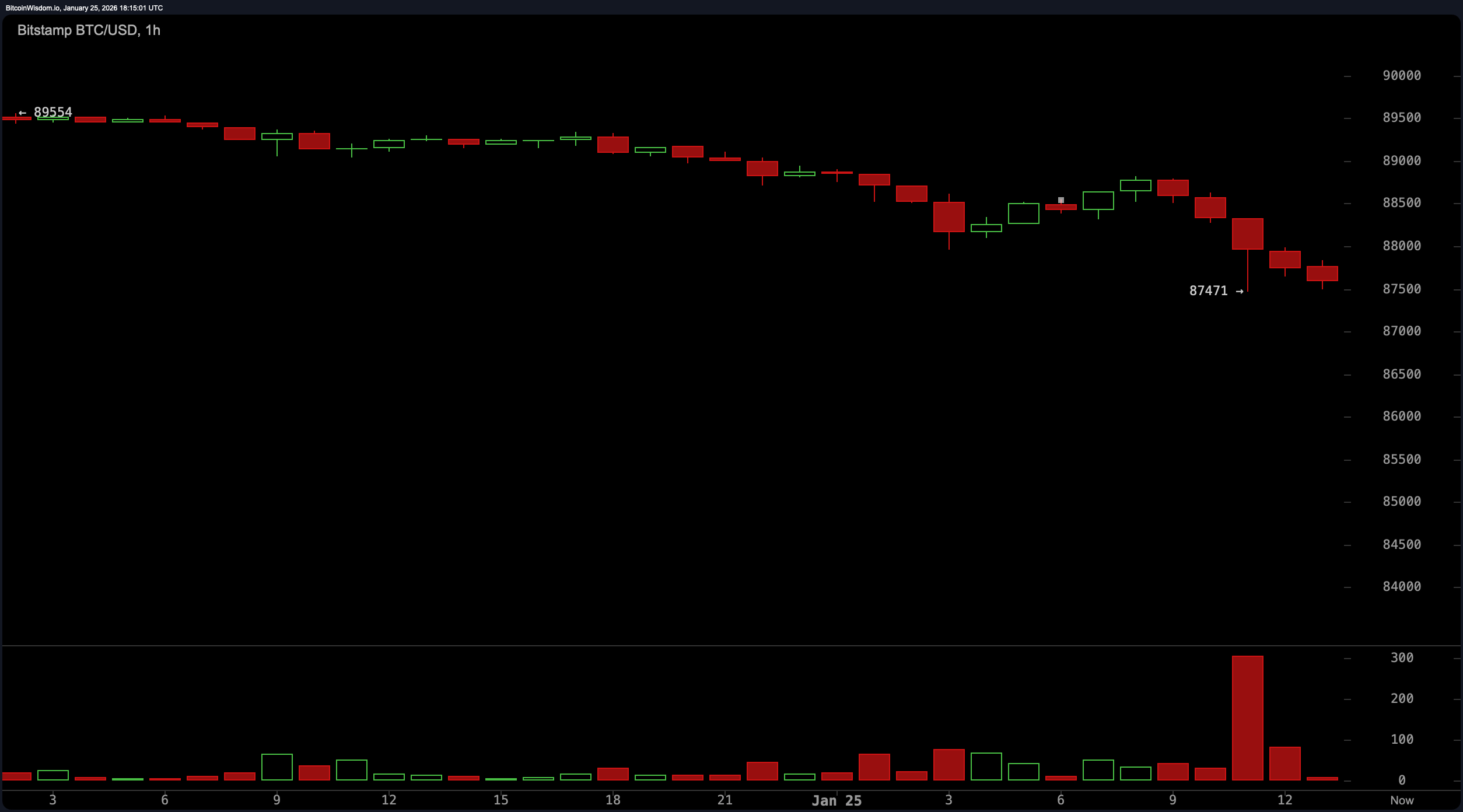

On Sunday, the value of bitcoin experienced a decline, dropping below the $88,000 threshold and reaching a low of $87,471 per coin. By midday (EST), the leading cryptocurrency was caught in a consistent downward trend characterized by successive lower highs and lows.

Low Liquidity Leads to Significant Fluctuations: Bitcoin Falls Below $88K Amidst Rising Liquidations

The overall cryptocurrency market has decreased by 1.75% compared to yesterday, with its total valuation now at approximately $2.96 trillion. The selling pressure intensified once bitcoin fell beneath the $88,250 mark—a level that had provided temporary support earlier in the day.

Currently, bitcoin is down 1.7% for the day and has seen a decline of 7.6% over the past week against the U.S. dollar. Nevertheless, since January 1st this year, BTC has shown minimal movement with an increase of just 0.30%. After breaching below $88,000, negative momentum accelerated sharply as multiple steep declines indicated that sellers were firmly in control rather than experiencing a gradual fade due to low trading volume.

BTC/USD one-hour chart via Bitstamp on January 25th.

The trading volume remains relatively low at around $25.11 billion—a condition that can lead to abrupt price movements. Volume dynamics played an essential role on Sunday as significant bursts coincided with dips into session lows; this pattern suggests aggressive distribution and possible short-term seller fatigue often followed by either minor rebounds or periods of consolidation.

At present though, any optimism appears subdued. BTC hit an intraday low of $87,471 and as per data available at 1 p.m EST., it is currently fluctuating just above the $87,700 mark. According to Coinglass statistics, there were liquidations affecting about 149 thousand traders across various crypto derivatives markets resulting in losses totaling approximately $343 million.

Around $78 million worth of those liquidated positions came from BTC long positions while about $90 million pertained to ETH longs respectively.

Many analysts attribute bitcoin’s downturn partly to geopolitical tensions and macroeconomic uncertainties alongside remarks made by U.S President Donald Trump regarding Canada’s situation over the weekend where he claimed it is “systematically destroying itself.”

This drop for bitcoin (BTC) on Sunday—despite expectations for potential positive announcements on Monday—has become somewhat routine lately; repeating consistently each week.

Currently observed trends reveal thin liquidity conditions along with anxious traders enabling sellers to capitalize effectively.

Till there’s either increased trading volume or some clear trigger disrupts this ongoing pattern,

it seems like bitcoin will continue its sideways movement instead of making any significant upward strides.

Recent Sundays have illustrated that mere optimism isn’t sufficient enough alone for altering these established trends.

FAQ ❓

Why did Bitcoin fall below $88k?

The decrease occurred due largely because selling pressure surged after losing short-term support near $88k amidst limited weekend liquidity.

How much was lost during this sell-off?

Around $269 million worth crypto derivatives positions faced liquidation impacting nearly140 thousand traders overall during this period!

What impact did trade volumes have concerning declines?

The reduced volumes hovering around $25 billion amplified price fluctuations intensifying moves towards session lows considerably!

Is Bitcoin’s decline every Sunday becoming standard practice?

Lately observed patterns indicate that Bitcoin consistently weakens each Sunday even when positive catalysts seem likely ahead!