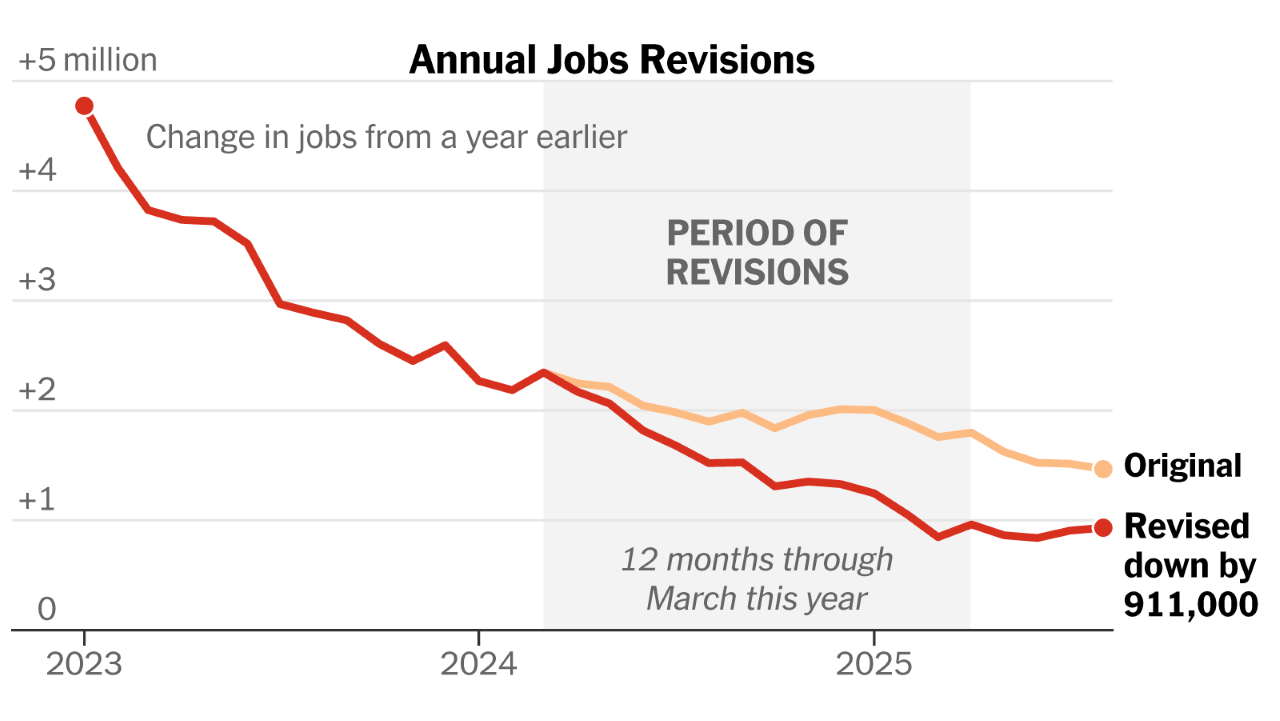

The U.S. Bureau of Labor Statistics has revealed that the job growth for the year ending March 2025 was nearly a million positions lower than earlier estimates suggested.

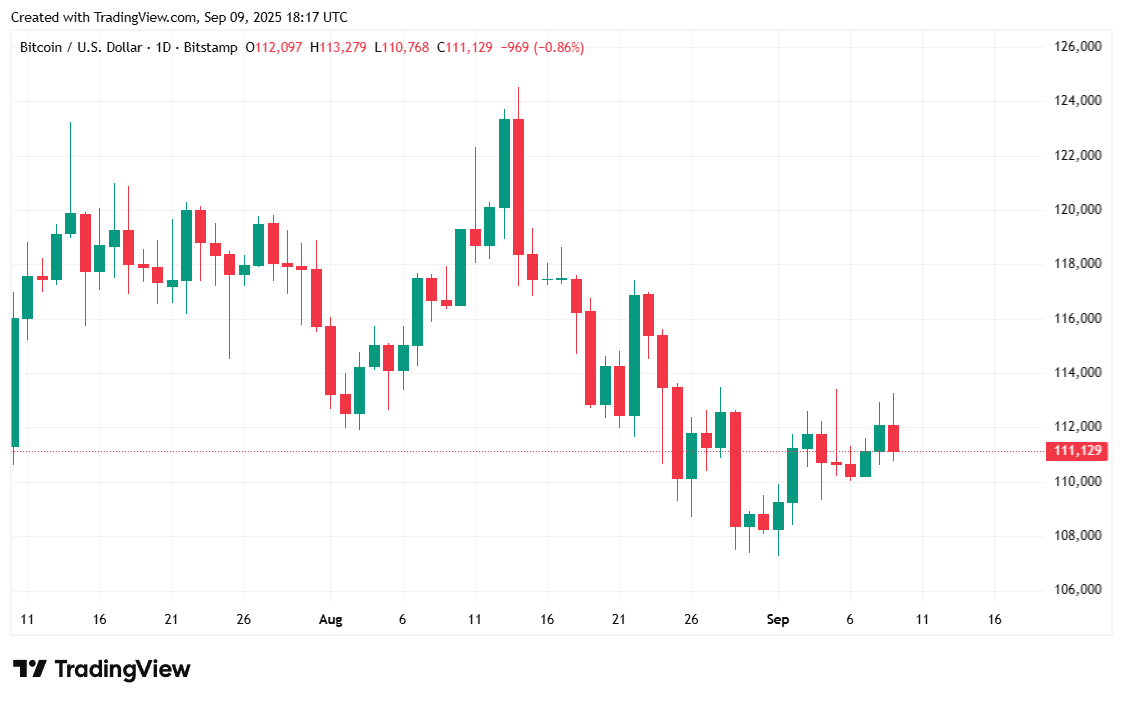

Stunning Jobs Data Revision Causes Bitcoin to Drop to $110K

A total of 911,000 jobs were removed from the Current Employment Statistics (CES) national benchmark following a preliminary revision released by the U.S. Bureau of Labor Statistics on Tuesday. While stock markets remained relatively stable in response, bitcoin (BTC) experienced a decline of approximately 1.5%, falling into the $110K range.

(Tuesday’s shocking update marks the largest downward preliminary revision in job data in over 25 years / U.S. Bureau of Labor Statistics via The New York Times)

This initial benchmark revision assesses how accurate monthly CES estimates are—or rather, how inaccurate they can be. The BLS revisits previous employment figures from March each year and aligns them with data sourced from the Quarterly Census of Employment and Wages (QCEW). These employment counts derive from state unemployment insurance tax records submitted by nearly all employers. After this initial assessment, revisions are finalized and officially published in February of the subsequent year as part of BLS’s Employment Situation report.

A review conducted by Bitcoin.com on all preliminary benchmark revisions dating back to before 2000 indicates that Tuesday’s adjustment represents an unprecedented downward shift within that quarter-century timeframe. Last year’s estimate also saw a significant reduction with an adjustment downwards by 818,000 jobs; however, it ultimately settled at just 598,000 after final calculations were made. The most substantial final adjustment occurred in 2009 when Barack Obama assumed office following George W. Bush’s presidency—during which around 902,000 jobs were deducted from prior employment statistics.

“Today marks a historic moment as we witness record-breaking downward revisions confirming President Trump’s assertions: Biden’s economic policies have failed miserably while exposing flaws within BLS,” stated White House Press Secretary Karoline Leavitt. “Just like BLS has let down Americans everywhere; Jerome ‘Too Late’ Powell must now face reality—it’s time for rate cuts.”

In early August, former BLS head Erika McEntarfer was dismissed by President Donald Trump who accused her administration of skewing job statistics negatively against him during his term in office.

Recently observed trends suggest bitcoin is reacting more acutely than stocks do regarding macroeconomic changes such as Tuesday’s labor report announcement—with cryptocurrency prices dropping post-negative news while equities continue climbing towards record highs despite weak labor indicators.

Market Overview

As per Coinmarketcap at reporting time today, bitcoin is valued at $111,147.80—a decrease noted at around -1.12%. Over recent hours trading activity fluctuated between $110,776 and $113K mark.

(Bitcoin price / Trading View)

The trading volume surged up by approximately +15% since yesterday reaching about $45 billion during this writing session.

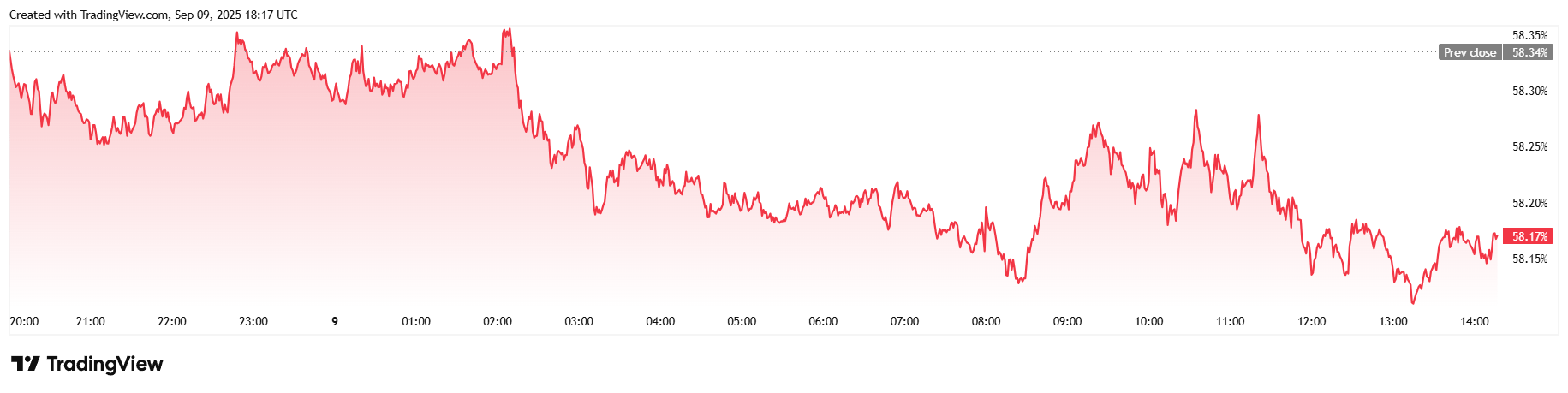

Market capitalization fell roughly -1% settling around two trillion dollars while bitcoin dominance dipped slightly to stand at about +58%, reflecting a minor decrease throughout today’s market activities (-0.%30).

(Bitcoin dominance / Trading View)

Total open interest for bitcoin futures rose +1% reaching approximately over eighty-two billion dollars across twenty-four hours according Coinglass reports.

Liquidations concerning bitcoins climbed significantly totaling near sixty-one million dollars today—with long liquidations contributing predominantly accounting for almost forty-seven million versus short liquidations totaling thirteen million respectively throughout these sessions!