Bitcoin (BTC) has seen a rise of approximately 4% compared to last week, which is encouraging for the cryptocurrency but raises concerns about the broader economic landscape.

The recent downturn in economic indicators from last week has led to increased speculation that the Federal Reserve may lower interest rates this Wednesday, making riskier investments like stocks and bitcoin more appealing.

Let’s review the data supporting this perspective.

The most significant data point was released on Thursday—the U.S. Consumer Price Index (CPI). The headline inflation rate came in slightly above expectations, suggesting that inflation might be more persistent than previously thought.

Prior to this, revisions to employment figures were announced on Tuesday. The U.S. economy added nearly one million fewer jobs than initially reported for the year ending in March—marking the largest downward adjustment in history.

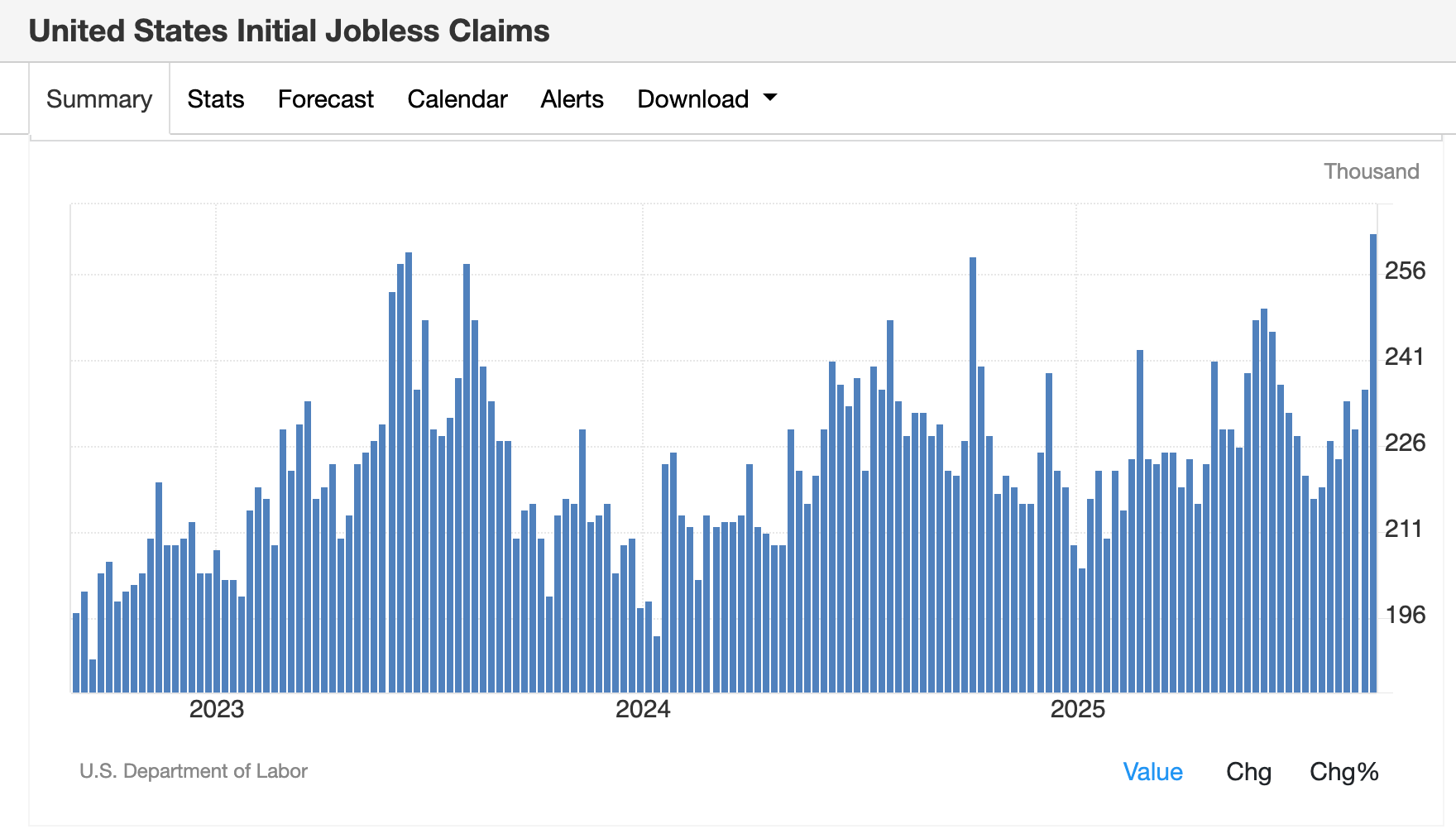

This announcement followed a closely monitored monthly jobs report published the previous Friday. According to the Bureau of Labor Statistics, only 22,000 new jobs were created in August while unemployment rose to 4.3%. Additionally, initial jobless claims surged by 27,000 to reach 263,000—the highest level since October 2021.

US Initial Jobless Claims (TradingEconomics)

The combination of rising inflation and declining job numbers does not bode well for the U.S. economy; hence it’s no surprise that discussions around “stagflation” are resurfacing within macroeconomic analysis.

In light of these developments, bitcoin—viewed as a risky asset by Wall Street—has continued its upward trajectory surpassing $116,000 on Friday and nearing closure of an August CME futures gap at $117,300.

This trend aligns with traders also pushing up other high-risk assets such as equities; for instance, the S&P 500 index reached record highs for two consecutive days fueled by hopes surrounding potential interest rate cuts.

What should traders consider regarding BTC’s price movements?

From my perspective as a chart enthusiast, current price trends appear positive with higher lows being established since September’s low at $107,500. The average over a span of 200 days has risen to $102083 while Short-Term Holder Realized Price—which often acts as support during bullish markets—has hit an all-time high at $109668.

Short Term Realized Price (Glassnode)

Performance Overview: Bitcoin-Related Stocks

Despite bitcoin’s weekly gains not translating into similar performance for Strategy (MSTR), which is recognized as one of Bitcoin’s leading treasury firms—with shares remaining relatively unchanged over the week—its competitors have fared better: MARA Holdings saw an increase of about 7%, while XXI gained around 4% during this period.

MSTR has underperformed relative to bitcoin throughout this year and continues trading below its long-term moving average currently positioned at $355 per share. Closing Thursday at $326 puts it near crucial support levels observed back in September and April earlier this year.

The company’s market NAV premium has contracted below a factor of approximately1 .5 when factoring outstanding convertible debt along with preferred stock or roughly around1 .3 based solely on equity value.

MSTR (TradingView)

Issuance related specifically towards preferred stocks remains subdued; only$17 million was raised through STRKand STRFthis past week indicating most issuance occurring presently is still channeled via common shares instead.Accordingly ,the company stated options are now available listed &trading across all four perpetual preferred stocks—a development likely providing extra yield opportunities linked dividends.

Potential Bullish Drivers For Crypto Stocks?

CME’s FedWatch tool indicates trader expectations suggest there will be25 basis-point reduction regarding USinterest rates comeSeptember alongside three total reductions anticipated before year’s end.This signals potential shift back towards growth-oriented sentiments favoring crypto-linked equities underscored recently when10-year US Treasury briefly dipped below4 %during prior weeks trading sessions .

US10-year( TradingView )

Nonetheless ,the dollar index(DXY )remains firmly anchored within multi-year support levels presenting possible inflection points worth monitoring closely .

( TradingView )