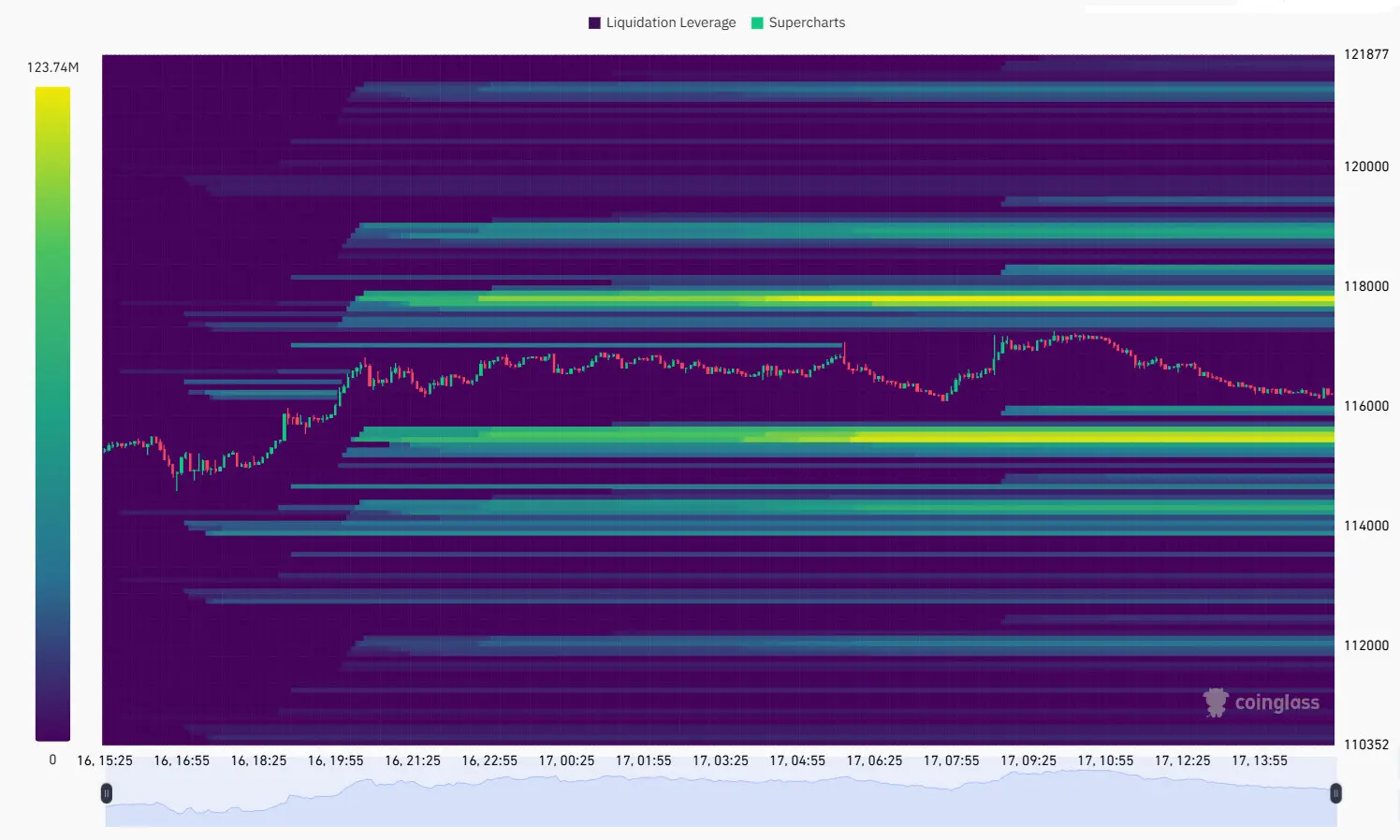

Bitcoin (BTC) is currently at a pivotal point, with its price fluctuating almost precisely between two key liquidation zones. Traders are faced with the challenge of deciding whether to target positions around the $115,000 or $118,000 marks.

The next few hours could see increased volatility for BTC due to the accumulation of both short and long positions. At present, BTC is trading at approximately $116,353. The presence of leveraged positions on either side may trigger a more pronounced price movement.

BTC finds itself sandwiched between two liquidity zones that could potentially lead to liquidations: long positions above $115,000 and short trades near $118,000. | Source: Coinglass

If BTC rises to the $118,000 level without traders closing their positions in time, it could result in liquidations totaling approximately $123.74 million on Binance.

Conversely, if there’s a downward shift below the $115,000 threshold, it might trigger liquidations amounting to about $131.54 million. This delicate balance creates an environment ripe for volatility within a few thousand dollars’ range.

More drastic declines could see BTC plummet as low as $104,000 or even dip below the critical psychological level of $100K based on projections from CME futures data. However, any imminent price movements will likely first interact with Binance’s available liquidity pool which boasts over $13.5 billion in derivative open interest as recorded on September 17.

What direction will Bitcoin take?

The market has not provided clear signals over the past day regarding Bitcoin’s trajectory; thus short-term fluctuations may be influenced by upcoming decisions from the Federal Reserve’s FOMC concerning interest rates.

Despite some unwinding activity recently observed in Bitcoin’s open interest—which remains above a substantial figure of 40 billion—there have been significant moves toward short liquidations resulting in losses exceeding 32 billion within just 24 hours. Currently though,BTC appears resilient against capitulation while sustaining its bullish trend characterized by relatively minor pullbacks.

The ratio between long and short holdings is slightly leaning towards bullish sentiment for BTC; however most traders are still exercising caution amidst this uncertainty.The crypto fear and greed index stands neutral at 57 points indicating mixed market sentiments among participants

Bullish momentum has returned with Bitcoin dominance climbing back above 56% even as some focus shifts towards altcoins during this season . Nevertheless ,accumulation by whales along with institutional investments continues unabated alongside expanding corporate treasuries .

Will Bitcoin finish September positively?

This month holds particular significance for observing how well Bitcoin performs historically speaking .September trends have varied widely throughout previous years but generally ending it positively correlates strongly into larger year-end rallies thereafter

Thus far ,the performance seen so far indicates that this September may yield one of its best results yet over thirteen years ! With only two weeks remaining left until month’s end,BTC seems poised strategically set pace leading up towards year-end conclusions ahead!

Notably too ,historically speaking past FOMC meetings held during Septembers often coincide significantly marked upward rallies regardless prevailing direction taken regarding changes made within interest rates themselves! Even potential rate cuts won’t necessarily guarantee ensuing bull runs following them!

On Hyperliquid platform itself nearly sixty percent (58%) trades consist solely outlong position types where largest single trade amounts reach upwards hundred-two million dollars ($102M) whereas biggest shorts sit around three hundred eleven point six million ($311M). Sentiment metrics suggest both retail investors & savvy traders alike appear somewhat bearish overall presently !