Following a discreet move by China’s Ministry of Commerce to broaden export restrictions on rare earth elements, concerns have been heightened.

Bitcoin Dips as Trump’s Tariff Warning Triggers Market Turmoil

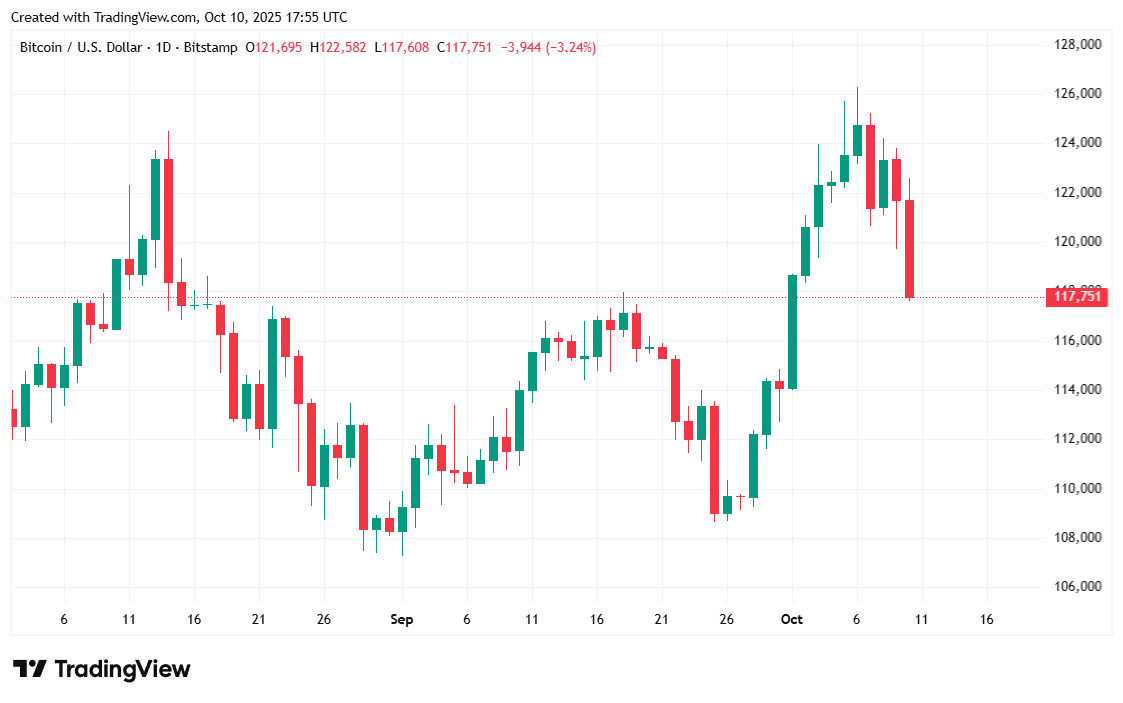

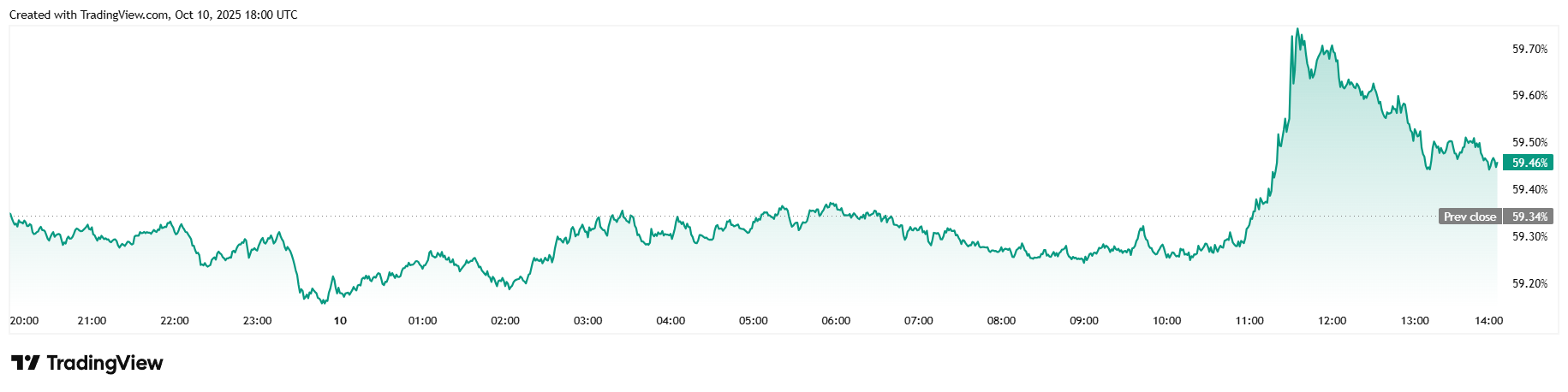

The financial markets reacted sharply on Friday morning when President Donald Trump cautioned China about facing “a significant tariff escalation” if it proceeded with its plan to extend export limitations on rare earth minerals. This announcement led Bitcoin to fall by 2.53%, and stock markets also experienced declines.

“They aim to enforce Export Controls on every aspect related to Rare Earths production,” Trump stated, while outlining his administration’s potential response. “We are currently considering a substantial increase in tariffs on Chinese imports into the United States.”

China’s quiet expansion of its rare earths export controls came just weeks before President Xi Jinping is scheduled for talks with Trump at the Asia-Pacific Economic Cooperation (APEC) summit in South Korea at the end of October. Many analysts view this move as an attempt by China to strengthen its negotiating position ahead of their meeting.

As the leading global producer, China accounts for 90% of all rare earth production worldwide. These minerals are essential components in products like electric vehicles, smartphones, and medical equipment. The new regulations require companies exporting goods containing these materials from China to obtain government approval first. Thursday’s update extended these controls over five additional minerals.

With Trump’s strong reaction following this announcement, there is uncertainty about whether the anticipated meeting in South Korea will proceed as planned. If Trump’s tariff threat materializes, it could have adverse effects both economically and within cryptocurrency markets such as Bitcoin.

“I never imagined it would reach this point but perhaps now is indeed that time,” remarked Trump optimistically adding that despite potential challenges faced initially; ultimately such actions may prove beneficial for America.”

A Look at Market Statistics

At present according Coinmarketcap data shows Bitcoin decreased by 2.53%, priced around $117655.04 while experiencing a decline over seven days amounting up-to -3.61%. Since Thursday fluctuations were observed between $ 117624&48;& 122509&66;..