The Relative Strength Index (RSI) of Bitcoin compared to gold has fallen to 30, marking only the fourth instance in Bitcoin’s history where this indicator reached such a low level. This suggests that Bitcoin is currently significantly undervalued when measured against gold.

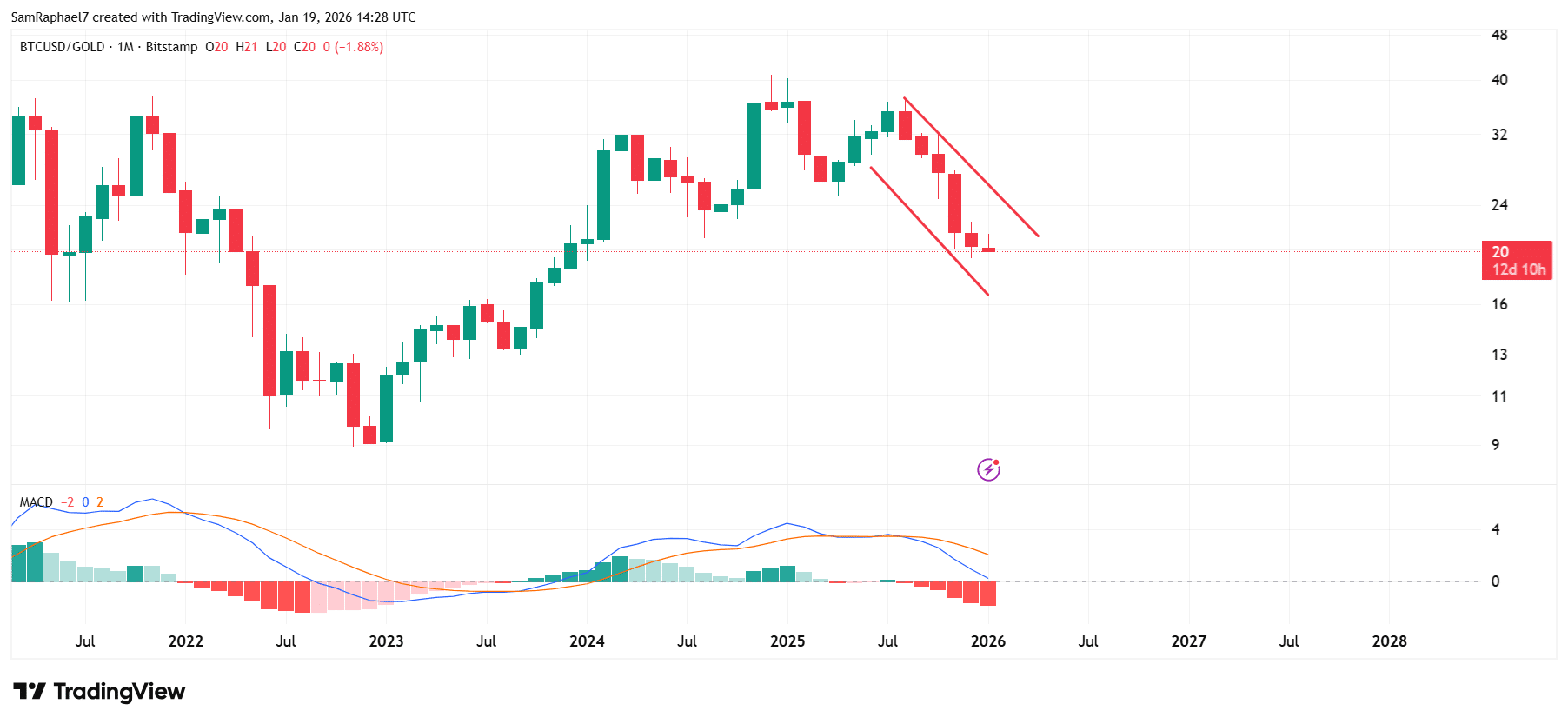

This recent trend unfolds as Bitcoin (BTC) continues its underperformance relative to gold (XAU), a pattern persisting for over half a year. After peaking at 37 ounces of gold in August 2025, BTC has experienced five straight months of decline against the precious metal and appears poised for a sixth consecutive monthly drop.

During this downturn, Bitcoin’s value against gold has plummeted to 20 ounces and remains confined within a descending channel on the monthly chart. Market analytics confirm that the BTC/XAU pair’s RSI hitting an all-time low of 30 for just the fourth time ever signals that BTC is deeply undervalued versus gold.

Highlights

Since reaching its high point at 37 ounces of gold in August 2025, Bitcoin has steadily lost ground relative to gold.

This decline translates into five consecutive months where BTC underperformed while gold consistently achieved new record highs.

Bitcoin’s drop down to 20 ounces amid this slump coincides with its weekly RSI on the BTC/XAU pair falling sharply to 30.

This rare RSI threshold—only seen three times before—has historically preceded notable rebounds in Bitcoin’s price relative to gold.

Bitcoin Faces Challenges Against Gold

Michaël van de Poppe, an experienced market analyst, highlighted these developments while reviewing Bitcoin’s current price dynamics amid ongoing downward pressure. After briefly recovering near $98,000 by January 14th, BTC encountered persistent selling pressure leading it back down toward $92,000 — triggering approximately $785 million worth of long position liquidations.

The recent slide was intensified by macroeconomic uncertainties linked with President Trump’s latest tariff announcements. This added strain exacerbated what had already been a declining trend since August 2025 when bitcoin peaked at an equivalent value of 37 ounces of gold.

Since then, bitcoin’s valuation against XAU dropped nearly 46%, settling around just 20 ounces and enduring five straight months marked by bearish candles on monthly charts. Despite being trapped inside this descending channel formation on one-month charts versus XAU, there may be renewed optimism for recovery ahead based on technical signals emerging now.

Bitcoin’s RSI Versus Gold Hits Critical Low

The weekly RSI metric comparing bitcoin with physical bullion recently plunged downwards reaching exactly 30 — as confirmed through van de Poppe’s charting data — marking only four historic occurrences where such lows were recorded before.

Historically speaking, BTC’s lowest points compared with yellow metal have often coincided with these extreme oversold conditions indicated by RSIs near or below thirty.

- This pattern signaled exhausted sellers and attracted value investors preparing positions ahead for subsequent upward cycles.

- The current presence within a falling channel structure further supports expectations typical during corrective phases: eventually resolving via bullish breakouts reversing momentum upwards again.

A Look Back: Historical Precedents

Michaël van de Poppe’s historical analysis also reveals all previous instances occurred during bear markets affecting bitcoin prices broadly:

- The most recent prior event happened November 2022 amidst fallout from FTX collapse, BTC’s valuation bottomed near nine ounces before rebounding strongly up towards thirty-four ounces by March 2024.

<img decoding="async" title="Bitcoin RSI Against Gold Drops To Thirty Michael Van De Poppe"

src="https://cnews24.ru/uploads/eee/eee9e4518a4e1f0c0de97ba2b3d0a71afc77d556.jpg"

alt="

&amp;amp;amp;amp;p>&amp;;#x42;&x69;tcoin&x52SI&x41gainsGoldDropsToThirtyMichaelVanDePoppe“>