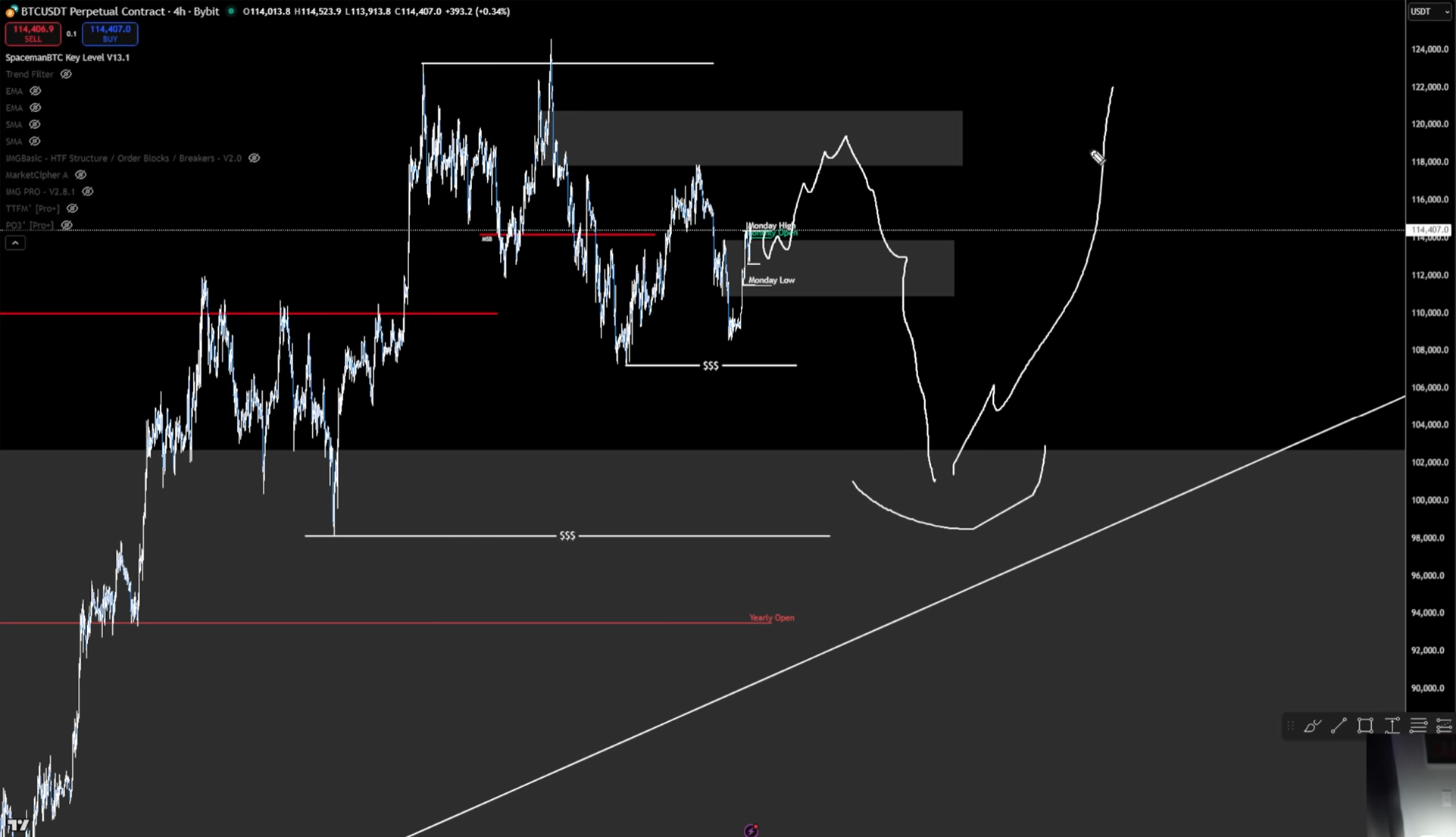

A cryptocurrency analyst known as Trader Mayne has issued a warning that Bitcoin might be poised for a significant decline before continuing its upward trend towards the end of the year. He suggests that an uncollected “$98,000 weekly liquidity level” could be targeted in early October.

Bitcoin’s Potential Price Paths

In a video analysis released on September 30 titled “Did Bitcoin Just Top? The Signal Everyone’s Ignoring…,” Mayne presented two possible scenarios: one involves taking advantage of short-term liquidity movements for potential gains before a deeper correction, and the other considers a substantial drop to $98,000 followed by an upward movement in the fourth quarter.

“TLDR — I anticipate we are approaching a larger correction soon to address the $98k weekly liquidity level,” Mayne mentioned on X. He added that there might be opportunities for short-term gains preceding this correction and still expects prices to rise in Q4, viewing any early dip as an opportunity to buy.

Regarding Bitcoin’s market structure, Mayne noted adherence to his recent strategy: initial growth followed by retesting key levels. Currently, he sees decision points marked by higher-timeframe resistance levels and intraweek lows. “We had daily bullish momentum with Bitcoin closing above resistance,” he observed while noting that although monthly trends are positive, “the weekly chart remains technically bearish.”

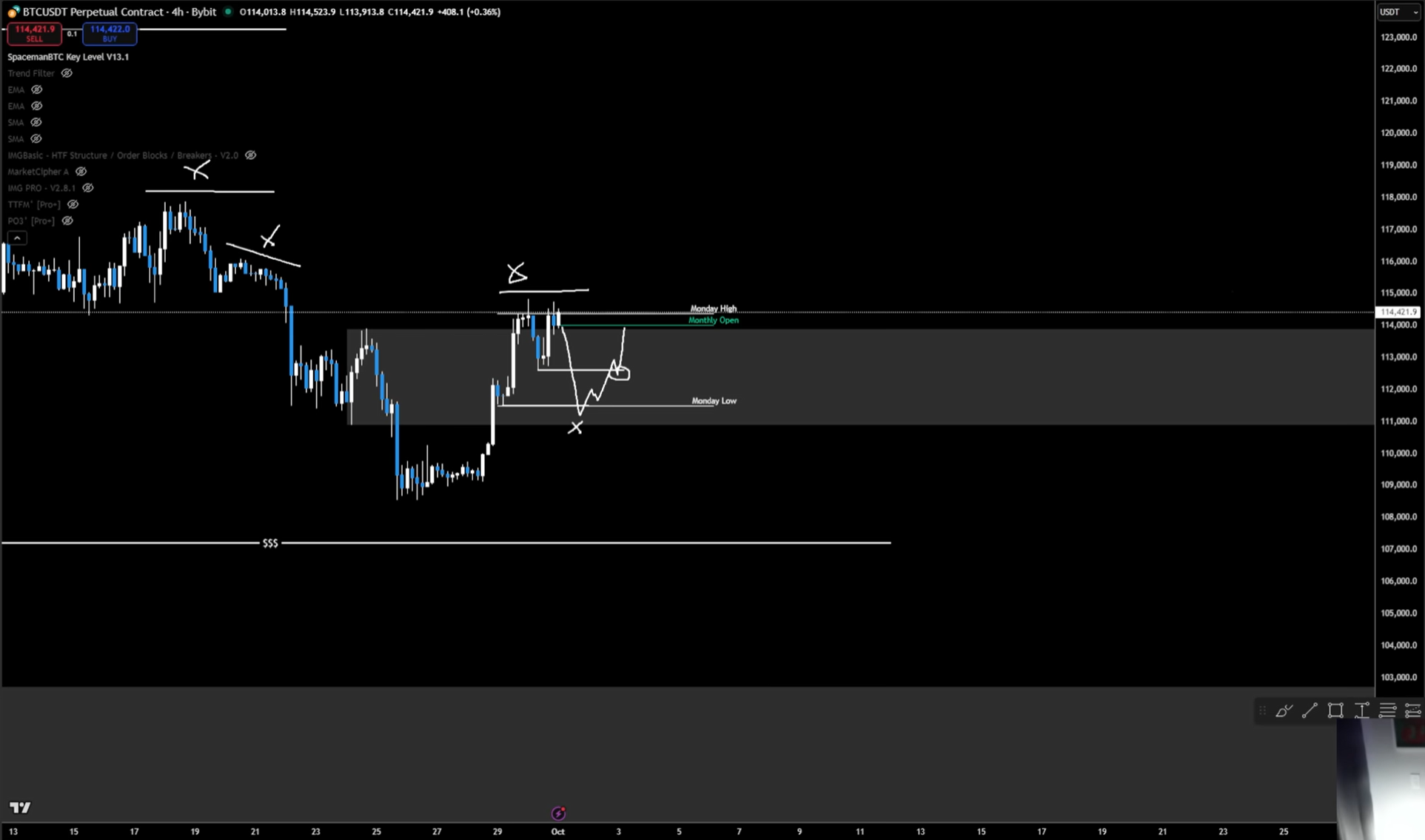

With higher timeframes indicating bullishness against weaker weekly signals, he is focusing on four-hour charts for trade alignment. “If H4 shows bullish signs—which it does—taking positions based on H4 liquidity runs will align with daily trends at least.”

The immediate catalyst is local low sweeps aimed at minimizing risk rather than entering broad retests with high invalidation risks. “I’d like these small H4 liquidity pools cleared first…that becomes my setup with tight stops and clear targets,” he explained.

“Monday’s low” serves as an important pivot point which if breached could lead into mean-reversion longs targeting nearby bearish resistances or previous highs—“perhaps even triggering pullbacks initially but ultimately guiding my approach here.”

A Final Dip Before Q4 Surge?

The Ethereum market exhibits similar characteristics where daily & 12-hour trends turn constructive within weekly order blocks yet demand precise entries via lower timeframe grabs.“ETH mirrors BTC closely—we’ve seen bullish flips alongside breaker retests here,” said Mayne describing ongoing structural changes involving both SFPs & breaks but emphasizing stop placement remains challenging unless Monday-low sweeps offer clearer triggers.”ETH looks promising assuming setups materialize,”he added.

Featured image created using DALL.E, chart from TradingView.com