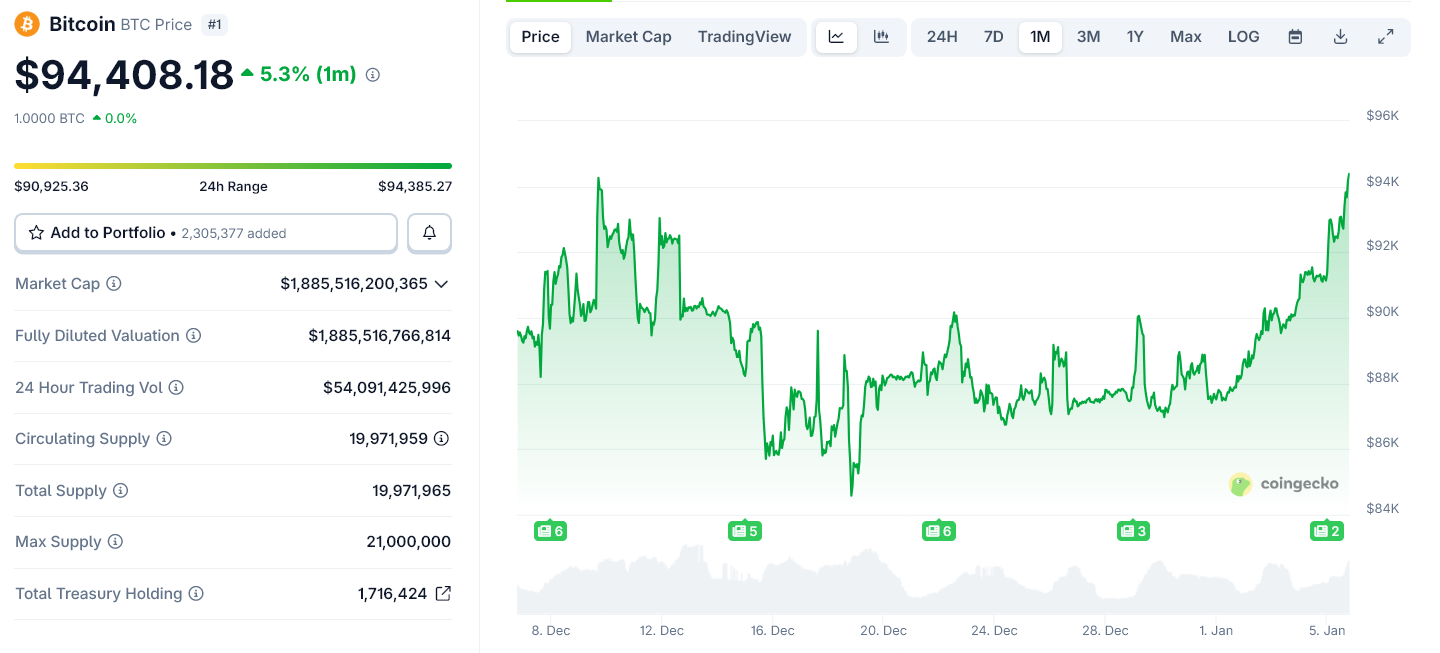

On Monday, Bitcoin surged past the $94,000 mark, breaking free from nearly a month of stagnant trading. This upswing coincided with a positive opening in US stock markets following a sharp escalation in tensions between Washington and Caracas over the weekend.

This price movement highlights how cryptocurrency markets remain closely intertwined with traditional equities once conventional financial markets resume trading, despite geopolitical disturbances.

Markets Interpret Venezuela’s Political Shift as a Catalyst for Risk Appetite

US stock indices began the day on an optimistic note as investors evaluated the unfolding situation involving Venezuela’s leadership.

Instead of sparking widespread fear, this development bolstered risk-taking sentiment. Market participants viewed the event as controlled and decisive, without immediate threats to global supply chains or financial systems.

BREAKING: US stock market indices open sharply higher in their initial reaction to this weekend’s events.

The S&P 500 is back above 6,900. pic.twitter.com/HUOtD4bctx

— The Kobeissi Letter (@KobeissiLetter) January 5, 2026

This early strength in equities set a favorable tone for digital currencies. Bitcoin—which had been confined within tight price ranges for weeks—reacted swiftly once Wall Street demonstrated renewed confidence.

The cryptocurrency climbed back toward levels last observed at the end of November while other digital assets also recorded modest gains.

The upbeat response from equity markets was driven by several key factors:

- Clarity over uncertainty: Investors perceived swift and unilateral US actions without immediate signs of retaliation that could jeopardize trade routes or energy supplies globally.

- Energy market implications: The scenario suggested potential medium-term benefits to oil supply from Venezuela changes — influencing inflation expectations positively.

A reduced long-term inflation outlook supports equity valuations amid ongoing sensitivity around interest rate forecasts.

Bitcoin Closely Mirrors Movements in US Stock Markets

The crypto sector followed suit because prevailing narratives centered on recalibrating risk rather than seeking safety. Bitcoin did not act like a traditional safe haven asset during this period.

Instead, it tracked alongside stocks reflecting its increasing role as a high-beta macro asset when investor confidence rises. There were no notable spikes in exchange inflows or panic-driven sell-offs; traders appeared to be repositioning rather than exiting positions abruptly.

The timing was significant: this marked the first full trading day after weekend developments—and early-year positioning often amplifies directional trends across asset classes.

Was Palantir involved?

Palantir stock, $PLTR, is up nearly +5% in overnight trading in its initial reaction to this weekend’s events in Venezuela.

The market is buying Palantir after a “seamless” US mission to capture Maduro.

Markets think Palantir was heavily involved. pic.twitter.com/MjScYy1Bu7

— The Kobeissi Letter (@KobeissiLetter) January 5, 2026

Catalyzed by strong openings on Wall Street equities continued their momentum into crypto markets instead of losing steam early on Monday morning trades.

This correlation might not persist indefinitely though; Bitcoin’s recent rally depends heavily on assumptions that Venezuelan unrest remains limited and contained within national borders only.

If military engagements prolong or regional instability spreads—or if critical energy infrastructure faces disruption—the mood across risk-sensitive assets could quickly sour causing reversals throughout both crypto and equity sectors alike.

For now , however , investors have reached consensus : they regard these developments primarily as localized geopolitical incidents instead of systemic risks . This viewpoint has buoyed stocks , lifted bitcoin beyond prior consolidation zones , and reinforced short – term synchronicity between cryptocurrencies & conventional financial instruments .

Whether bitcoin can surpass psychologically important thresholds such as $100k will hinge less upon headlines emanating out of Caracas but more so upon sustained optimism within broader equity markets .

Provided Wall Street maintains composure going forward , cryptocurrencies seem poised to follow suit confidently .

The post Bitcoin reclaims $94,000 as Wall Street Opens Higher after Venezuela Shock appeared first on BeInCrypto.