During Saturday’s trading session, Bitcoin exhibited a rather uneventful performance, oscillating between $89,596 and $91,924. Currently priced at $90,617, its market capitalization stands at an impressive $1.8 trillion with a trading volume of approximately $32.66 billion. While these figures indicate sustained interest in the cryptocurrency, they lack the momentum necessary for significant price movement.

Bitcoin Chart Analysis

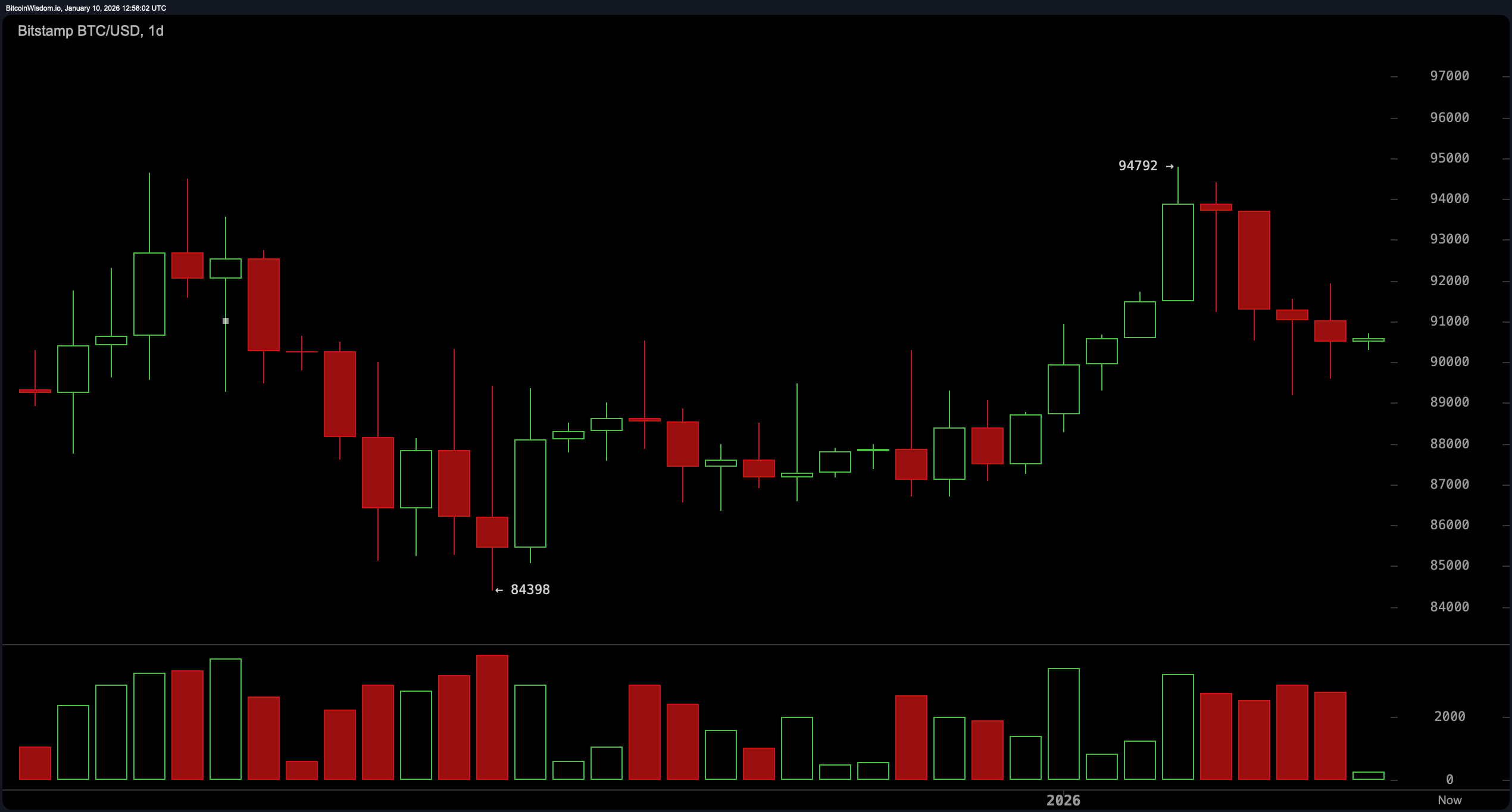

The daily chart resembles the conclusion of a sprint; Bitcoin surged from $84,398 to reach as high as $94,792 before abruptly losing momentum. The recent three-day retracement has seen prices stabilize around the pivotal mark of $91,000. Interestingly enough, this pullback was accompanied by declining volume—a classic indicator of bearish sentiment despite the presence of relatively small daily candles.

This candle’s positioning reflects uncertainty and fatigue among traders. For those monitoring this situation closely, a robust close above the critical level of $92,000—preferably supported by increased volume—will be essential before considering another attempt to breach resistance levels between $94,000 and $95,000.

BTC/USD 1-day chart via Bitstamp on Jan. 10.

Diving into the 4-hour chart reveals diminishing optimism surrounding Bitcoin’s price action. The cryptocurrency has been fluctuating within a narrow range between approximately $90K and $91K; technical patterns suggest it may be forming a bear flag—a consolidation following downward movement rather than an invitation to rally higher. The lackluster volume accompanying upward movements indicates that buyer enthusiasm is either absent or significantly overestimated. A decisive drop below the key level of $90K could lead to revisiting support zones around$88K-$89K if confirmed by increasing selling pressure.

BTC/USD 4-hour chart via Bitstamp on Jan 10.

The hourly chart illustrates that Bitcoin remains trapped in an endless loop; it continues to hover within bounds set between roughly$90k-$91k with intraday breakout attempts quickly thwarted—including one failed surge towards$91,$924 . Volume remains stagnant while volatility appears subdued—this environment primarily favors agile scalpers who can exploit fleeting opportunities amid established support and resistance levels—but lingering uncertainty makes holding onto trades risky.

BTC/USD 1-hour chart via Bitstamp on Jan 10.

Oscillator metrics reflect this indecisiveness: with relative strength index (RSI) at52 , Stochastic also sitting neutral at50 ,and commodity channel index (CCI) registering45 .The average directional index(ADX ) confirms weak trend strength measuring only24 ,while Awesome oscillator lingers near1941 without providing clear signals.The momentum indicator shows3 ,101 while moving average convergence divergence(MACD ) sits at509 ; both indicators hint bullishness but lack corroboration from others making them feel more like hopeful speculation than solid assurance.

As for moving averages (MAs), there’s evident contention across various timeframes: short- & mid-term exponential & simple MAs exhibit mixed signals favoring upward/downward trends respectively—the10 -day EMA/SMA flashing red whereas20 -day &30 -day averages lean green.Long-term indicators present decisively bearish outlooks as100 -day&200 -day EMAs/SMA remain deeply entrenched in red territory suggesting macro trends continue cooling off despite temporary stabilization.It’s essentially sideways movement until either breaking past92 K or falling below90 K—the charts advocate patience over predictions for now!

Bullish Outlook:

If Bitcoin manages to reclaim$92 K convincingly along with substantial volumes backing it up then short-term momentum could re-emerge paving way towards retesting ranges near94 K-95 K.Supportive mid-term MAs combined with positive signals from both momentum indicators/MACD provide some tailwinds—as long as bulls maintain vigilance!

Bearish Outlook:

With current pricing trapped beneath significant resistance coupled alongside potential formation bears flags appearing on four hour charts suggests risks exist for slipping under ninety thousand dollars ($90000).Weak volumes during upticks combined bearish pressures stemming from longer term moving averages imply recent uptrends are fading—and downside targeting88 k-89 k might soon come back into play!

Frequently Asked Questions ❓

What is bitcoin’s current price?At8 :45 AM Eastern Time Saturday January tenth twenty twenty-six bitcoin stands priced around ninety thousand six hundred seventeen dollars($90617).

Is bitcoin experiencing an uptrend or downtrend?Currently,Bitcoin appears consolidating after having recently undergone previous upward movements showing signs indicating short term indecision prevailing amongst traders involved within market space itself!

What does today’s trading range look like for bitcoin?Today sees its twenty-four hour pricing band fluctuate anywhere ranging roughly eighty-nine thousand five hundred ninety-six ($89596)-ninety-one thousand nine hundred twenty-four($91924).

What are crucial support/resistance levels associated specifically pertaining toward bitcoins activity? Support lies nearby right around nine hundred dollars($90000) whereas resistances hover closer towards areas ranging approximately ninety-two-thousand(ninety-two k)-ninety-five-thousand(ninety-five k).