The connection between Bitcoin and gold is intensifying as both assets are gaining recognition as safeguards against economic instability, according to Ki Young Ju, CEO of CryptoQuant.

In a recent post on X, Ju highlighted that the correlation between BTC and gold has surged significantly alongside gold’s climb to unprecedented heights. He stated, “Gold continues reaching new all-time highs. The BTC-gold correlation remains strong; the digital gold narrative persists. Demand for inflation hedges is still present.”

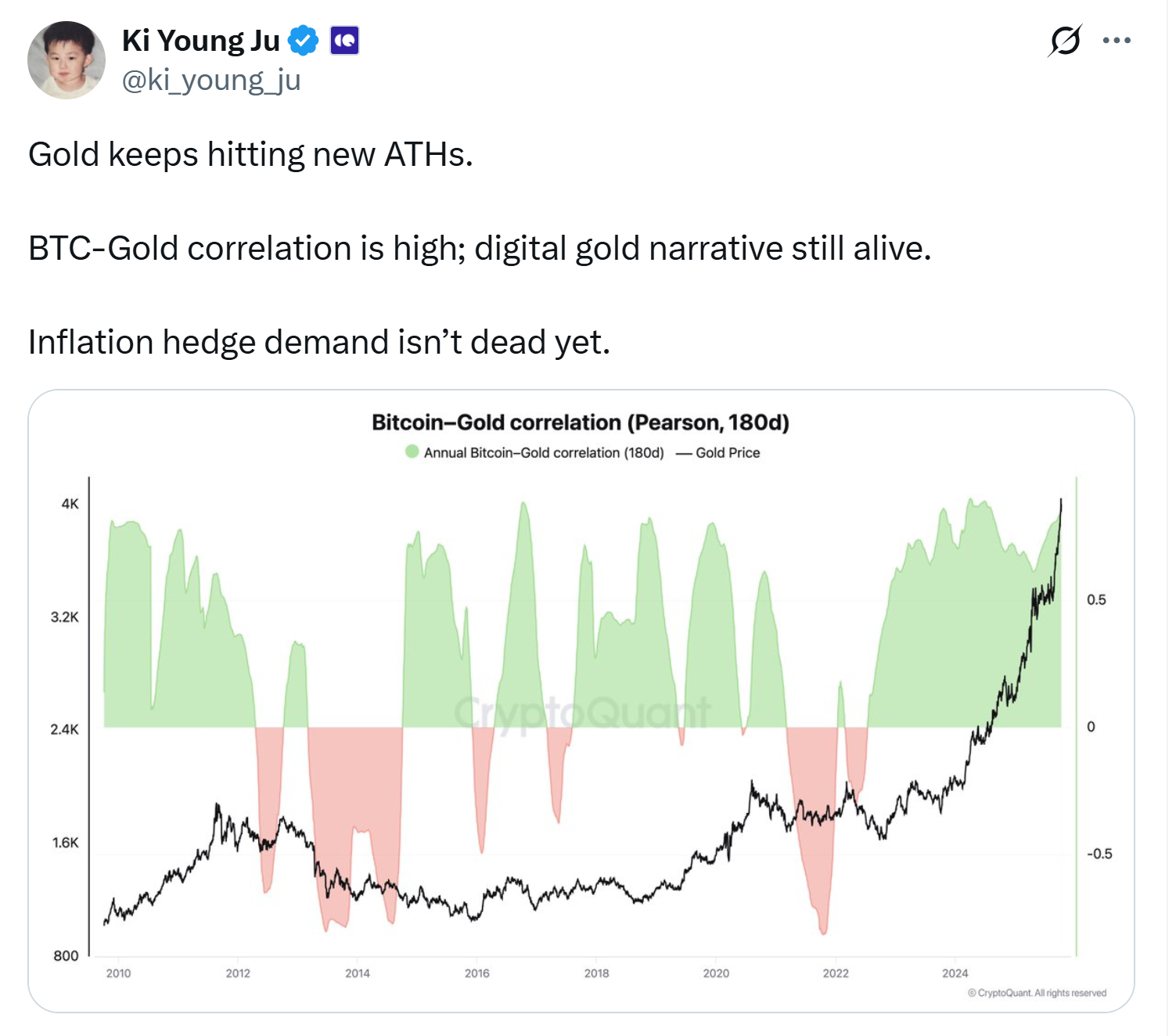

CryptoQuant data reveals that the current BTC-gold correlation exceeds 0.85, a notable increase from -0.8 in October 2021. This metric previously peaked at approximately 0.9 in April of last year.

The rise in BTC-gold correlation is evident. Source: Ki Young Ju

Related: Bitcoin to $1M? Why Gemini’s Winklevoss twins call it ‘gold 2.0’

The Path of Bitcoin Mirrors Gold

DWF Labs’ managing partner Andrei Grachev noted that this growing correlation reflects institutional investors’ views on Bitcoin (BTC). “Capital tends to flow into assets seen as stable value stores,” he explained.

Grachev likened Bitcoin’s evolution to that of gold, which transitioned from being an active currency to becoming a wealth repository. “Gold was once widely used for transactions before evolving into primarily a store of value, and Bitcoin seems headed down this same path, which accounts for its price behavior mirroring that of gold,” &he added;

&Ben Elvidge,&head&of commercial applications at Trilitech and product lead for Uranium.io,&remarked&that currently,&Bitcoin serves more effectively as&a store-of-value than&a transaction medium due&to its programmed scarcity.”Its potential capital appreciation outweighs ease-of-transfer-for-payments,” he commented.

&Related:&What Central Bank Gold Buying Means For Bitcoin

A Surge in Gold and Silver Prices

&p&&On Tuesday,&the price of &gold soared-to-an-all-time-high-of &dollar4&comma179&period48 per ounce&period Spot prices increased by &percnt0&period5 reaching &dollar4&comma128&period49 while US futures contracts slated-for December delivery rose-to-&dollar4&comma158-per-ounce.&The metal has gained over &percnt57 this year driven-by geopolitical risks.

&p&&Silver also achieved-a-record high hitting-&dollar53&rpar60 before settling-at-&52&rpar27 extending-its annual gain beyond-per-cent85 surpassing-the-rally-in-gold-price&speriod;

&p&&This surge-in-both-metals-occurs-as-financial institutions increasingly embrace-the-“debasement trade”&comma investing-in-assets-that-protect-against purchasing power erosion caused-by continuous-money-printing&speriod;

&p&&Last week entrepreneur Anthony Pompliano mentioned-that institutions now acknowledge-that-“no one will ever cease printing money”&comma boosting demand-for-hard-assets&speriod;

<i</i<iEU’s privacy-killing Chat Control bill delayed — but fight isn’t over>

)%22%20alt=%22image%22%20class=%22article-detail-image)%20style=%22margin-bottom:%2016px;width:100%%3E