October is renowned for delivering bitcoin’s most impressive median returns, consistently outperforming other months.

History Repeats: Bitcoin Surges Past $120,000 in Seasonal Rally

The month of October has traditionally been a bullish period for bitcoin enthusiasts. Data from Coinglass reveals that over the past twelve years, October has generally yielded positive results for bitcoin, with exceptions only in 2014 and 2018. As we step into this month, the cryptocurrency has already seen a notable rise of 5.41% after just two days.

A recent government shutdown at midnight on Wednesday did not dampen trader spirits; instead, it seemed to fuel their optimism. Following a deadlock between Senate Republicans and Democrats regarding temporary federal funding, both stocks and bitcoin experienced an uptick. Even an unexpected decline in private sector employment was interpreted as encouraging news for continued interest rate cuts by the Federal Reserve throughout the year.

This monthly trend appears to be holding steady. The S&P 500 rose by 0.16%, Nasdaq increased by 0.42%, and Dow climbed by 0.29%. Meanwhile, bitcoin saw a gain of 2.55% within just one day—reinforcing the “Uptober” narrative.

Market Metrics Overview

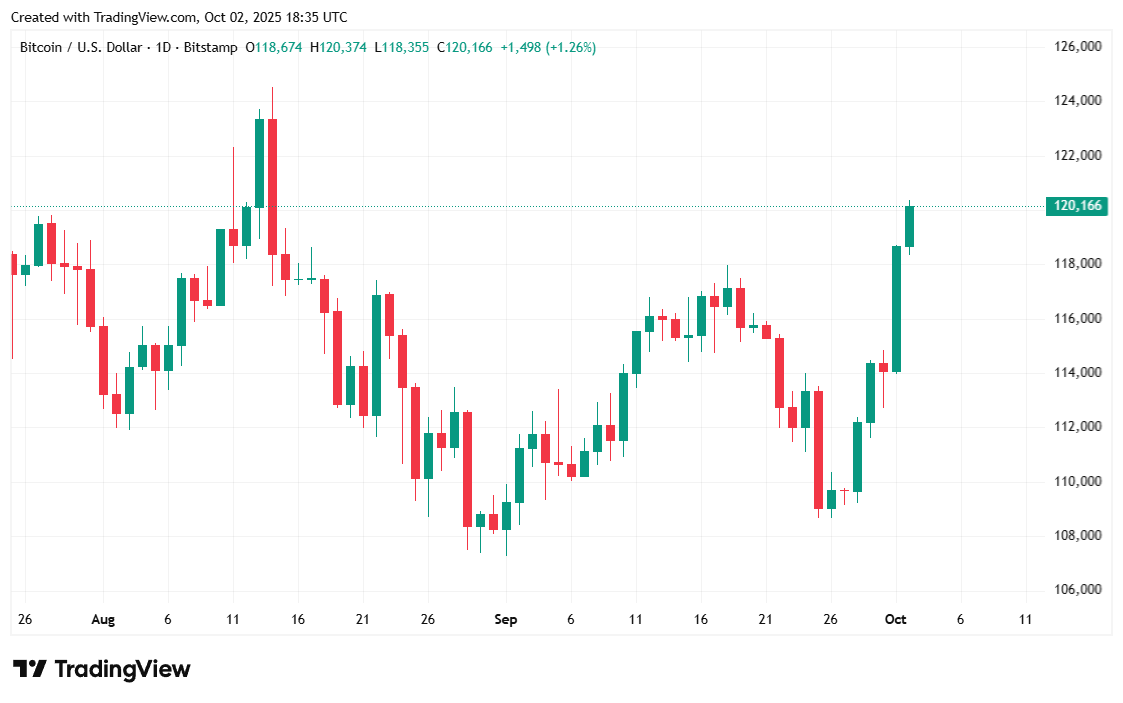

At present writing time, Bitcoin is valued at $120,128 .94, marking an increase of 2 .55% since yesterday and up nearly 9.7% over this week according to Coinmarketcap data;. It traded within ranges from $117, 235 . 26 to $120, 324 . 11 during that timeframe;

( BTC price / Trading View)

The trading volume over twenty-four hours decreased slightly by 4.88% reaching approximately $67.&#82 billion while market capitalization rose about “”2.&#54%; aligning with its daily price growth.

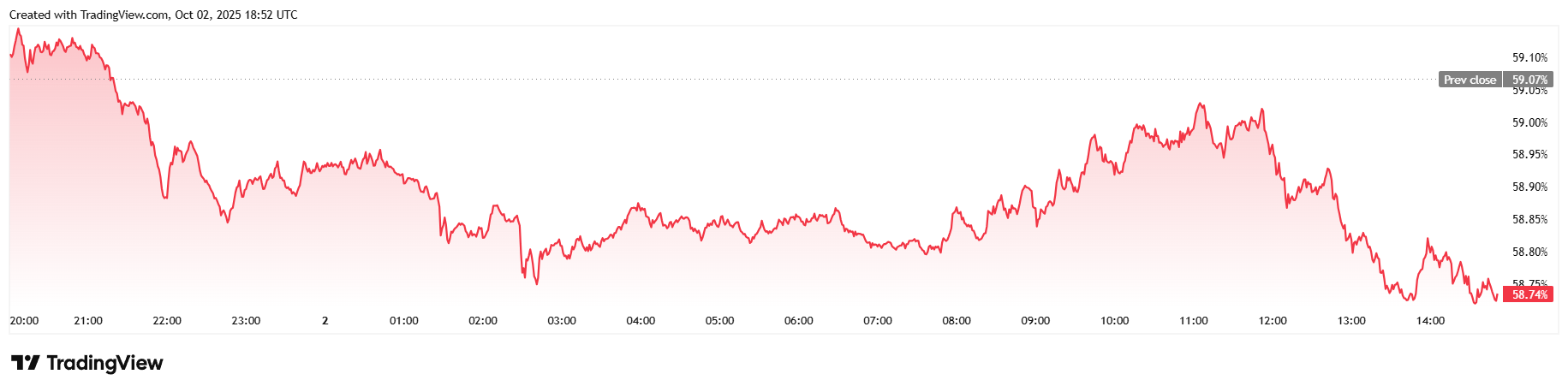

( BTC dominance / Trading View)

Total open interest on Bitcoin futures increased >>”3.<"59%" over one day&comma resulting in approximately $$88˙$40 billion according to Coinglass data.; Liquidations reached around $$134.$$70 million dominated primarily through short sellers losing out due incorrect bets totaling near "$117."17 million while bullish investors who went long incurred smaller losses summing up roughly "$17."53 million overall liquidations figure.