In the United States, spot Bitcoin exchange-traded funds have experienced significant withdrawals totaling over $1.2 billion this week. Despite this, Charles Schwab is observing a growing interest in these financial products.

The eleven spot Bitcoin ETFs in the U.S. collectively faced an outflow of $366.6 million on Friday, marking a challenging week for both the asset and related institutional investment offerings.

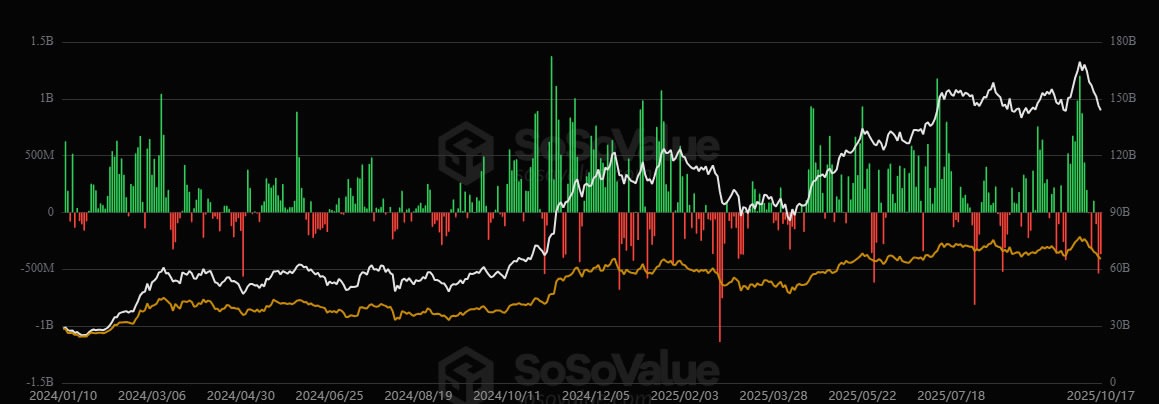

BlackRock’s iShares Bitcoin Trust was hit hardest with a withdrawal of $268.6 million as reported by SoSoValue. Fidelity’s fund saw an outflow of $67.2 million, Grayscale’s GBTC lost $25 million, and Valkyrie ETF experienced minor losses while others remained unchanged on Friday.

This trend continued throughout the week with total withdrawals reaching $1.22 billion, despite only one day showing slight inflows on Tuesday.

The mass exit from ETFs coincided with Bitcoin’s sharp decline of more than $10,000—from just above $115,000 at Monday’s start to dipping below its four-month low at around $104,000 by Friday.

Spot Bitcoin ETFs experience downturns this week; Source: SoSoValue

Schwab witnesses heightened interest

Charles Schwab CEO Rick Wurster remains optimistic about crypto exchange-traded products and notes that their clients hold 20% of all crypto ETPs nationwide.

“Crypto ETPs are very active,” he mentioned during his CNBC appearance on Friday while highlighting that visits to their cryptocurrency website have surged by 90% over the past year.

“It’s a topic that’s generating substantial engagement.”

Related: ‘ETFtober’ expands as over five new crypto ETFs are filed this week

Nate Geraci—a recognized ETF authority—commented Saturday that Charles Schwab operates one of America’s largest brokerages and advised paying close attention to developments there.

The firm currently provides access to crypto ETFs alongside futures trading for Bitcoins; they plan introducing direct spot trading options come 2026 for their clientele base too!

Schwab CEO Rick Wurster discusses Crypto ETF dynamics; Source: Nate Geraci

A challenging October for BTC

This month bucks previous trends where gains were seen ten times within twelve Octobers according CoinGlass analysis indicating so far loss stands at six percent mark already!

<PNevertheless experts express optimism believing "Uptober" might resume since historically profits typically occur during latter half coupled potential Federal Reserve rate cuts which could stimulate upward momentum again soon enough!

Magazine:Korea faces Binance shake-up & Morgan Stanley explores security tokens Japan through Asia Express insights shared here today!