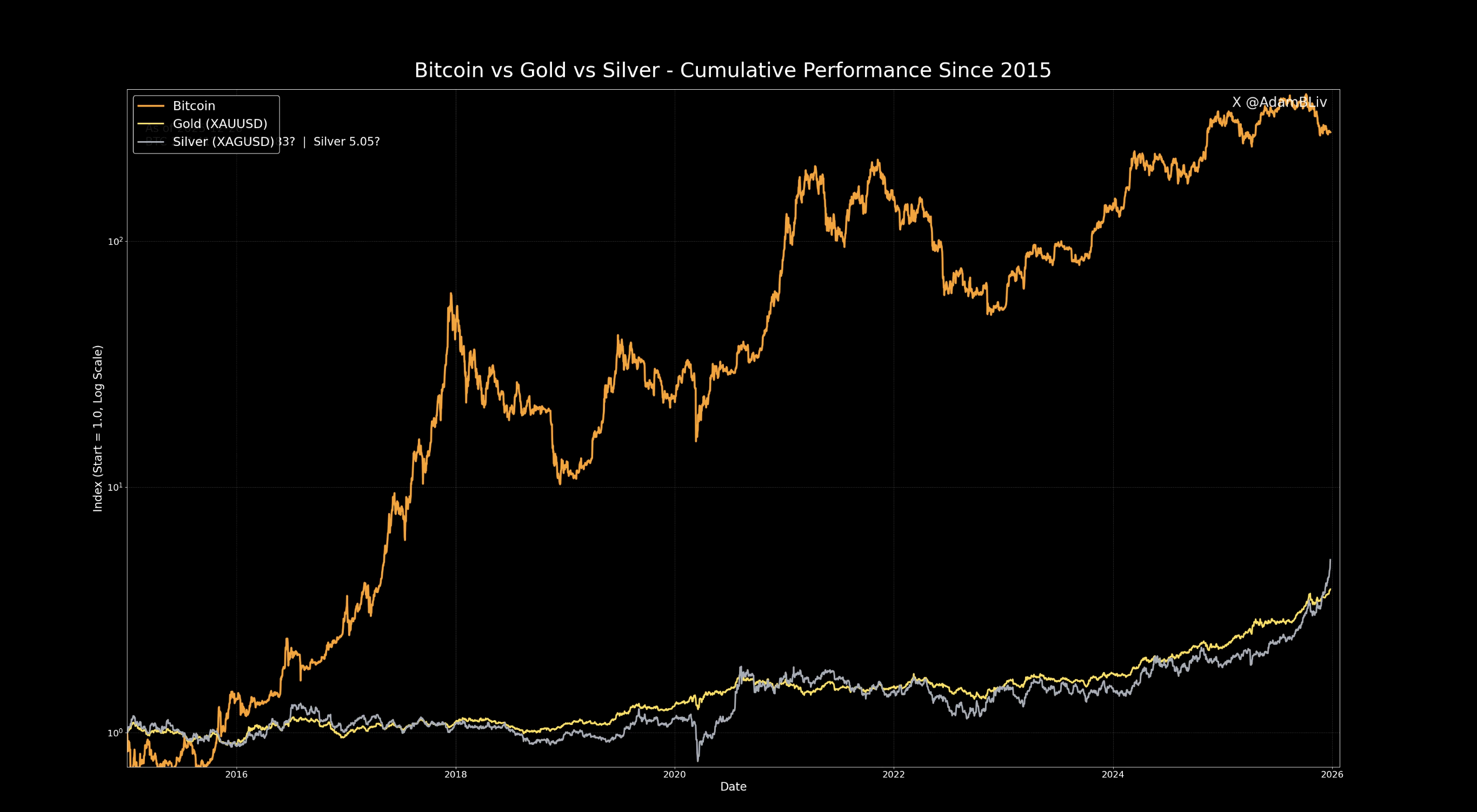

Since 2015, Bitcoin (BTC) has dramatically outpaced both gold and silver in terms of returns. According to analyst and author Adam Livingston, Bitcoin’s value surged by an astonishing 27,701%, while silver increased by just 405% and gold rose by only 283% during the same timeframe.

Livingston pointed out on X that even if one disregards Bitcoin’s initial six years—often criticized for skewing comparisons—the precious metals still fall far behind this leading digital asset.

Peter Schiff, a well-known advocate for gold and a vocal skeptic of Bitcoin, countered Livingston’s claim. He suggested that the comparison should focus on the past four years rather than a decade, asserting that “times have changed” and implying that Bitcoin’s dominance is fading.

The chart illustrates how Bitcoin’s price performance compares with gold and silver since 2015. Source: Adam Livingston

Matt Golliher, co-founder of Orange Horizon Wealth—a firm specializing in managing cryptocurrency assets—offered insight into commodity pricing dynamics. He explained that over time prices tend to align closely with production costs because rising prices encourage increased supply until equilibrium is restored.

“When prices climb,” Golliher noted, “production ramps up accordingly which inflates supply faster than demand can absorb it—thus pushing prices back down unless the asset has a fixed supply.”

He added that certain sources of gold and silver mining which were previously unprofitable have become viable again due to current elevated market prices.

The ongoing debate between supporters of precious metals versus proponents of cryptocurrencies as superior long-term stores of value remains heated. This discourse intensifies amid historic price rallies in metals alongside periods where BTC experiences stagnation—and concurrently as the US dollar weakens roughly 10% against major global currencies.

In 2025, gold reached an unprecedented peak near $4,533 per ounce while silver also achieved record highs close to $80 per ounce (not shown). Source: TradingView

The US Dollar Faces Challenges at Year-End While Fed Policies Boost Scarce Assets

Ethan Ralph—a media personality covering financial markets—noted that the US dollar is poised for its worst annual performance in ten years after nearly dropping 10% on the US Dollar Index (DXY) throughout 2025.

This index measures the dollar’s strength relative to several key fiat currencies such as the euro (€), Japanese yen (¥), British pound (£), Canadian dollar (C$), Swedish krona (kr), and Swiss franc (CHF).

The DXY experienced almost a ten percent decline during 2025. Source: Barchart

Analyst Arthur Hayes emphasized how this depreciation combined with inflationary monetary policies from the Federal Reserve will likely serve as strong tailwinds propelling scarce assets—including gold, silver—and notably BTC—to higher valuations moving forward.