According to Haider Rafique, who oversees government and investor relations at the crypto exchange OKX, forming a national Bitcoin (BTC) reserve could adversely affect both BTC and the US dollar.

Rafique explained to Cointelegraph that if a government accumulates large amounts of BTC, it might manipulate market prices by selling off its holdings. This action would undermine Bitcoin’s fundamental role as an impartial and decentralized currency.

He posed the question: “What are the consequences if future administrations deem this strategy unwise?” Rafique further commented:

“Even with recent bipartisan backing for cryptocurrency, one must consider that governmental policies can shift rapidly. As time progresses, holding substantial BTC reserves could pose liquidation risks on a national scale.”

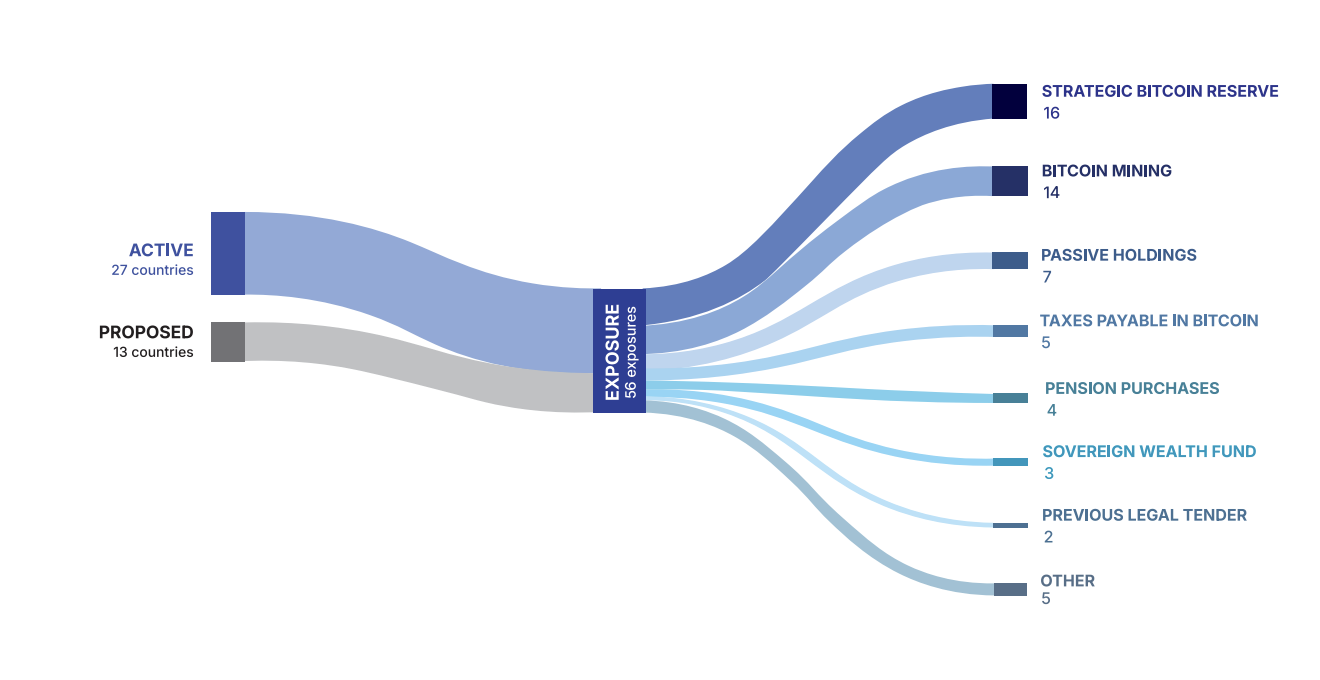

An analysis of how countries engage with Bitcoin. Source: Bitcoin Policy Institute

The German government’s decision in 2024 to sell off 50,000 BTC serves as an example; this move kept prices from rising above $60,000 per unit.

The idea of creating a strategic reserve for Bitcoin remains popular among its proponents. They argue that establishing such reserves at the national level is crucial for positioning Bitcoin as both a global reserve currency and standard monetary unit.

Related: US legislators enlist Saylor and Lee to push forward with a bill on creating a Bitcoin reserve

Dangers Facing the US Dollar and Broader Financial Markets

The creation of a strategic reserve in Bitcoins may lead to repercussions extending beyond just cryptocurrency markets; it could have extensive macroeconomic impacts according to Rafique’s discussion with Cointelegraph.

“The most notable macroeconomic consequence would be diminished trust in the dollar,” he stated.

This initiative suggests weakness within the US dollar—an essential pillar supporting global economic stability—and implies it cannot maintain value solely through economic strength alone.