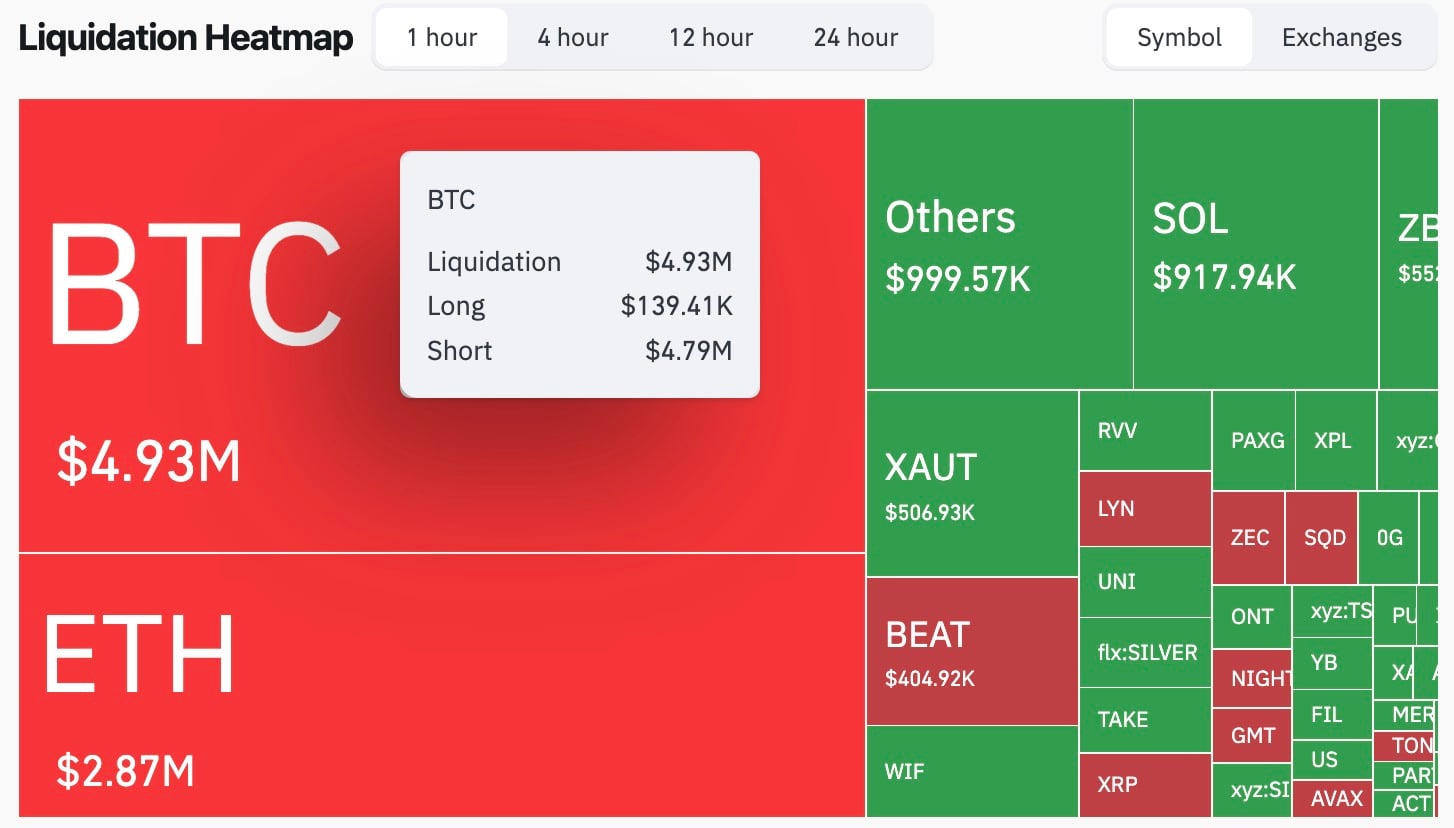

The recent Bitcoin liquidation statistics from the past hour have unveiled a remarkable disparity, with short positions being liquidated at an astonishing rate of approximately $4.79 million, in stark contrast to just $139,410 for long positions. This results in an incredible imbalance of 3,436%. Overall, the total liquidations for Bitcoin reached $4.93 million according to CoinGlass.

While this scenario resembles a squeeze situation, it coincides with a market that is witnessing cracks in its “safe haven” trades. Gold has seen a decline of around 3.1% today alone. The broader metals market fared even worse: silver plummeted by about 8.37%, platinum dropped by roughly 12.67%, and palladium fell by about 16.07%, all reaching new intraday lows.

This combination creates conditions that traders monitor for potential shifts: when previously successful assets experience significant losses within a single trading session, the immediate response tends to be profit-taking followed by capital seeking out other liquid opportunities that haven’t been part of the winning trades.

Despite today’s downturns, gold remains up by an impressive 64.9% year-to-date and silver has surged by 132.5%. In contrast, Bitcoin has declined by 6.5% over the same timeframe—making it clear that BTC is lagging behind and could serve as a “catch-up” asset as metals begin to weaken further.

Is this the flippening?

The significance of this liquidation imbalance lies in its ability to demonstrate real-time shifts in positioning within the market. Short sellers were heavily penalized during this one-hour period while long holders remained largely unaffected; such forced buying pressure often attracts new spot interest following it.

In just the last day alone, there were approximately 95,012 traders who faced liquidation totaling $293.55 million—$153.88 million from longs and $139.67 million from shorts specifically standing out among these figures was an individual BTC/USD liquidation amounting to $5.23 million on Hyperliquid—a transaction capable of transforming charts into headlines.