The price of Bitcoin has begun a downward adjustment from $94,500. Currently, BTC is facing challenges and may decline towards the crucial support level at $89,000.

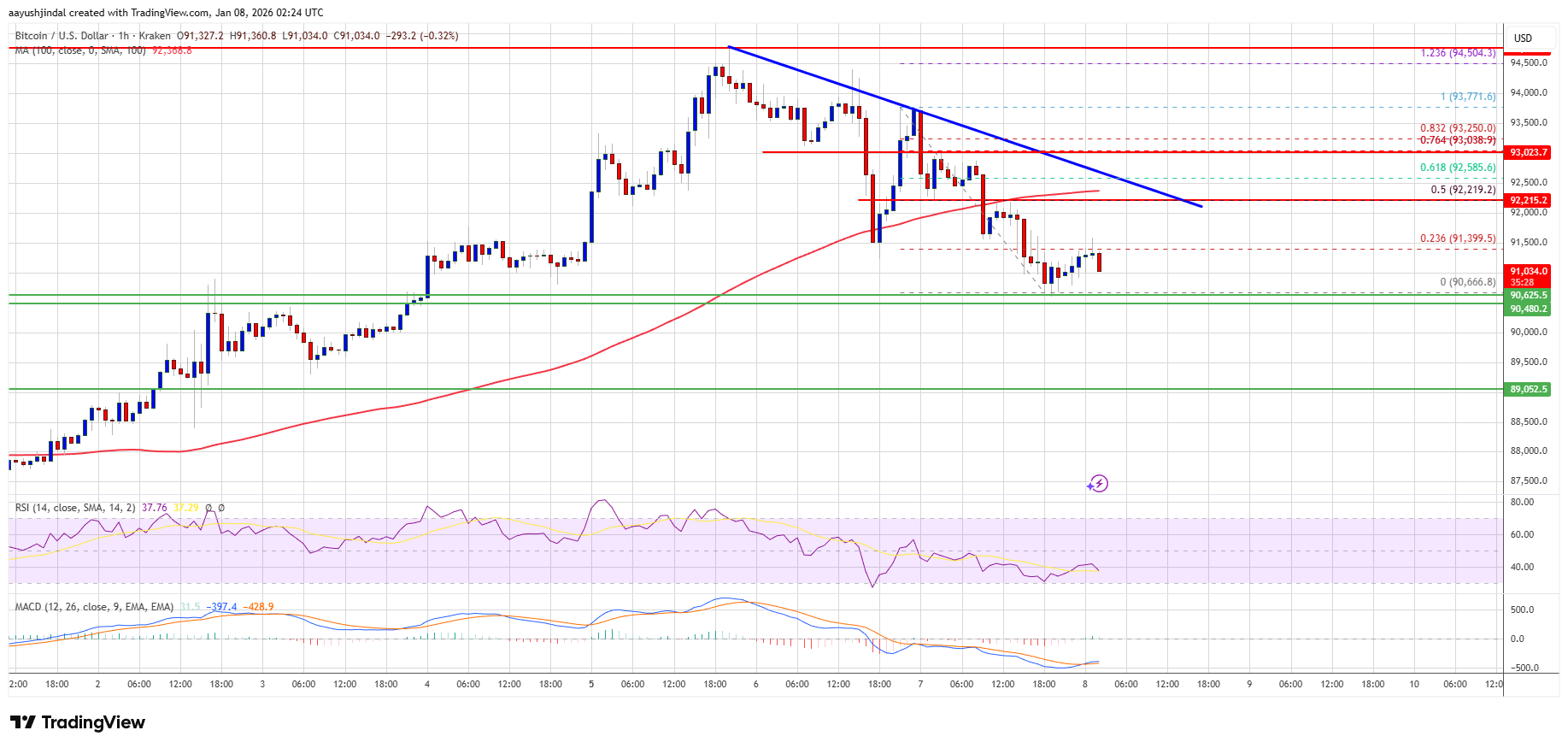

Bitcoin has initiated a downward correction and has fallen below the $92,000 mark. The current trading price is under both the $92,000 threshold and the 100-hour Simple Moving Average (SMA). A bearish trend line is developing with resistance positioned at $92,650 on the hourly chart for the BTC/USD pair (data sourced from Kraken). If it remains beneath the $92,500 level, further declines are likely.

Bitcoin Price Begins Downward Adjustment

The Bitcoin price was unable to maintain its position above $94,000 and consequently started a downward correction. It fell below both $93,200 and $92,500 entering into a short-term bearish territory.

The value even dropped beneath $92,000 reaching as low as approximately $90,650. A low point was established at around $90,666 where it currently appears to be consolidating its losses. It also tested the 23.6% Fibonacci retracement level of its recent drop from a swing high of $93,771 down to that low of around$90,666.

At present time Bitcoin trades below both the critical threshold of$92 ,000andthe100-hourSMA.Additionally,a bearish trend line with resistance near$92 ,650is forming onthehourlychartforBTC/USDpair.

If prices can hold steady above$90 ,500,it may attempt another upward movement.Immediate resistance lies close to$91 ,400.The first significant resistance stands near$92 ,200and corresponds withthe50%Fibonacciretracementleveloftherecentdeclinefromthehighofaround$93 ,771toaroundlowofapproximately$90 ,666.

The next potential resistance could be found at about $92 500.A close above this mark might propel prices higher.In such an event,thepricecouldriseand testtheresistanceatabout 93 050.Anyadditionalgainscouldpushit towardsthelevelofapproximately 93 800.The next hurdle for bullish traders could lie between 94 000and 94 500 .

Is More Decline Ahead for BTC?

If Bitcoin cannot break through that crucial barrier at about ${displaystyle { text{ } }}${displaystyle { text{ } }}${displaystyle { text{ } }}${displaystyle { text{ } }}{displaystyle {mathbb {R}}}$ ${displaystyle {mathbb {R}}}$ $mathrm{{𝑅}^n}$ then we might see another downturn beginning immediately.Support existsnearabout $mathrm{{𝑅}^n}$80$mathrm{{𝑅}^n}$0whichwillbecrucialifpricescontinuefalling .Thefirstmajor support zone can be found around $mathrm{{𝑅}^n}approx $90000$.

The subsequent support area now hovers around 89 dollars.Any additional losses could push prices down towards approximately 87 200 inshort order .The main support remains situatedat $86,00$,below whichBTCmightexperienceanaccelerateddeclineinthenearfuture.

Technical indicators:

Hourly MACD – The MACD indicator shows increasing momentum withinbearishterritory.

Hourly RSI (Relative Strength Index) – Currently,theRSIforBTC/USDstandsbelow50.

Major Support Levels – Around $90500,$90000followedbyotherkeyareas.$

Major Resistance Levels–Close to $92200,$92500.