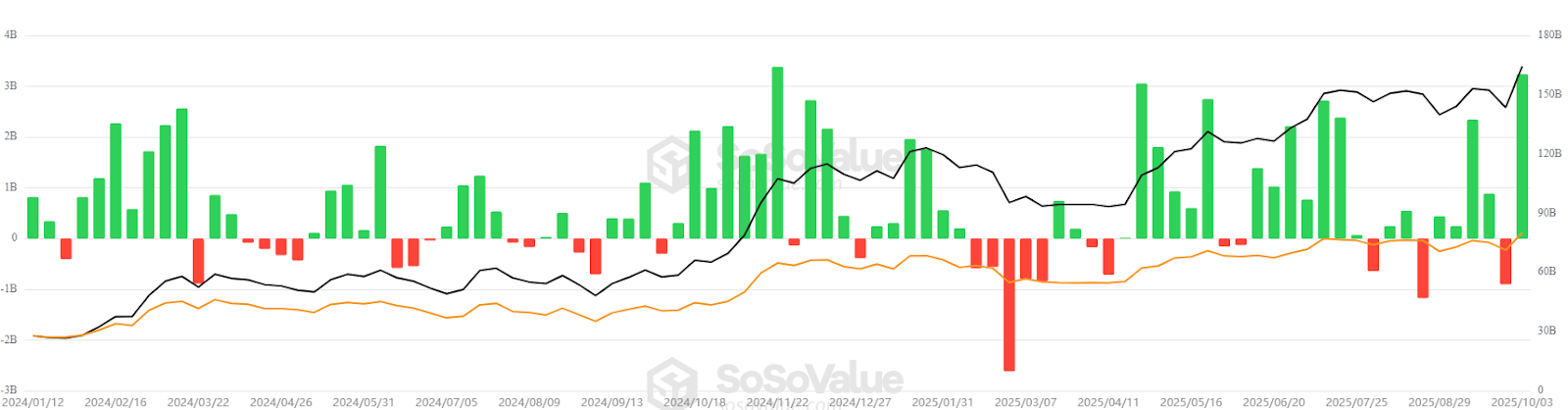

US-listed spot Bitcoin exchange-traded funds (ETFs) kicked off October, a historically favorable month for the cryptocurrency, with their second-highest weekly inflow since inception. This surge indicates renewed investor confidence.

In the past week, spot Bitcoin (BTC) ETFs experienced net positive inflows totaling $3.24 billion, closely approaching their record of $3.38 billion from late November 2024, as reported by SoSoValue.

This marks a significant recovery from the previous week’s outflows of $902 million. Analysts attribute this shift to heightened expectations of another US interest rate reduction, which has bolstered sentiment towards riskier assets.

The anticipation of an interest rate cut in the US sparked a change in sentiment that attracted fresh investor interest in Bitcoin ETFs. “This brought four-week inflows close to $4 billion,” stated Iliya Kalchev from digital asset platform Nexo to Cointelegraph. “At this pace, Q4 could see over 100,000 BTC withdrawn from circulation — more than twice new issuance.”

“ETF absorption is gaining momentum while long-term holders are distributing less,” he added, aiding BTC’s foundation near crucial technical support levels.

US spot Bitcoin ETFs historical chart on a weekly basis: Source: Sosovalue

Related: Wall Street’s next crypto venture might focus on IPO-ready crypto firms rather than altcoins

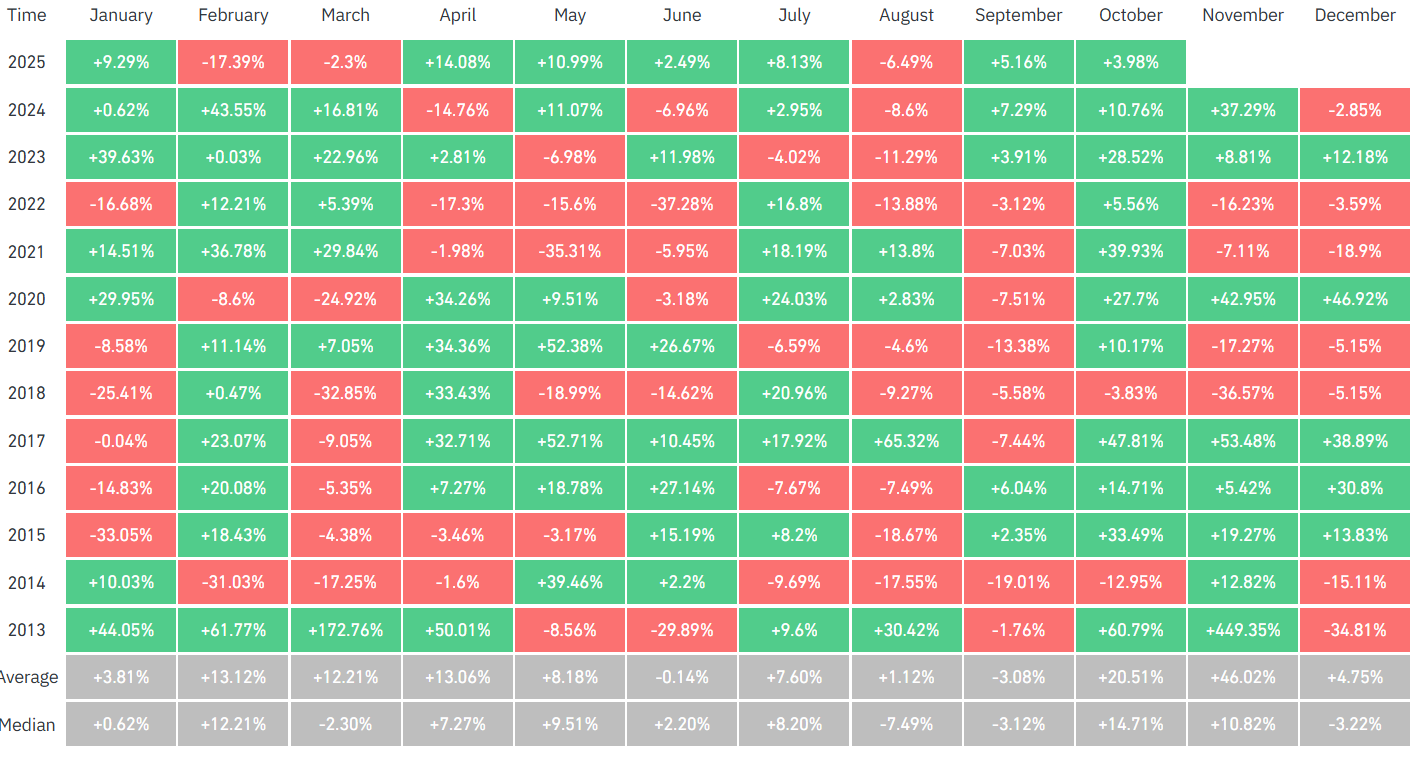

Sustained ETF inflows could provide substantial support for Bitcoin throughout October—often dubbed “Uptober” by crypto enthusiasts due to its historically strong returns.

This week’s influx briefly pushed Bitcoin’s price above $123,996 on Friday—a level not seen since mid-August—according to TradingView data.

BTC/USD daily chart: Source: Cointelegraph/TradingView

A breakout above $120,000 may lead to rapid movement beyond its all-time high of $150,000 before 2025 ends,” said Charles Edwards from Capriole Investments during Token2049 in Singapore when speaking with Cointelegraph.

The promise of Uptober raises hopes for new peaks in Bitcoin prices

“Uptober is signaling an early-Q4 breakout within the crypto market fueled by ETF investments seasonal strength and accommodating macroeconomic conditions.”

Bitcoin monthly returns overview: Source: CoinGlass