According to market analyst James Van Straten, the expansion of derivatives such as options contracts—financial tools granting investors the right but not the obligation to purchase or sell an asset at a set price—will propel Bitcoin’s (BTC) market value to exceed $10 trillion.

Van Straten highlights that these derivatives attract institutional investors and provide stability against the notorious volatility associated with digital assets.

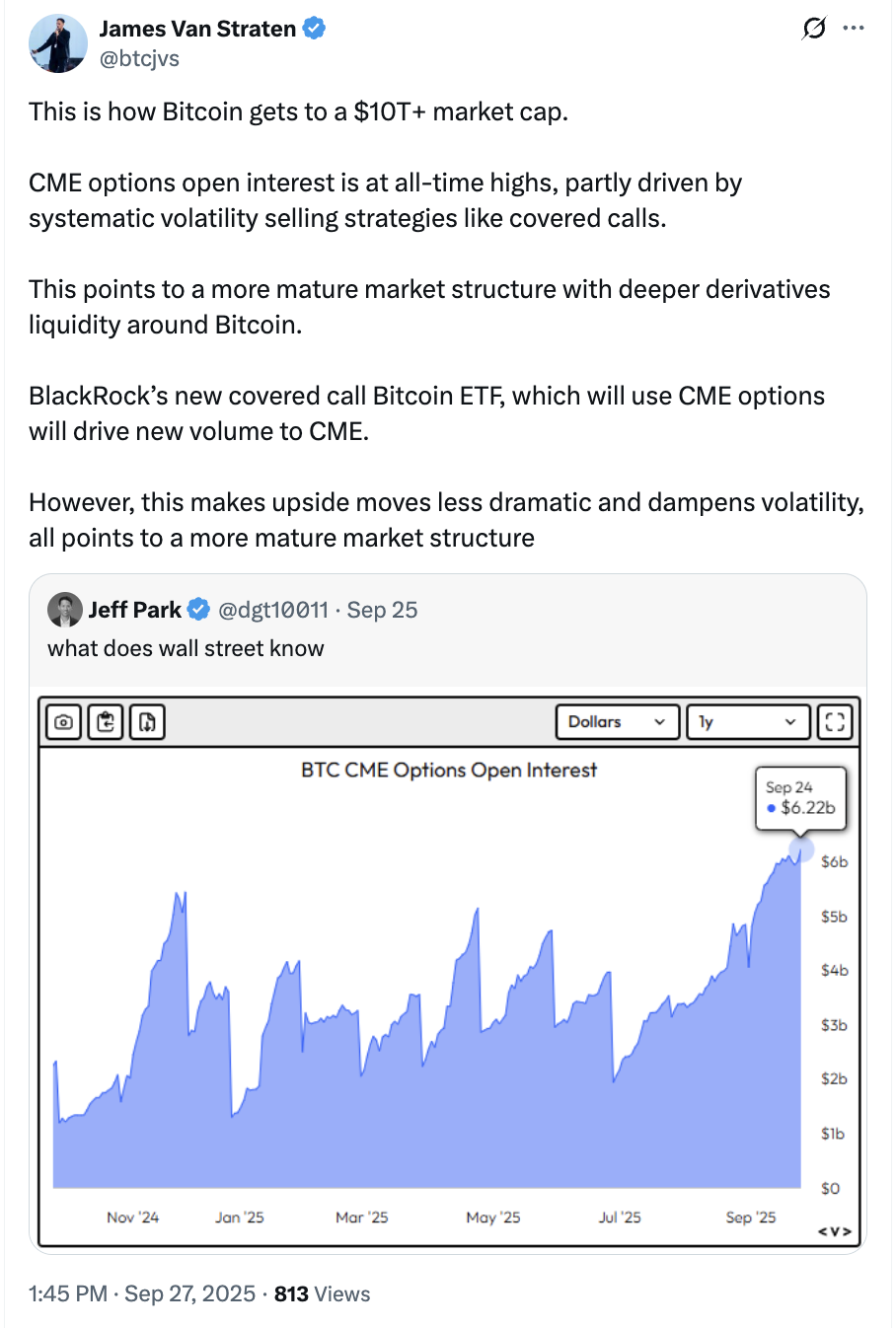

He references open interest for BTC futures on the Chicago Mercantile Exchange (CME), renowned as the largest global derivatives marketplace, as evidence of this transformation. Van Straten stated:

“The open interest in CME options has reached unprecedented levels, partly fueled by systematic strategies like covered calls aimed at selling volatility. This indicates a more sophisticated market structure with enhanced liquidity in Bitcoin derivatives.”

Source: James Van Straten

The reduction in volatility impacts both gains and losses, meaning that while sharp declines will be less frequent, traders may also experience fewer explosive gains than they are used to seeing, added Van Straten.

The ongoing debate among analysts revolves around how financial derivative products and investment vehicles influence Bitcoin’s market cycle and broader crypto trends. Some suggest signs of maturity are evident; others believe investor psychology is what truly drives markets.

Related: The next Federal Reserve chair pick could be Bitcoin’s ‘biggest bull catalyst’: Novogratz

Is Bitcoin’s four-year cycle obsolete?

The impact of institutional involvement alongside investment vehicles and financial derivatives on cryptocurrency markets remains contentious among experts.

Xapo Bank CEO Seamus Rocca shared with Cointelegraph his belief that despite claims otherwise, Bitcoin’s traditional four-year cycle persists due to influences from news cycles, public sentiment, and investor behavior.

“Many assert that institutional presence negates Bitcoin’s cyclical nature—but I’m skeptical about this conclusion,” Rocca remarked.”

A proponent for Bitcoin who analyzes markets named Matthew Kratter argues human psychology fundamentally moves markets regardless if participants are retail or institutional investors—both groups exhibit irrational behaviors alike.

&# 8220 ; The recent bear phase from 2021 through 2022 largely stemmed from poor decisions made by institutions like Grayscale , Genesis , Three Arrows Capital , FTX , &# 8221 ; Kratter noted .

Magazine : Crypto traders deceive themselves with forecasts : Peter Brandt