The value of Bitcoin has been moving sideways for several months, but liquidity indicators that have accurately tracked this cycle suggest a potential shift is imminent. The relationship between global M2 money supply, stablecoin availability, and gold trends indicates that BTC might be gearing up for a significant move.

Global M2’s Influence on Bitcoin

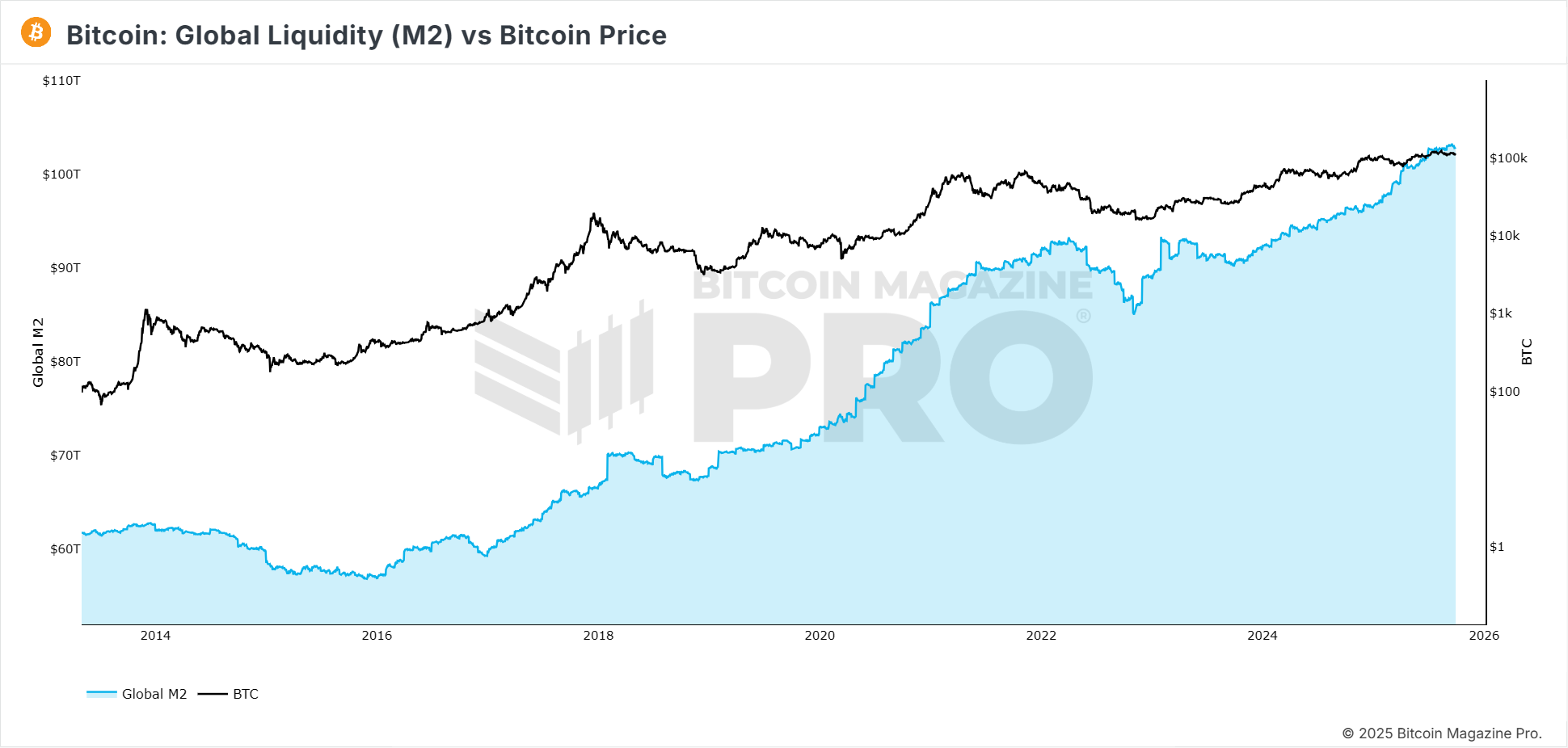

Historically, the global M2 money supply has shown a notable connection with Bitcoin’s market cycles. When the supply expands, it often aligns with bullish phases; conversely, when it contracts or stagnates, it corresponds to periods of market inactivity or decline. Recently, growth in Global M2 has decelerated while BTC prices have remained flat after reaching nearly $124,000 at their peak. A resurgence in Global M2 typically channels funds into speculative assets like Bitcoin, suggesting future gains.

Figure 1: Global Liquidity (M2) vs Bitcoin Price. View Live Chart

Stablecoin Dynamics and BTC Patterns

The availability of stablecoins within the cryptocurrency sphere serves as an even more reliable predictor than Global M2. The correlation with BTC exceeds 95%, maintaining near-perfect alignment year-over-year. Historically, when stablecoin supply growth surpasses its 90-day average change rate, it’s been an opportune moment to acquire bitcoin before substantial price increases occur.

Gold Trends Impacting Bitcoin

Throughout 2025, there has been a strong correlation between Gold and Bitcoin prices with approximately a 40-day delay –a connection exceeding 92% correlation .–. Gold’s continuous climb to new record highs this year provides momentum for BTC as investors shift towards harder assets and speculative opportunities ;. If this pattern persists ;, we could see BTC breaking out towards $150;,,,..;000 by early November !

The US Dollar’s Role Against Crypto Values

Although liquidity metrics alongside gold correlations lean positively;, recent movements in the US Dollar Strength Index indicate otherwise:. Typically trading inversely relative to USD strength,, bitcoin faces some resistance due partly due increased DXY activity over recent weeks.; Year-on-year inverse correlations hover around minus forty percent,; implying possible short-term volatility despite longer-term upward prospects.

A combination involving global monetary factors like m- two supplies along w-stable coins plus-gold correlations suggests-btc stands poised near breakout territory during Q4 seasonal trends enhancing bullish outlooks yet conflicting signals from dollar highlight sideways trade risks amid false starts common across cycles past .-Bitcoin historically consolidates extensively pre-explosive moves currently data implies proximity nearing such transition now

;

Fo-r comprehensive analysis view latest YouTube video titled

"-Bitcoin Is PERFECTLY Following THIS Data Point"-      ;

;

;

;

;

;

;

This article serves informational purposes only not financial advice always conduct personal research prior investment decisions.

This post originally appeared on <a href="-http://bitcoinmagazine.com"->Bitcoin Magazine</a> authored by Matt Crosby.</strong></pgt;