As the third quarter nears its conclusion, Bitcoin (BTC) continues to grapple with recovery after a series of sell-offs earlier this week.

The cryptocurrency is currently valued at approximately $111,600, marking a decline of over 5% in the weekly analysis. In the past seven days alone, Bitcoin’s market capitalization has decreased by more than $120 billion.

Over the last 24 hours, Bitcoin’s price has dropped by 1.39%, while trading volume surged by 26.27%, reaching $61.35 billion during this period.

AI Forecasts for Bitcoin’s Q3 End Price in 2025

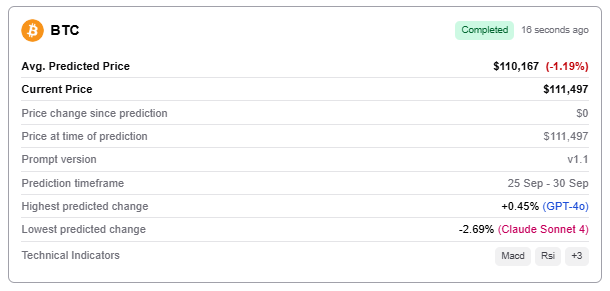

An AI tool developed by Finbold called AI Signals combines large language models (LLMs) with momentum-based market indicators to estimate an average BTC price as we approach the end of this quarter. According to these projections, Bitcoin might be priced at around $110,167—a decrease of about 1.19% from current figures.

The most optimistic model in their analysis was GPT-4o predicting a rise to $112,000 (+0.45%), whereas Claude Sonnet 4 and Grok 3 suggested declines to $108,500 (-2.69%) and $110,001 (-1.34%), respectively.

This challenging phase for Bitcoin follows forced liquidations that wiped out roughly $1.5 billion from leveraged positions earlier this week—an issue compounded by Federal Reserve Chair Jerome Powell’s cautionary remarks regarding monetary policy risks during his September speech at The Crowne Plaza in Warwick, Rhode Island.

“There is no risk-free path,” stated Powell.”If we ease too aggressively we could leave inflation control incomplete requiring future reversal; conversely prolonged restrictive policies may unnecessarily weaken labor markets.”

Other cryptocurrencies like Ethereum (ETH) mirrored these declines falling by about 4% down to its lowest point in seven weeks ($4010). Currently exchange-traded funds remain influential; notably on Wednesday September twenty-third bitcoin ETFs saw net inflows totaling two hundred forty-one million dollars contrasting against ethereum ETF outflows exceeding one hundred million dollars .

Featured image via Shutterstock