Bitcoin ($BTC) has experienced a significant decline, trading at approximately $67,307 as of February 20, which is nearly half its value from early October 2025. Despite this downward trend, the competition between bullish and bearish sentiment in the cryptocurrency market remains notably fierce.

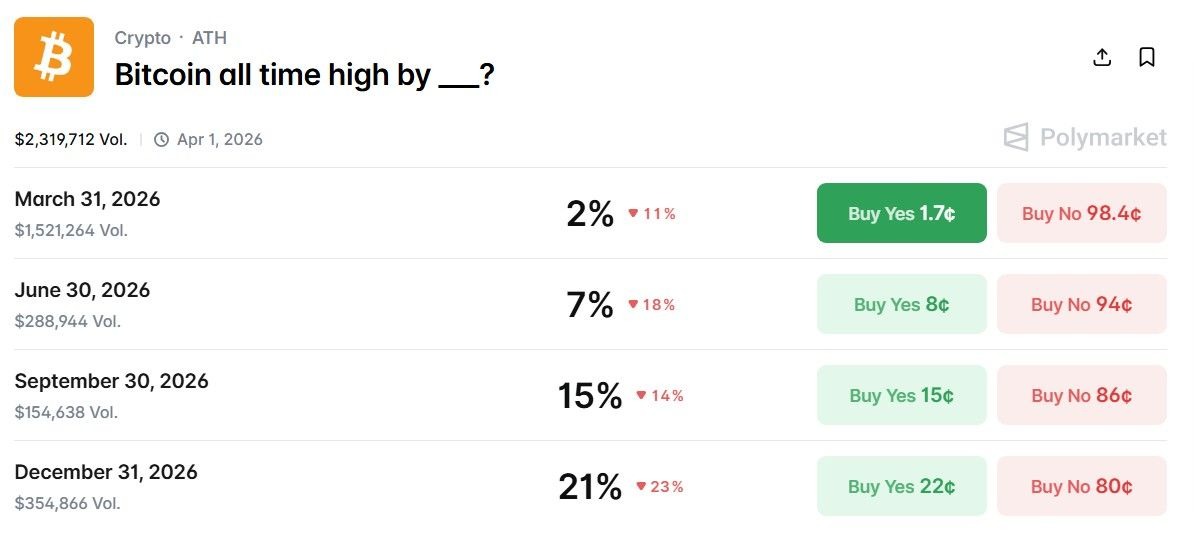

On the prediction platform Polymarket, traders appear to lean more towards a pessimistic outlook. A particular trade titled ‘Bitcoin all time high by ___?’—with all potential dates set within 2026—has amassed $2.3 million in volume. However, the probability that Bitcoin will reach a new all-time high ($ATH) during this period seems quite slim.

Projected Dates for Bitcoin’s Next All-Time High

The prediction market lists only four possible deadlines for Bitcoin to achieve a new peak: March 31, June 30, September 30, and December 31 of 2026. Interestingly, the date with the highest chance is December 31; yet even this carries just about a 21% likelihood.

The chances assigned to other dates are lower still—15% for September end, around 7% by mid-year (June), and merely about 2% by March’s close—indicating that overall confidence in Bitcoin hitting fresh highs within this year remains under fifty percent.

Unusual Aspects of This Prediction Market

This predictive trade focuses exclusively on Bitcoin price movements recorded on Binance exchange:

“The market resolves to ‘Yes’ if any one-minute candle for BTC/USDT on Binance between December 16, 2025 at 10:30 AM ET and midnight ET on the specified date shows a ‘High’ price exceeding any previous one-minute candle’s ‘High.’ Otherwise it resolves as ‘No.’”

An odd detail is that as of February 20, 2026—the press time—the resolution date mentioned in the title appears incorrectly set as April 1, 2026.

The Bearish Outlook for Bitcoin in 2026

A strong consensus among many investors and analysts supports skepticism regarding new highs next year. Observers note that $BTC seems entrenched in its usual cyclical downturn phase.

Blockchain analyst Ali Martinez projected via social media platform X that Bitcoin could drop toward $50,000 or even plunge further near $38,000 before potentially bottoming out around October.

Similarly renowned investor Michael Burry drew parallels between early-2026 chart patterns and those seen during crypto winters of 2021–22—a period marked by steep declines across digital assets markets.

The Bullish Case For Bitcoin In 2026

Certain optimistic bets are supported by institutional forecasts predicting substantial rallies ahead. Earlier this year Bernstein released an especially bullish forecast suggesting $BTC

might surge up to an unprecedented ATH near $150K within months — dismissing bear scenarios as relatively weak.

<P The British banking giant Standard Chartered has taken what might be called a mixed stance: although it lowered prior targets—from an ambitious XRP price point at $8 downwards along with trimming its earlier bitcoin target from $150K—it still anticipates notable rallies.

Specifically , Standard Chartered now forecasts bitcoin rebounding strongly toward roughly $100 ,000 while XRP may climb back up near $ { ' ; } s u00262 .80 . & lt ; / p & gt ;

Featured image courtesy Shutterstock