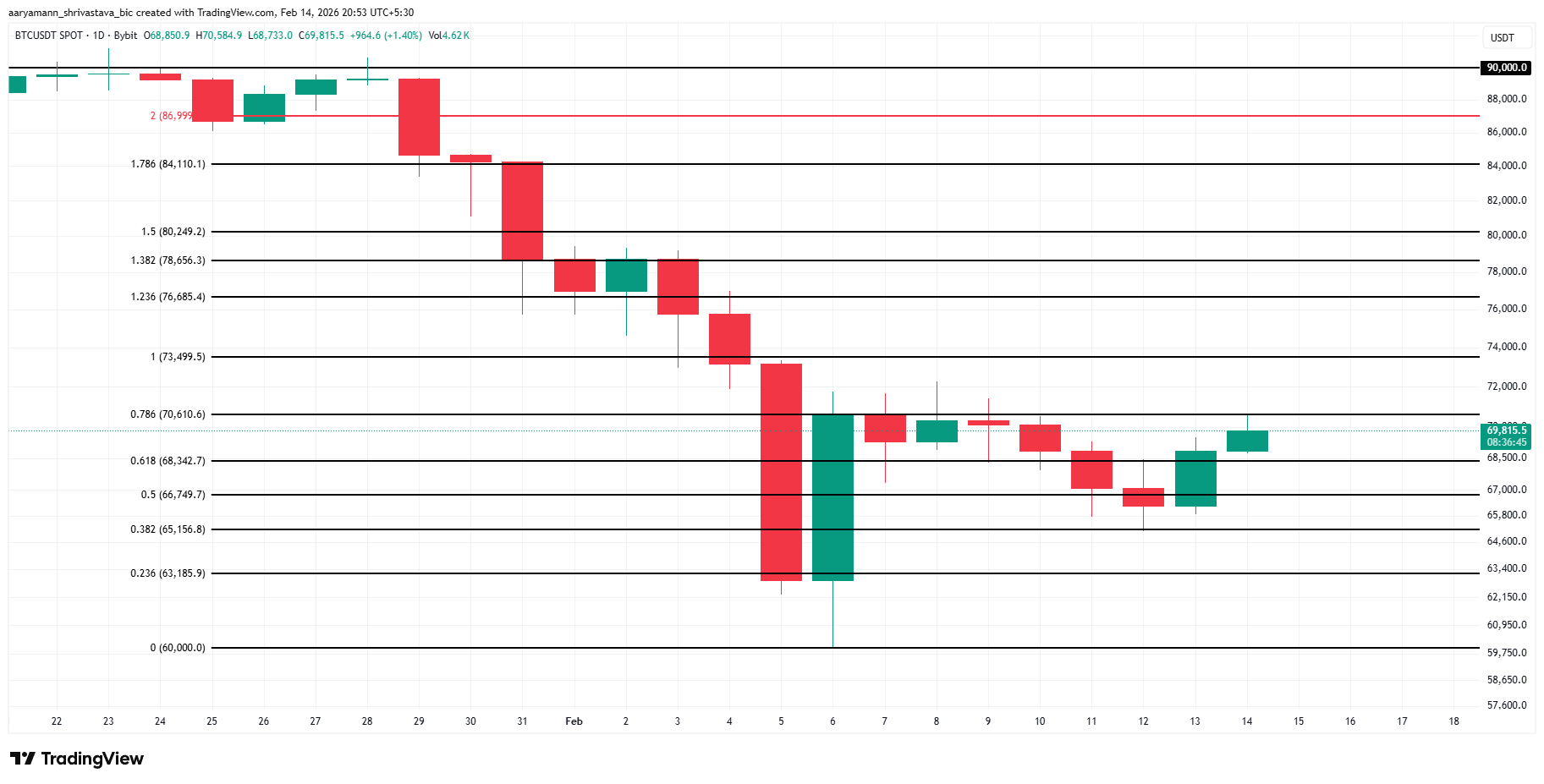

Bitcoin is making another attempt to break through the $70,000 mark after experiencing several weeks of volatile sideways movement. At the time of writing, $BTC is trading around $69,815, just shy of the resistance level at $70,610. While this leading cryptocurrency aims to regain its recent losses, conflicting signals from on-chain data and derivatives markets create an uncertain short-term forecast.

Traders are paying close attention to this key psychological barrier. A sustained push above $70,000 could decisively shift market sentiment in favor of bulls. Nevertheless, persistent bearish bets suggest that price swings might intensify before a clear directional trend takes hold.

The Resemblance Between Current Bitcoin Shorts and Past Patterns

Data aggregated from major crypto exchanges reveals a sharp increase in short positions reflected by deeply negative funding rates—the lowest seen since August 2024. That period historically marked a crucial bottom for Bitcoin.

Back in August 2024, traders heavily favored downward bets as funding rates dropped dramatically. Instead of continuing lower afterward, Bitcoin reversed course sharply which led to widespread short squeezes and propelled an approximately 83% rally over the next four months.

If you want more insights like these on tokens and market trends? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter today.

The extreme negativity in funding rates highlights heavy bearish sentiment accompanied by widespread fear and uncertainty (FUD). Although such conditions don’t guarantee an immediate price surge, they establish a fragile market structure where any upward move could trigger forced short-covering that amplifies volatility and accelerates gains.

Is Bitcoin Approaching Capitulation?

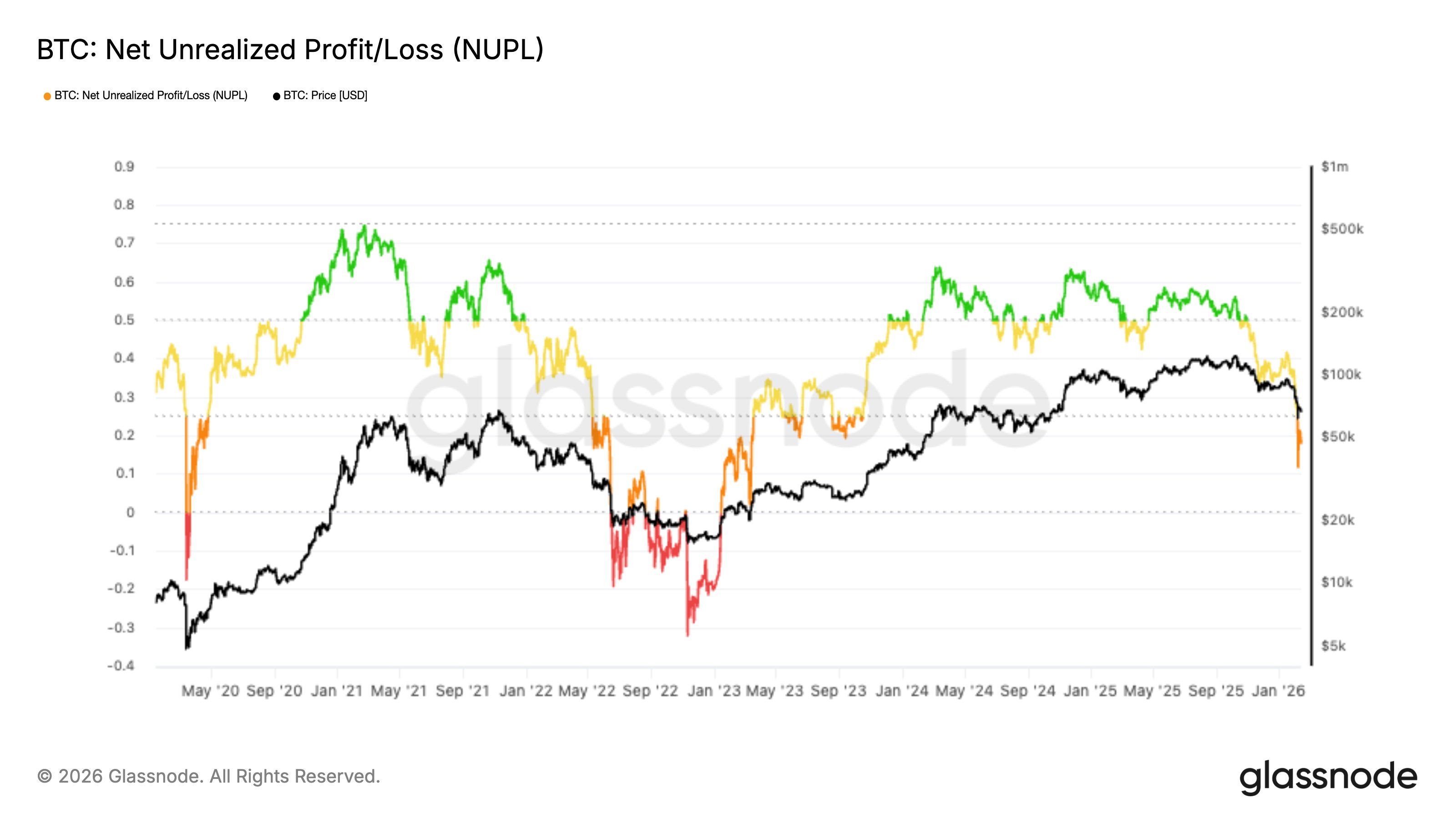

The Net Unrealized Profit/Loss (NUPL) indicator has recently fallen back into the Hope/Fear zone near 0.18—signaling that holders’ profit cushions are minimal at best. Historically speaking, when NUPL reaches this range markets tend to become reactive rather than stable.

This zone often precedes prolonged weakness phases characterized by panic selling before forming sustainable bottoms. Without significant capitulation resetting investor psychology first, Bitcoin may remain susceptible to deeper declines prior to stabilization.

A Look at Short-Term Technical Indicators

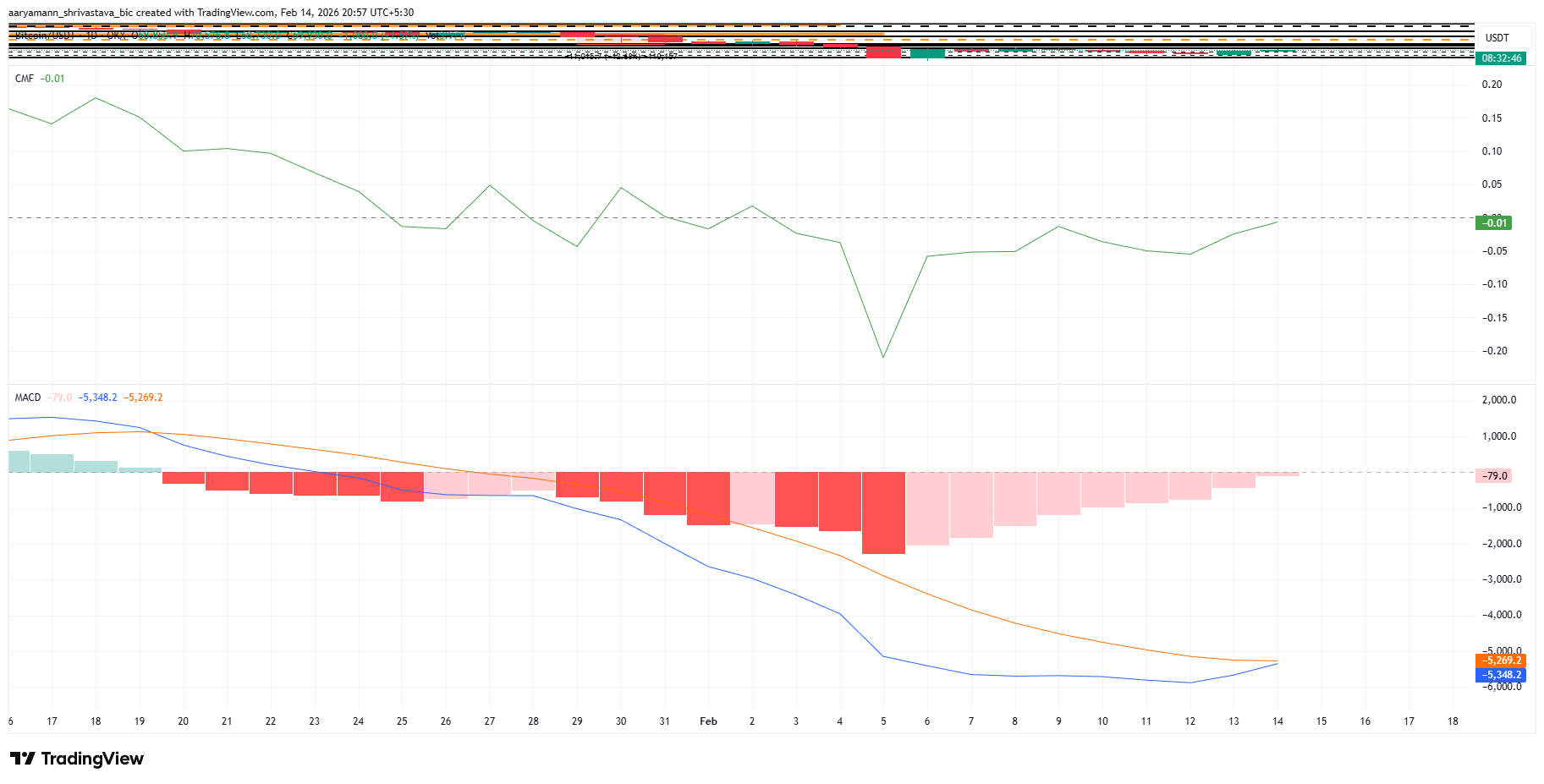

Technical analysis suggests momentum is improving slightly in the near term: The Chaikin Money Flow indicator—which tracks capital inflows versus outflows—is nearing zero from below; crossing into positive territory would indicate renewed buying interest for Bitcoin.

At the same time,the Moving Average Convergence Divergence (MACD) indicator approaches a bullish crossover—a sign that momentum may be shifting from bearish toward bullish territory—but early signals still require confirmation through sustained upward price action.

Despite these improving technical signs,the overall market mood remains cautious with shorts unlikely closing positions voluntarily under weak conditions.This dynamic raises chances that any recovery will be sparked primarily by forced liquidations triggered via price moves rather than gradual shifts in trader sentiment alone.

$BTC Needs Strong Momentum To Break Resistance

The current trading level around $69,&815 keeps bitcoin capped just below critical resistance near $70,&610.The psychological importance attached to surpassing "$70K" means breaking above it decisively could attract fresh capital inflows fueling further rallies.

However,bearish dominance within derivatives markets continues exerting pressure.Long-standing prevalence of shorts risks confining prices beneath &$70000. Should support near $65156

break down,a cascade of long liquidations might ensue intensifying downside volatility.

If bitcoin manages strong backing overcoming selling pressure beyond seventy thousand dollars,rally targets come into view quickly.A surge towards seventy three thousand four hundred ninety nine dollars appears plausible.

Sustained strength beyond here might extend gains up towards seventy six thousand six hundred eighty five invalidating bearish outlooks confirming broader recovery attempts.

This article originally appeared on BeInCrypto titled “<strong>Bitcoins Shorts Reach Most Extreme Level Since 2024 Bottom</strong>.”</P