Analysis provided by CoinDesk analyst and Chartered Market Technician, Omkar Godbole.

As Bitcoin hovers near unprecedented highs, traders are keenly observing for indicators of future movements, particularly significant levels that might serve as pivotal points or barriers.

Here are three critical levels to monitor attentively:

$126,100

This mark signifies the upper limit of a broadening range pattern that has been evolving since mid-July. This potential resistance is delineated by a trendline connecting the peaks from July 15 and August 14.

BTC’s expanding price range. (CoinDesk)

A reversal at this point could initiate a corrective decline towards the lower boundary of this range, indicated by another trendline extending from the lows on August 3 and September 1.

$135,000

If Bitcoin breaks out from its expanding range, attention may shift to $135,000. At this level, market makers hold a net long gamma position based on Deribit-listed options data tracked by Amberdata.

Market makers with net long gamma positions typically counteract market trends – purchasing during declines and selling during rallies – to sustain their neutral stance in the market. This hedging behavior generally reduces price volatility under stable conditions.

This means that $135,000 could act as an obstacle in upward movements.

BTC options on Deribit: Distribution of dealer/market maker gamma. (Amberdata)

$140,000

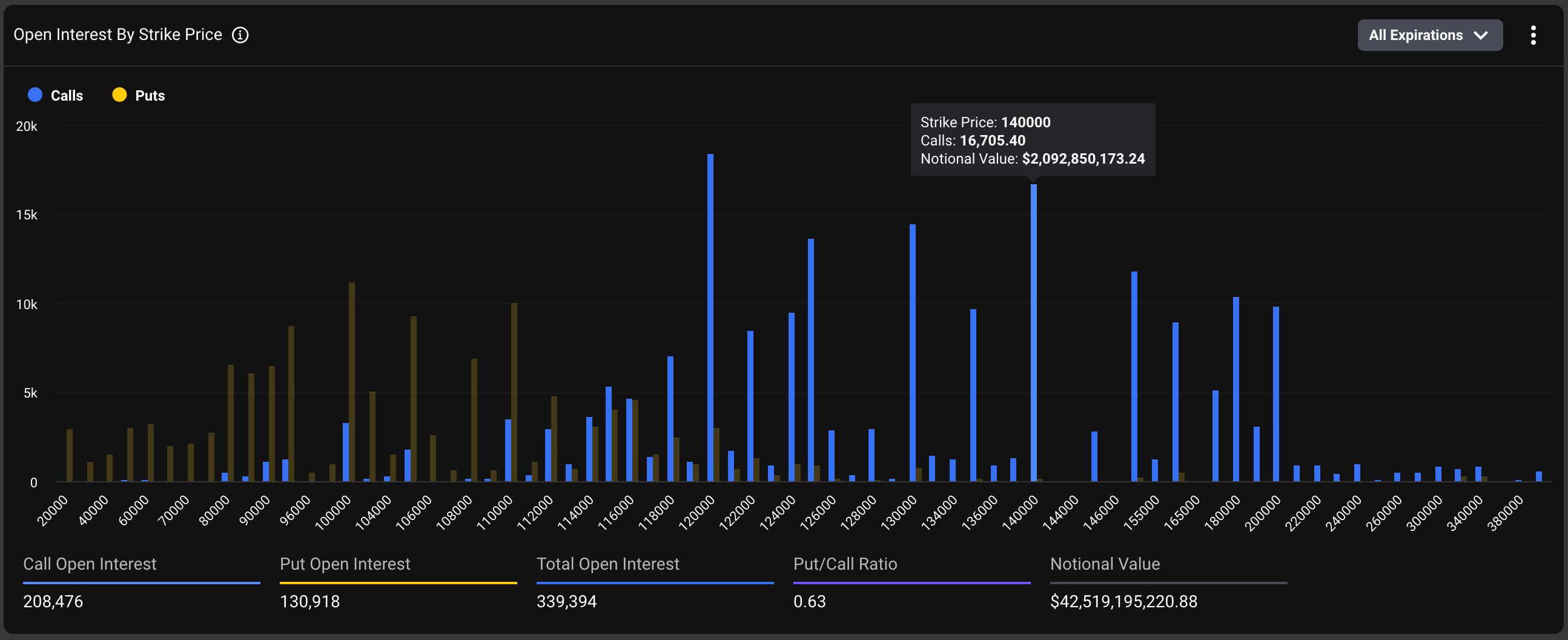

The $140,000 level emerges as crucial because Deribit’s data indicates it is one of the most favored strike calls on their platform with over $2 billion in notional open interest associated with it.

Notional open interest refers to the total dollar value tied up in active or outstanding options contracts at any given moment.

BTC options: distribution of open interest. (Deribit Metrics)