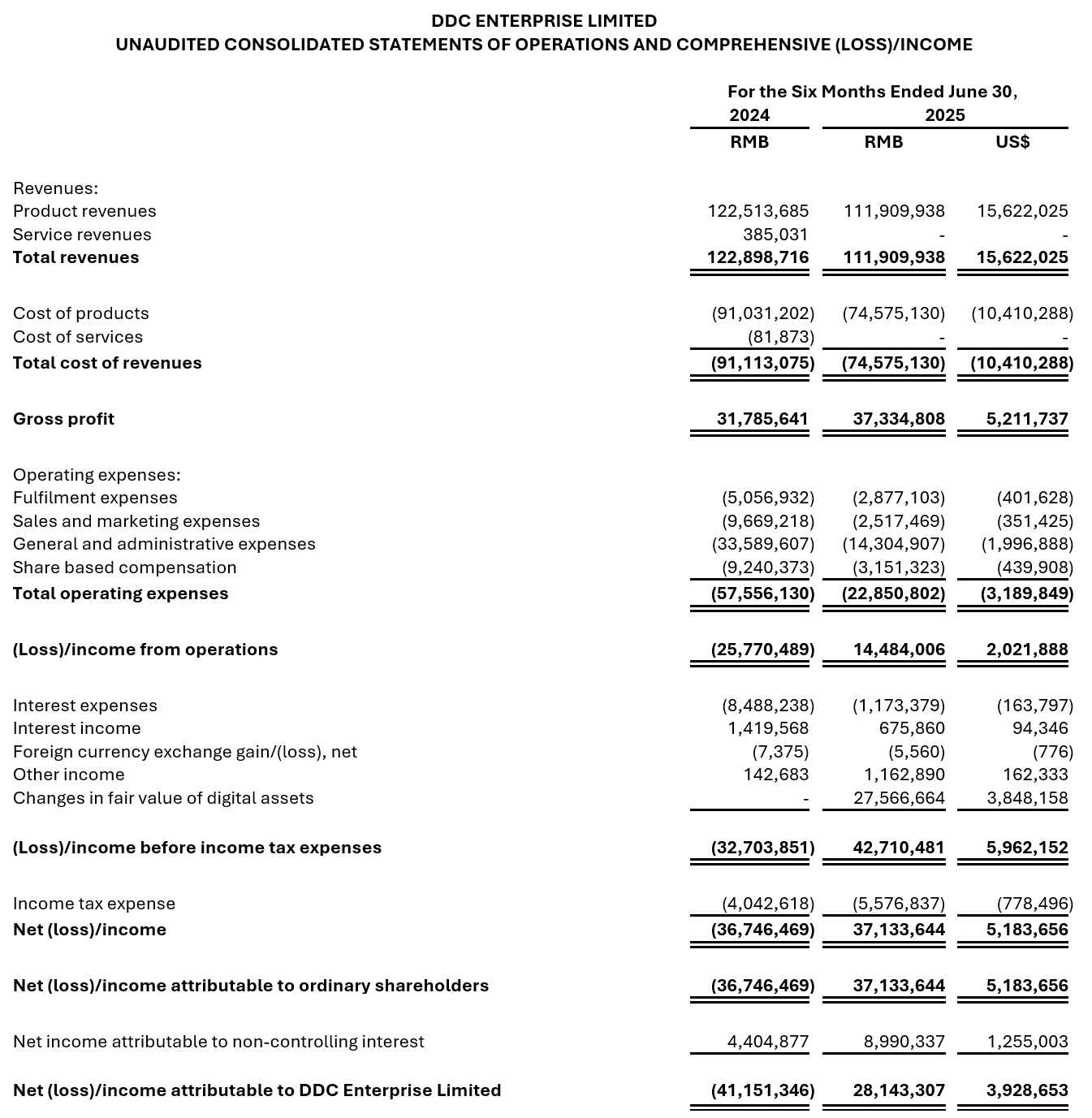

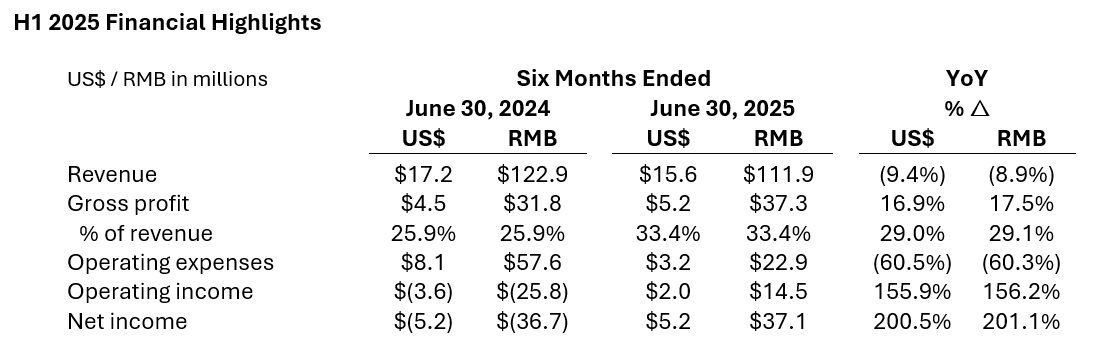

H1 2025 Financial Summary

All amounts compared to H1 2024 unless otherwise noted

Total revenue of US$15.6 million was down 9.4% year-over-year due to our strategic exit from loss-making U.S. operations. Domestic China business revenue grew 7.5% year-over-year, driven by increase in sales volume in China.

Gross profit of US$5.2 million was up 16.9% year-over-year, driven by our stringent supply chain optimization and deflation in China providing raw material cost savings.

Operating expenses of US$3.2 million was down 60.5% year-over-year due to exit of loss-making US operations and stringent cost control across the entire business.

Net Income was US$5.2 million vs. US$(5.2) million driven by the above as well as a $3.8 million unrealized gain in fair value of digital assets.

Cash and cash equivalents and short-term investments were US$25.1 million as of June 30, 2025.

H1 2025 Bitcoin Summary

“BTC Yield” KPI: Achieved BTC Yield of 367% in H1 and 1,798% since first purchase1 (as of August 31, 2025).

Digital Assets: As of June 30, 2025, the Company’s digital assets were comprised of approximately 138 BTC. During the six months ended June 30, 2025, the Company recordedan unrealized gain in the fair value of digital assets of $3.8 million.

H1 2025 Capital Markets Summary

Closed an aggregate of $528 million in strategic financing for Bitcoin treasury strategy:

$26 million strategic PIPE investment from premier Bitcoin and digital asset investors, which included conversion of outstanding debt to further strengthen the balance sheet.

$25 million by issuance of first tranche of convertible notes (with committed additional capacity of up to $275 million available in subsequent drawdowns) with Anson Funds.

$2 million in a private placement from Anson Funds in addition to a $200 million equity line of credit.

Filed a $500 million universal shelf registration statement on Form F-3 with the U.S. Securities and Exchange Commission (SEC).

As of September 4, 2025, DDC has utilized a total $53 million of its $528 million strategic financing for its Bitcoin purchases. $275 million of convertible note and $200 million equity line of credit with Anson Funds still remains undrawn. In addition, as of September 4, 2025, DDC has not utilized any of the $500 million universal shelf.

Earnings Conference Call

DDC hosted its H2 2025 earnings conference call at 8 am ET on September 4, 2025. View it here.

Shareholder Letter from DDC Founder, Chairwoman and CEO Norma Chu

DDC also published a shareholder letter from Founder, Chairwoman, and CEO Norma Chu regarding its Bitcoin treasury strategy and macro outlook. Read it here.

About DDC Enterprise Limited (NYSE: DDC)

DDC Enterprise Limited (NYSE: DDC) is spearheading the corporate Bitcoin treasury revolution while maintaining its foundation as a leading global Asian food platform. The Company has strategically positioned Bitcoin as a core reserve asset, executing a bold and accelerating accumulation strategy. While continuing to grow its portfolio of culinary brands, DDC is now at the vanguard of public companies integrating Bitcoin into their financial architecture.

Media & Investor Contacts

Investor Relations

Orange Group | Yujia Zhai

ddc@orangegroupadvisors.com

Press and Media

pr@ddc.xyz