As September draws to a close, Bitcoin finds itself hovering around the $109,000 mark. The crypto community is already buzzing with excitement for “Uptober,” a month known for its potential bullish momentum.

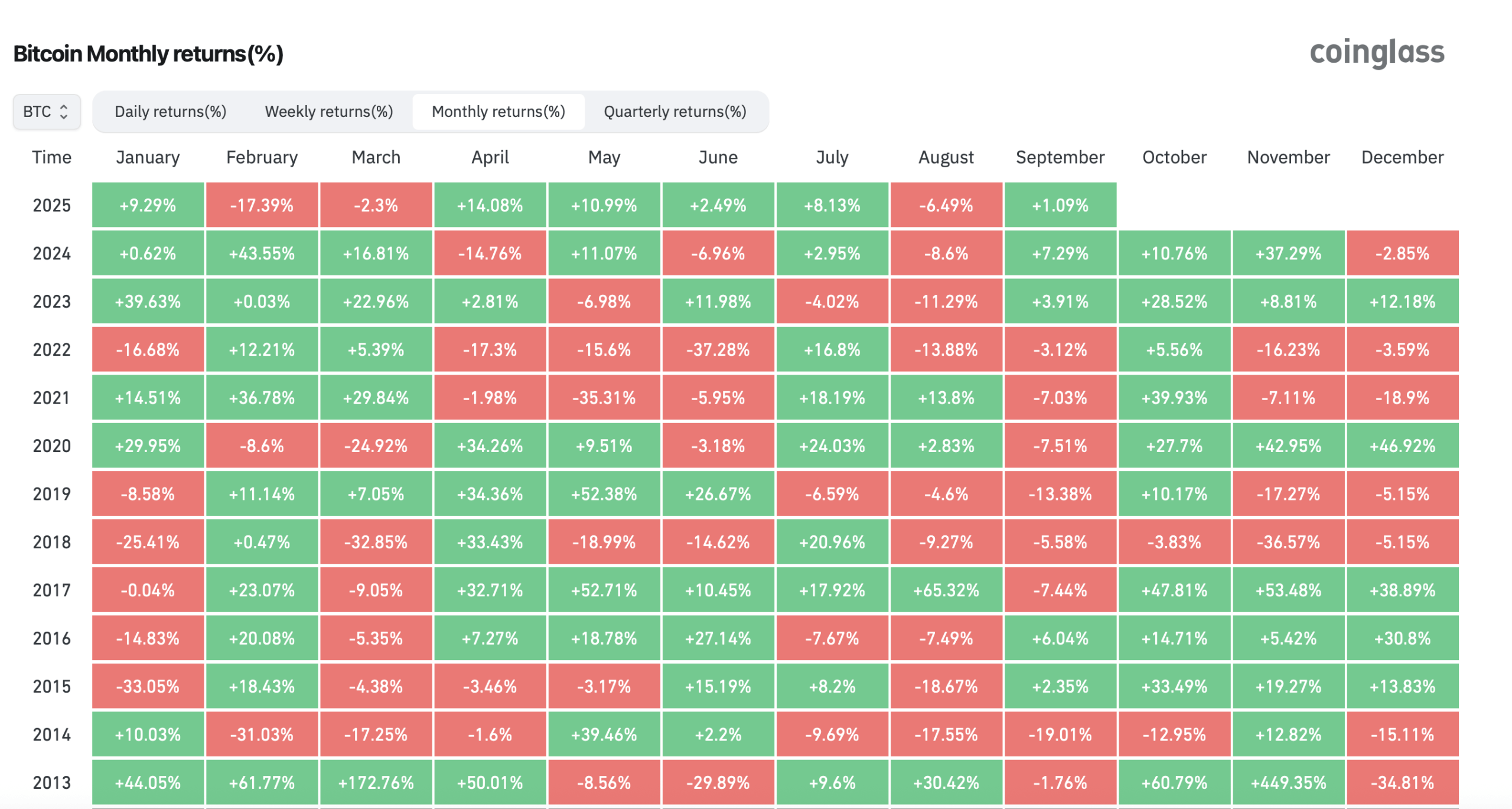

October has become something of a holiday for Bitcoin enthusiasts. While September wasn’t disastrous, it also wasn’t particularly thrilling. Over the past couple of weeks, Bitcoin has dipped by about 5.5%, reminding everyone that optimism often faces hurdles before gaining traction. Despite this, historical data from coinglass.com shows a slight gain of roughly 1% in September so far, shifting focus to October—a month celebrated for its history of significant gains over the past 12 years.

The term “Uptober” humorously captures October’s reputation as a favorable period for Bitcoin trading. Although no month guarantees profits like clockwork, traders recognize October’s seasonal patterns: it frequently delivers positive results and sometimes exceeds expectations significantly. This creates an anticipatory cycle—expectations lead to strategic positioning; positioning can spark momentum; and momentum fuels more Uptober discussions.

The accompanying chart illustrates this narrative clearly: since 2013, October has seen gains in 10 out of the last 12 years. Notable years include impressive returns such as +60.79% in 2013 and +47.81% in 2017 among others—a testament to its potential impact on Q4 performance even during modest winning streaks like those seen in recent years.

However, cautionary tales exist too—-12.95% (in −‑‑‑‑−)and −&#59;;383 (in −)remind us that not every year follows suit exactly as planned….If September tends towards negativity within cryptocurrency lore while remaining relatively neutral overall throughout various cycles without dramatic highs or lows observed recently by comparison instead being viewed simply yet optimistically still potentially resetting markets sufficiently enough ahead toward another push forward next seasonally favored timeframe thereafter instead now turning attention back onto upcoming possibilities awaiting just beyond horizon soon thereafter again once more…

So why does October shine so brightly? There isn’t one single reason behind these trends but rather recurring patterns emerge consistently each year during Q4 periods when appetites rise across sectors alongside increased discourse surrounding cryptocurrencies themselves ultimately leading traders away from summer lulls into allocations carrying greater heat overall thus creating opportunities where liquidity meets narratives halfway through anticipation-driven setups accordingly…context remains key however despite current spot prices sitting approximately eleven point nine percent below annual highs there’s no panic present either open interest funding breadth all playing roles determining whether Uptobers act trampoline-like bouncing upward quickly versus treadmill-like moving slowly forward instead…